If a carrier collected a milliondollars in premiums for an employer plan that offers health,dental, and vision, how much was the dental costing the company?You couldn't find out until now, says Eric Ryles about JDA's latestupdate to its benefits tool. (Photo: JDA/ALM)

If a carrier collected a milliondollars in premiums for an employer plan that offers health,dental, and vision, how much was the dental costing the company?You couldn't find out until now, says Eric Ryles about JDA's latestupdate to its benefits tool. (Photo: JDA/ALM)

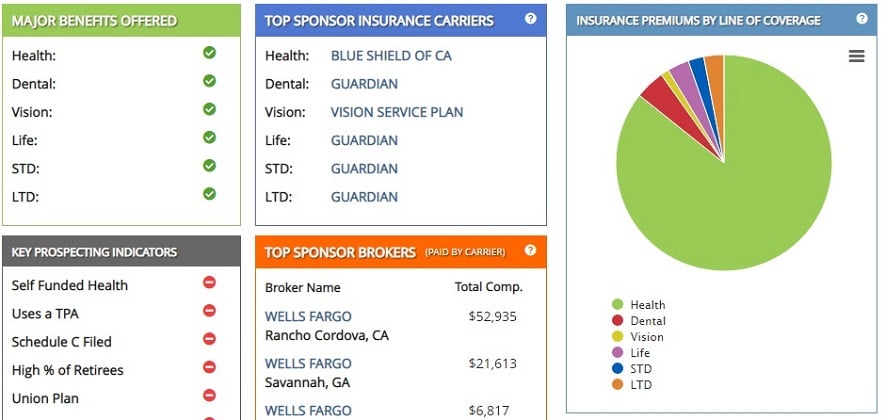

For brokers and carriers, getting an accurate figure for howmuch plan sponsors are spending on particular benefits can be a challenge. We spoke with dataanalyst Eric Ryles, our colleague at ALM's research arm, Judy DiamondAssociates, about how to solve this problem. The key, he saysis modeled premiums.

|BenefitsPRO: So what exactly do you mean by modeledpremiums? What are they?

|Eric Ryles: OK, I'm going to try to keep thisas simple as possible even though it's really complex. On each5500, the insurance carrier completes a section called Schedule A.This schedule lists all of the benefits that the carrier providesto the plan sponsor.

|The problem with this form is that a carrier can say “We providehealth, life, dental, and vision,” but they only have to list asingle dollar figure for what they collected in premiums,regardless of how many different benefits they are actuallyproviding.

|So if you have a plan that offers health, dental and vision andthe carrier collected a million dollars in premiums, how do youknow what the dental part of the plan is costing the company and the plan participants?The answer is that you couldn't until now.

|BenefitsPRO: You figured out how to break those premiumsapart? How do you know you're doing it correctly?

|Ryles: We did. We worked on our model foryears, and once we thought it was good enough we took it to anumber of insurance carriers and asked them if they could match ourdata up against theirs, to see how close the model was to how theyactually allocated the money from the plan sponsor.

|After a lot of iterations, we eventually got to the point wherewe were consistently plus or minus about 10 percent of the actualvalue the carriers themselves were ascribing to each line ofcoverage.

|BenefitsPRO: Why is it important to break this numberapart? Can't you just eyeball the policy and get an idea of whatgoes where?

|Ryles: It's important because it allows brokersand carriers to accurately gauge how much a plan sponsor isspending on a particular benefit type.

|If I'm a specialty carrier like Delta Dental, I can't look at aplan offered by someone like UnitedHealthcare, where both healthand dental are covered on the same contract, and get any idea ofwhat's being spent on dental. It makes market share analysis andterritory planning extremely difficult, if not downrightimpossible.

|With the new modeled premiums, I can now separate the chocolatefrom the peanut butter, as it were. This opens up all kinds ofexciting new options, like creating visualizations based on modeledpremiums, tracking the rise in a certain kind of premium backwardsacross years, or finding plan sponsors where their health premiumis going up faster than market average based on their size,industry, or location.

|BenefitsPRO: Is this model available to industry? Is itpart of the new tool you launched this week?

|Ryles: Yes, though it's probably moreappropriate to say that we released a new version of an existingtool. Our Group Insurance platform got a major upgrade, which we'veinternally been calling Group Insurance 3.0.

|We brought in several major new features and, more importantly,changed the way we looked at some of the insurance data.

|BenefitsPRO: Changed in what way?

|Ryles: Two big changes and about a dozensmaller ones. The first big change is that we're looking at theinformation in a more holistic way and have organized the data andthe various screens/graphics around all of the benefits offered bya plan sponsor, not just whatever can be found on a single 5500form.

|The second and arguably more interesting of the two big changesis the one I mentioned earlier — our new method of modelingpremiums.

|BenefitsPRO: So existing users will upgrade to this newversion?

|Ryles: In fact, they already have been. Anyexisting Judy Diamond Group Insurance user has access to the newtool. There was no upgrade fee, premium membership, or contractpapers for anyone to sign.

|New users will simply slot right into the new version of thetool. We upgraded our base platform because of this great new waywe found to corral and present data, and we want everyone to beable to use it.

|I can't wait for people to get into the new tool and developtheir own insights. I may even be working on a report that analyzesmarket trends based on modeled premiums.

|Read more at BenefitsPRO:

|5 ways to keep benefits costs down in2018

|Harnessing the power of sentiment analysis tostreamline benefits

|3 ways to know if you're overpaying for healthcare

|

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.