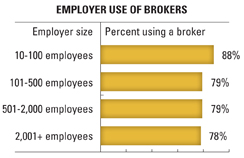

Lowered commissions, increased competition, loss-ratio mandates, buying direct from exchanges, carriers withdrawing from the medical market, and on and on and on. While it has become fashionable for industry pundits to talk about the impending demise of the broker, benefit managers and employers tell the real story. In a survey released in early 2010, the majority of benefit managers said they use a broker for their benefits package.

The exact percentage varied by size of the case as seen below: But even more important than the percentage using a broker is the increasingly important role the broker is playing. Several years ago, benefit managers felt that the role of the broker was “secondary” and that they were doing much of the due diligence and/or decision-making. In the more recent survey, however, almost half (48 percent) of benefit managers said their broker either investigates the alternatives and makes recommendations or is their trusted advisor whose advise they typically follow.

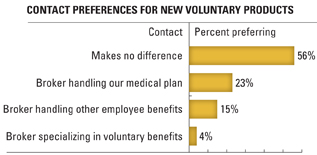

It appears that the increasing demands on the benefit managers’ time and the complexity of putting together a comprehensive benefits package while controlling costs are taking their toll. As a result, today’s benefit managers are looking to brokers to help them out. Those surveyed said that they would prefer to purchase benefits through a broker or consultant than through a business association, TPA, or even directly from the insurance company. The good news is that when considering voluntary products, benefit managers are open to any broker who brings them a good idea or good product.

In fact, when asked from whom they prefer purchasing voluntary, most said it makes no difference. If brokers are an endangered species, no one seems to have told the buyers. So it’s up to you to decide whose opinion is more important: buyers of your services or the pundits of pessimism?

Gil Lowerre can be reached at (860) 676-9633 or [email protected]. Bonnie Brazzell can be reached at (803) 738-1236 or [email protected].

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.