Middle-class consumers show growing interest in permanent life insurance products, according to an August survey from First Command Financial Services.

Forty percent of middle-class Americans own some form of permanent life insurance coverage, and among those who don't own a permanent life policy, one in four say they're likely to purchase this type of coverage in the future.

In a statement, First Command's CEO Scott Spiker says consumers are now seeing "how a market downturn can threaten a seemingly sound financial strategy. These numbers support findings by others in the industry who note that Americans are turning to permanent life coverage as a time-tested tool for managing long-term risk."

The most popular permanent insurance product is whole life, which is owned by 26 percent of middle-class families. Other permanent life products held by survey respondents include universal life and variable life, which are owned by 10 percent and 4 percent, respectively.

Term life insurance remains the "go-to" product for many consumers, according to First Command. Term policies are owned by 45 percent of middle-class families.

Survey findings show people who own term life policies feel less comfortable with their coverage than those who own whole life and other permanent products. The survey reveals a five-point gap between those who feel "extremely" or "very" comfortable with their permanent life insurance coverage (49 percent) and those who feel the same way about their term life insurance coverage (44 percent).

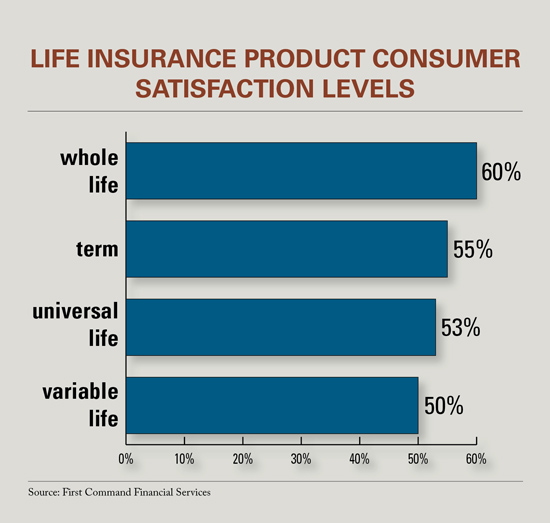

Also, consumer satisfaction levels are highest for whole life (60 percent), followed by term (55 percent), universal life (53 percent) and variable life (50 percent).

While only 4 percent of Americans report making changes to their life insurance coverage as a result of the economy, Spiker says it's concerning that roughly a third of Americans have no coverage at all.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.