A recent study by Corporate Synergies Group, a benefits broker and consulting firm, finds that while 54 percent of senior financial executives said that keeping their employees' medical benefits costs to a minimum was important, many companies are forced to make tough decisions, including reducing workers' disposable income in order to maintain benefit levels.

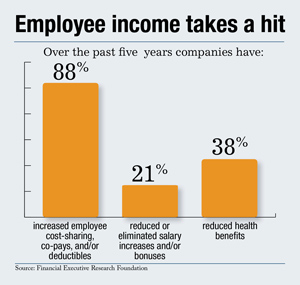

In the past five years, a vast majority of companies surveyed (88 percent) increased employee cost-sharing, co-pays, and/or deductibles. One-fifth (21 percent) of companies even reduced or eliminated salary increases and/or bonuses for employees. Almost two-fifths of the respondents (38 percent) took a different tack – they reduced health benefits.

"Financial executives are clearly faced with tough financial trade-offs as they remain committed to offering medical coverage to their employees. Yet in aggregate, these decisions – increased employee cost-sharing, higher deductible plans, reduced employee raises and bonuses – can mean significantly less disposable income for employees. Often these decisions are made in the short-term by slightly tweaking plans year over year, but it's important that financial executives look at the big picture and realistically consider, and communicate, the long-term implications to their employees," says John Turner, President and CEO, Corporate Synergies Group.

"Financial executives are clearly faced with tough financial trade-offs as they remain committed to offering medical coverage to their employees. Yet in aggregate, these decisions – increased employee cost-sharing, higher deductible plans, reduced employee raises and bonuses – can mean significantly less disposable income for employees. Often these decisions are made in the short-term by slightly tweaking plans year over year, but it's important that financial executives look at the big picture and realistically consider, and communicate, the long-term implications to their employees," says John Turner, President and CEO, Corporate Synergies Group.

Some Benefits are Sacrosanct — For Now

According to Corporate Synergies Group, it's clear that there are some benefits items that most senior financial executives haven't yet considered "on the table."

Recommended For You

For example, only 9 percent have reduced non-medical benefits and only two percent have eliminated dependent coverage.

While voluntary benefits are slowly catching on, only 4 percent of those surveyed have shifted from employer-paid policies to voluntary policies for medical coverage and only 3 percent have shifted to voluntary policies for non-medical benefits.

Financial Executives Entrenched in Benefits Decision

The group's survey indicates final benefits decisions are split almost evenly between executive team/board of directors and human resources.

Among the companies surveyed, 48 percent said the final decision was made by the executive team or board of directors, and 44 percent said it was made by HR.

Senior financial executives are the final decision makers in 28 percent of companies.

While 83 percent of respondents say that the final decisions have been made consistently by the same group at their organization, there does seem to be a slight shift to the executive team. Of those who said that the decision maker had changed in the last three years, almost half (44 percent) responded that the medical benefits decision was now led by the executive team. Yet, despite the finance department's common role in employee benefits decisions, just 47 percent say that they are very informed about their various options and feel comfortable making the decisions.

"Employee benefits represent a major portion of total compensation costs – 47 percent of companies said that providing employee medical benefits for the most recent fiscal year cost more than 10 percent of their total compensation costs. Yet, with less than half of financial executives saying that they are very informed about various benefits options and therefore comfortable making the decisions, it's clear that the complexity of these decisions is weighing on the minds of senior financial executives," says Tom Thompson, Research Associate with Financial Executives Research Foundation, Inc. (FERF) and co-author of the report.

HSAs, Cost Reduction Programs Adopted but Met With Skepticism

According to the study, 60 percent of companies have switched to higher deductible plans in the last two fiscal years, while half (51 percent) of businesses currently offer a health savings account (HSA) to their employees.

Financial executives see a number of advantages in offering HSAs, most often citing the tax deductible contributions (76 percent), allowing employees the flexibility to decide how to spend their medical dollars (62 percent), giving employees more control over individual health care decisions (60 percent) and the offsetting of high deductibles (58 percent).

Among the companies that do not currently offer an HSA, 32 percent believe that they need more education about the benefits of HSAs and 30 percent say that their employees need more education about the advantages of HSAs. Nine percent of financial executives that do not offer HSAs believe that their employees think negatively about them.

"Despite the cost savings, many financial executives say that they believe their employees would not accept HSAs. Underscoring that concern, many companies that have offered the plans have seen fairly low enrollment rates. But this apprehension is keeping employers from reaping the myriad advantages of HSAs," adds Andrew Bloom, Executive Vice President of Operations, Corporate Synergies Group.

"Therefore, both thoughtful communication and appropriate benefit structure are keys when it comes to the adoption of these programs. To fully embrace HSAs and high deductible plans, employees need to know more about how the programs work and what costs they can expect, and the benefits need to be priced and configured attractively for employees' adoption."

Many companies are also turning to cost reduction programs – 65 percent have offered wellness programs to their employees, such as weight loss programs, smoking cessation programs, on-site gyms, and/or nutritional seminars and services, 28 percent have offered disease management programs and 15 percent have put a greater emphasis on claims profiling. Nonetheless, half (52 percent) of financial executives have not yet seen a return on their investment for these programs. Of the 35 percent of companies that have seen a return on investment for these programs, 42 percent said that it took over two years to realize.

"As tempting as it is to look at current cost and one year return on investment for employee benefit programs, the most effective way to manage benefits cost over time is through multi-year programs such as wellness and disease management, which typically require three or more years to deliver ROI," says Michael Beauvais, Director of Worksite Wellness, Corporate Synergies Group. "This requires financial executives to find a way to include some benefit cost reduction programs as part of their multi-year projects."

Download a full copy of the report here: www.corpsyn.com.

Methodology

The Trends & Tradeoffs in Employee Medical Benefits Survey was conducted from February 25 – May 31, 2011 and consisted of two studies fielded in collaboration with the Financial Executive Research Foundation. The qualitative survey consisted of eleven in-depth interviews with senior financial executives and the quantitative portion consisted of an online survey of 156 financial executives.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.