Look back on 2011, and you'll likely be struck by the extraordinary number of new seeds of innovation that were sown in the health care industry. Consider:

The health benefits giant WellPoint purchased CareMore, an innovative West Coast delivery system that uses prevention and high-touch strategies to drastically reduce the cost of caring for frail elders.

The Centers for Medicare and Medicaid Services pushed its innovation agenda into the provider community with programs to encourage new developments in accountable care, bundled payments and local initiatives.

The human resources consultant and outsourcer Aon Hewitt announced it would create a private health insurance exchange for self-funded large group and national accounts, and then launched groups starting this past January.

A leaked document implied Wal-Mart might be planning to become the nation's largest integrated provider of primary care services (a plan the company subsequently pooh-poohed).

A consortium of Blues purchased Bloom Health, a company that creates private exchanges and defined-contribution programs for employers.

Meanwhile, providers started taking on greater amounts of risk, to the point of offering insurance products—some independently, and some with help from some of the largest payers in the country. And you couldn't toss a brick without hitting a PCMH pilot program. To all appearances, the country was on the verge not just of health reform—but a health care revolution. Based on the headlines, the long-promised convergence of retail, insurance, health care delivery and IT seemed just a heartbeat away.

But this is health care—a garden in which even the hardiest seeds sprout slowly or wither prematurely, and the survivors take a painfully long time to reach maturity. Think of high-deductible, consumer-directed health plans, which were supposed to create a generation of discerning, value-oriented health care consumers. Or wellness programs with their sticks and carrots to stimulate healthy behaviors. Or member engagement programs, data exchange and informatics, and many, many more. To be sure, each of these efforts is having an impact in the market. But they all took time—lots more time than we first thought.

In this year's Benefits Selling / Oliver Wyman 2012 Health Care Survey, we sought to understand what is really happening in the marketplace. Presuming the Patient Protection and Affordable Care Act is implemented on schedule, we're nearing the dawn of public exchanges, essential benefits and more restrictive rating rules. Is the market ready? Will these innovations make it to market in time to have an impact? In this article, we'll share what we heard from nearly 600 agents, brokers and consultants across the national marketplace.

Will 2012 be the end of PPACA?

PPACA will run a gauntlet over the next 12 months. First, it will be reviewed by the Supreme Court, with an array of potential outcomes—including the chance the Court will completely invalidate the act. Then come the elections in November and the possibility that a strong Republican majority could repeal (and likely replace) the act. The channel doesn't expect either of these events. Just 11 percent predict the Supreme Court will overturn the legislation, and 14 percent believe that it will be repealed following the election.

Most (58 percent) believe that neither event will undo PPACA. Rather, the majority of agents and brokers believe PPACA will be implemented, but that specific provisions will be scaled down, or that implementation will be delayed.

Assuming PPACA moves forward, this year's survey again suggests that it will have a profound impact on the channel. Brokers and agents indicate that they will focus less on health insurance and supportive services such as wellness. As public exchanges attract members away from traditional individual and small group plans, our respondents expect to see demand for new support services for individuals and employees. They said they are already thinking about shifting their focus to supporting the emerging individual market—with compensation being a key remaining question. On the topic of compensation, this year's results indicate that agents and brokers continue to feel pressure on their commissions and fees, though the results have not been as dire as they predicted in last year's survey.

How do exchanges fit in?

PPACA put exchanges front and center as a new “solution” for a more efficient marketplace. They certainly have grabbed a great deal of attention for their perceived ability to create a uniform, competitive marketplace for health benefits, but they have remained a lightning rod for controversy and are being dealt with differently state-by-state. Will they stand up? And, if so, what impact will they really have?

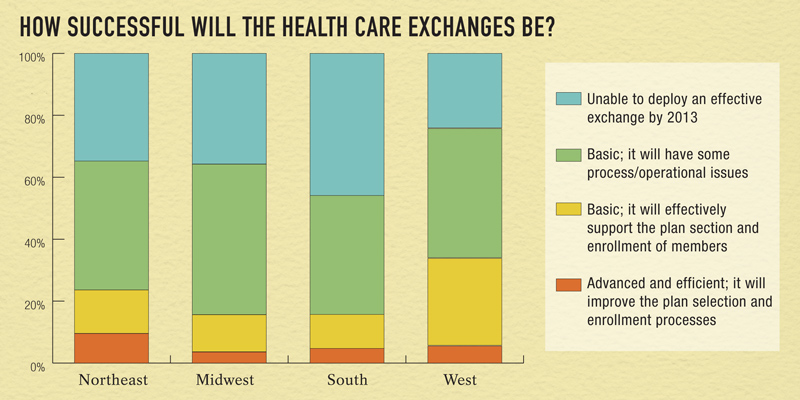

The brokers we talked to were skeptical on both counts. Roughly 35 percent said they doubted that public exchanges will be implemented by the 2014 deadline set forth in PPACA. Another 40 percent said exchanges will be created, but will experience operational and procedural issues. Not surprisingly, these perceptions vary geographically—western states taking a more bullish view.

