Four in 10 employers expect to devote more time addressing retirement plan governance issues over the next two years.

This is one finding from a new Towers Watson survey conducted in April and May.

“Managing and governing retirement plans has become increasingly difficult and time-consuming for plan sponsors over the past few years, especially as costs have risen and regulations have grown more complex,” said David Speier, Towers Watson’s Benefits Advisory and Compliance director. “Additionally, employers are growing concerned over many of the risks associated with their retirement plan governance. However, it appears that relatively few employers are proactively taking steps to address these concerns, particularly with respect to their defined contribution plans.”

The survey found that among respondents expecting to spend more time on plan governance, more than 80 percent cited regulatory complexity as a major reason, while two-thirds (67 percent) plan do to so as part of a greater emphasis on corporate governance.

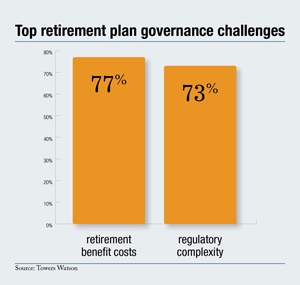

The survey also asked respondents to identify the greatest retirement plan governance challenges they expect to face in the next two years. The top two challenges were retirement benefit cost and regulatory complexity. Just over three-fourths (77 percent) placed retirement benefit costs among their top challenges, while slightly fewer (73 percent) cited regulatory complexity.

American Benefits Council President James Klein, testifying June 14 before the House of Representatives Committee on Education and the Workforce’s Subcommittee on Health, Employment, Labor, and Pensions, said regulatory requirements imposed on plan sponsors is prescribed by an “alphabet soup” of federal agencies. He urged lawmakers to change the status quo, providing plan sponsors and plan participants with predictable, clear and consistent guidance.

Specifically Klein, a former manager of pension and health care policy for the U.S. Chamber of Commerce Pension, advised:

- Congress needs to assert greater oversight on agencies that issue regulations clearly inconsistent with legislative intent. An example of this relates to hybrid plans. The statute requires interest crediting rates not to exceed a market rate of return. The proposed Treasury/IRS rules specify a certain interest rate and state that any other higher rate will violate the law. So even if the plan is able to get a higher rate in the market it cannot use it. This will force employers to reduce the rate at which it credits plan accounts, to the detriment of participants.

- Agencies need to give adequate time for employer plan sponsors to comply with new rules. The DOL recently announced an applicable date extension new fee disclosure rules between service providers and employers and the corresponding transition period for employers to comply with new participant fee disclosure rules. While the extra time is much appreciated, a two-fold problem remains: The service provider to plan sponsor disclosure rules have not yet been sent to the Office of Management and Budget for final vetting, likely leaving little time at the end of the year for compliance. Moreover, ideally a separate set of rules relating to electronic disclosure should be effective prior to the new participant fee disclosure guidance. This seems very unlikely to happen.

- Plan sponsors should be held to appropriate standards of care in their various government reporting functions. But when employers are penalized for what are obviously innocent mistakes, it undermines their willingness to continue to sponsor plans. An example of this is where the PBGC has sought significant additional premiums from companies that actually paid the correct amount of premium on time, but made simple clerical errors when submitting the premiums through the agency’s new electronic submission system.

- Sponsoring a pension plan is a costly endeavor, which many employers are willing to shoulder if they can plan accordingly. But pension funding rules – such as those prescribed under the Pension Protection Act – are highly sensitive to minor changes in interest rates or the stock market. This volatility erodes the ability of employers to continuing sponsoring plans – especially during tough economic times. Plan sponsors need predictability.

According to the Towers Watson survey, more than 80 percent of defined benefit and defined contribution plan sponsors identified regulatory compliance and investment volatility as the top risks over the next two years. However, while a majority of respondents are very concerned with compliance, only one in four (26 percent) schedule regular compliance reviews.

“Unfortunately, it appears that most plan sponsors generally wait until compliance issues emerge rather than take action to avert them,” said Robyn Credico, a senior consultant with Towers Watson. “Employers can take proactive measures to deal with risk issues. By conducting more regular compliance reviews, for instance, employers can get ahead of concerns over regulatory complexity and vendor quality.”

A total of 245 U.S. employers representing a broad range of industry sectors participated in the survey, Towers Watson reports. Eighty-one percent of respondents sponsor both defined benefit and defined contribution retirement plans. More details about the survey are available at www.towerswatson.com/governance-survey.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.