Working women's retirement savings is significantly lower than men's, regardless of individual and household similarities, according to a new LIMRA study.

"Women's average defined contribution plan balances are only 60 percent of men's average balances," said Cecilia Shiner, senior analyst of LIMRA's retirement research. "This is especially concerning because women live longer than men and thus need more retirement savings. In addition to a longer average lifespan, women are more likely to have work disruptions for care giving that hinder their capacity to save. Therefore, they need to capitalize on savings opportunities while they are working."

The Gender Matters: Retirement Savings of Working Men and Women report studied men's and women's retirement savings habits and discovered working women 50 years and older have lower defined contribution plan balances by nearly $63,000 than men of the same age and employment status. Though the typical defined contribution plan deferral rate is higher for women aged 50 or older, they are 53 percent more likely to earn less than men of the same age.

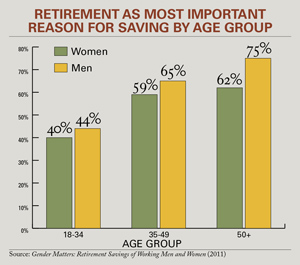

LIMRA researchers also found men of all age groups are more likely than women to name retirement as an essential reason for saving, suggesting women are likely than men to prioritize and oversee their retirement savings.

Based on the research, women tend to lack an understanding about financial products and services. When asked to rate their own knowledge about financial products and services, 29 percent of men and only 14 percent of women consider themselves knowledgeable. Fifty-four percent of women felt at least somewhat knowledgeable about financial products and services, but nearly three-quarters of men felt the same way.

However, the study shows employees with comparable financial knowledge, despite their gender, are similar regarding their behavior toward retirement planning. Both financially savvy men and women are more likely to be involved in managing their retirement savings than those who are not, which may suggest women would be more active in retirement planning if they improved their financial knowledge.

"As an industry, we have to do more to educate women on the importance of retirement saving and planning," Shiner says. "Companies can help employers provide the tools and information to encourage them to participate in their DC plans and become more involved in the financial decisions surrounding their retirement."

The study, which was conducted in July and August of 2010, surveyed almost 2,500 employees, who were not self-employed and did not work for the federal government or military but were also eligible for a defined contribution plan. All survey results are figured to represent a target sample population, according to U.S. Census numbers.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.