Not surprisingly, given these views, brokers were uncertain whether to recommend the exchanges to their clients. More than half of brokers serving small groups (fewer than 100 employees) said they didn't know whether they would recommend that their groups move to the exchange. Interestingly, the small group brokers that have formed an opinion on the exchanges are twice as likely to recommend them to their clients as not.

In separate research, employers are taking a similar wait-and-see stance. If the exchanges “work”—that is, if they provide employees with a good experience—employers will have a hard time resisting their efficiencies. But considering the uncertainty that currently surrounds public exchanges, employers indicate that privately run exchanges will likely be the preferred path.

Does the broker role change with exchanges?

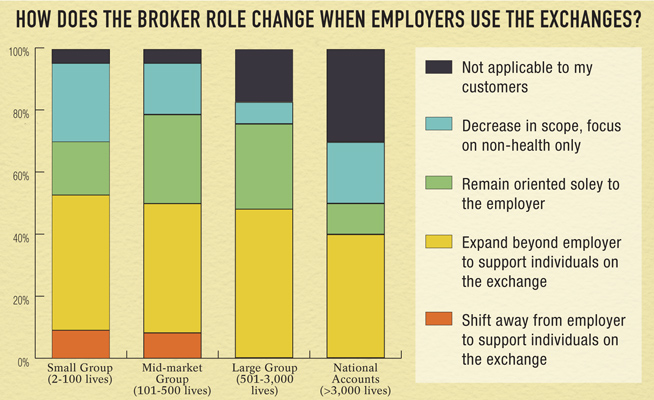

A key question for the employer-oriented brokers and consultants: If the market does embrace exchanges, what happens to the role of the adviser? Across the market, from small group to national accounts, roughly half of respondents foresee that their role will shift to include support for individuals as they purchase in the exchanges.

A key question for the employer-oriented brokers and consultants: If the market does embrace exchanges, what happens to the role of the adviser? Across the market, from small group to national accounts, roughly half of respondents foresee that their role will shift to include support for individuals as they purchase in the exchanges.

By contrast, the other half of respondents said their role will remain oriented solely to the employer, and that they will likely play a reduced advisory role on health benefits. This is startling if you think about it. Granted, there is much ambiguity around rules, regulations, and compensation—but these responses suggest that roughly half of the channel is ceding its potential to support, guide and influence the purchase of health coverage.

What about innovations?

These days, it seems we can hardly make it through the week without some new announcement—new products and services, new collaborations, new mergers and acquisitions. The news comes from every sector—insurers, providers, technology companies, retailers, financial institutions. But what does it mean? Which developments really count?

These days, it seems we can hardly make it through the week without some new announcement—new products and services, new collaborations, new mergers and acquisitions. The news comes from every sector—insurers, providers, technology companies, retailers, financial institutions. But what does it mean? Which developments really count?

This year's survey sought to understand the channel's perspective on four notable events and announcements from 2011, including:

- Walgreen's announcement that it will offer health insurance through its own private exchange

- Aon Hewitt's plan to develop a private exchange for large group employers

- Reports that Wal-Mart plans to provide primary care services

- The acquisition of Bloom Health by a consortium of health plans

While much uncertainty still surrounds these introductions, roughly a third of respondents identified two of them as significant: the Aon Hewitt private exchange announcement and Wal-Mart's (admittedly ambiguous) signal about entering primary care. On these two announcements, bullish respondents outnumbered their bearish counterparts by 4:1 and 3:1.

Interestingly, the channel regarded the Walgreen's announcement as least significant—with the lowest proportion of respondents saying that it was significant, and greater balance of bulls and bears. This is interesting in that it seems to indicate that channel does not foresee a shift to traditional retailers, holding apart Wal-Mart's potential foray into care delivery as a clear exception.

Beyond the headlines, we sought to learn what is really happening on a local level in the transformation to value. Patient-centered medical homes, accountable care organizations, high-performance networks, and value-based benefit designs are all concepts that have received considerable attention in recent years. Asked about them, the channel responded that it is seeing the adoption of value-based insurance designs, but that provider network strategies have yet to really show up in the market.

Given that some of the national carriers are overtly supporting provider systems in new insurance product-based commercialization efforts, we suspect that we will see provider-led products gain momentum in the very near future. One can look to any of a number of announcements made recently to know that providers will be actively bringing products to market in the near future.

Here we go…

The next 12 months promise to be a roller coaster. In the realm of regulation, the Supreme Court decision, the 2012 election, and state-level action (or inaction) will set new rules for health care. Meanwhile, continued innovation will blur traditional lines between stakeholders, and bring a bevy of new products and services to market. As the translator and adviser to much of the health care marketplace, the broker community will play a vital role in connecting demand for health care solutions to the best options in the new environment.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.