Consumer driven health plans in the United States experienced continued growth this year, though at a slower rate than in 2009 and 2010, according to preliminary results released by United Benefit Advisors from its 2011 UBA Health Plan Survey.

The survey is the nation’s largest health plan benchmarking survey, with more than 16,000 plans from nearly 11,000 employers.

CDHPs grew at a rate of 13.9 percent this year, still significant, but only about two-thirds the growth rate of 2010. Currently, CDHPs represent 22.9 percent of all plans offered and cover 17.3 percent of employees, a greater percentage of employees than are now covered in HMOs (11.9 percent), according to Bill Stafford, UBA vice president, member services.

The Northeast region of the country had the largest concentration of CDHPs (31.3 percent), followed by the Southeast region (27.4 percent). The average cost increase for all CDHPs at 8. percent was slightly lower than that of the average of all plan types, which increased 8.2 percent this year.

To help employees offset the higher out-of-pocket expenses under CDHPs, employers are offering health reimbursement arrangement or a health savings account and contributing funds. The survey found the average employer contribution to an HRA was $1,656 (up from $1,481 in 2010) for a single employee and $3,198 for a family (up from $2,857 in 2010).

“For the first time in more than seven years of reporting, CDHPs nationally did not create a savings over the clients’ in-force plan prior to renewal. This year experienced an increase (2.1 percent), albeit less than the average 8.2 percent increase of all plans,” Stafford says. “As these plans become more prevalent, the percentage of savings has continually declined.”

“We anticipate that in spite of passage of health care reform efforts, health care costs will continue to increase. There still needs to be concerted efforts to change or alter the underlying health care issues that control costs,” Stafford says

Other key findings from the survey:

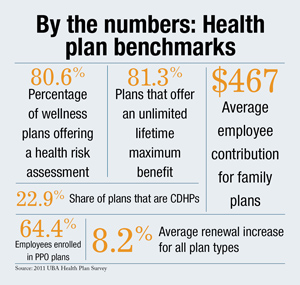

- The average renewal increase for all plan types was 8.2 percent.

- PPO plans have nearly two-thirds of all enrolled employees (64.4 percent).

- The average employee contribution for plans with contributions for all plan types is $117 for single and $467 for family.

- Four-fifths of all wellness plans (80.6 percent) offered a health risk assessment.

- As a direct result of health care reform criteria, 81.3 percent of all plans now offer an unlimited lifetime maximum benefit compared to just 16.1 percent in 2010.

- Of all plans in the Northeast, 80.7 percent still have 100 percent coinsurance, a decline of only 1 percent from 2010.

- About half of all covered employees also elected to cover their dependents, a decline of 6 percent.

“The intent of the survey is to provide employers of all sizes with the data they need to manage their health care benefit programs effectively,” Stafford says. “Especially for employers with fewer than 1,000 employees (which represents more than 99 percent of the employers in the U.S.)--and for employers who have operations in multiple locations, this survey is the best source of reliable regional--and in many cases, statehealth plan benchmarks by employer size and industry categories.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.