Introduced in March 2009, the federal COBRA subsidy covered 65 percent of the cost of COBRA premiums for up to 15 months.

In order to qualify for the subsidy, recipients must have originally become eligible for COBRA as the result of an involuntary termination of employment occurring between September 2008 and May 2010. The subsidy's last group of recipients — those who began receiving assistance in May 2010 — roll off the subsidy this week. As a result, they face a 186 percent increase in their monthly COBRA premiums

[See also: Goodbye, COBRA subsidy]

Recommended For You

Online health insurance provider eHealthInsurance says unless they are eligible to enroll in a new employer-based health insurance plan, former subsidy recipients who do not wish to go uninsured may opt to pay their COBRA premiums at the increased rate for an additional three months, until their COBRA eligibility ends. Alternately, they may search for more affordable options in the individual & family health insurance market or through government-sponsored programs.

Here are 5 tips for former COBRA subsidy recipients:

1) See if you can save money in the individual market

If you're relatively healthy, you may be able to purchase health insurance on your own at a cost similar to your formerly subsidized COBRA coverage, and for less than a full COBRA premium.

For example, the Kaiser Family Foundation found in 2010 that the national average cost of maintaining COBRA without the subsidy was $1,137 per month for families and $410 per month for individuals. By comparison, health insurance plans purchased through eHealthInsurance with coverage in effect as of February 2010 averaged $392 per month for families and $167 per month for individuals. Note, however, that if you are currently covered by COBRA and have a pre-existing medical condition, it is possible to be declined coverage in the individual & family market. Do not cancel your current insurance coverage until you are officially approved for a new plan. (Source: eHealthInsurance)

(Photo: Stuart Miles)

Jump to:

- See if you can save money in the individual market

- Understand your government-sponsored options

- Get hip to HIPAA

- Make your consulting work official for health insurance and tax breaks

- Negotiate health care costs whenever possible

2) Understand your government-sponsored options

Health care reform expands access to programs like CHIP and Medicaid but does not provide free coverage. You may qualify for assistance based on your income. For persons with pre-existing medical conditions, health reform also expands access to high-risk pools, also known as pre-existing condition insurance plans (PCIP).

Though you no longer need to be declined coverage before you can qualify for a PCIP, you may still have to be uninsured for six months. To learn more about your government-sponsored options, contact your state department of insurance or the non-profit Foundation for Health Coverage Education at coverageforall.org. (Source: eHealthInsurance)

(Photo: From left, supporters of President Obama's health care policies Ron Pollack, Larry Kim, Dell Erwin, Ray Scher, and Kevin Wilson hold a rally in front of federal court in Richmond, Va. Tuesday, May 10, 2011. AP Photo/Steve Helber)

Jump to:

- See if you can save money in the individual market

- Understand your government-sponsored options

- Get hip to HIPAA

- Make your consulting work official for health insurance and tax breaks

- Negotiate health care costs whenever possible

3) Get hip to HIPAA

HIPAA (the Health Insurance Portability and Accountability Act of 1996) is a law that guarantees access, for consumers who meet specific criteria, to special health insurance plans that do not have pre-existing condition limitations.

If you can show that you have had "creditable health insurance coverage" (which includes COBRA) without a gap of more than 63 days, you may qualify for a HIPAA plan. This is a good option for people who can afford COBRA at the full-price but have exhausted their 18-months of COBRA eligibility. HIPAA plans can be expensive, but they provide persons with pre-existing medical conditions valuable access to coverage. (Source: eHealthInsurance)

(Photo: At a doctor's office where she is the office manager, Barbara Velez, right, makes certain every visiting patient receives a privacy notice, Friday, May 2, 2003. AP Photo/Bebeto Matthews)

Jump to:

- See if you can save money in the individual market

- Understand your government-sponsored options

- Get hip to HIPAA

- Make your consulting work official for health insurance and tax breaks

- Negotiate health care costs whenever possible

4) Make your consulting work official for health insurance and tax breaks

Many of today's unemployed earn supplemental income by consulting or contracting. By officially going into business for yourself, you may qualify for group health insurance and special health insurance tax breaks.

[See also: IRS gives details on small biz tax credit]

Depending on the rules in your state, you may be eligible for a small business health insurance plan with only one or two full-time employees (including yourself) – and you can't be turned down due to pre-existing medical conditions. The 2010 health care reform law provides a tax credit of up to 35 percent of the money certain businesses spend on health insurance premiums for low to moderate-income workers.

Not all small businesses will qualify for the full tax credit and rules for incorporating your business may vary from one state to another, so consult with your accountant. (Source: eHealthInsurance)

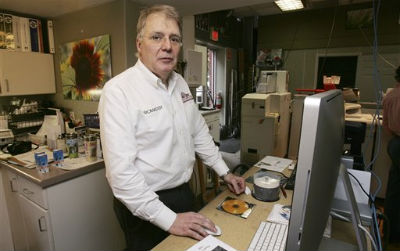

(Photo: Michael St. Germain, president of Concord Camera, poses at his store in Concord, N.H., Tuesday, March 23,2010. St. Germain owns a small business and said he is grateful the health bill passed. AP Photo/Jim Cole)

Jump to:

- See if you can save money in the individual market

- Understand your government-sponsored options

- Get hip to HIPAA

- Make your consulting work official for health insurance and tax breaks

- Negotiate health care costs whenever possible

5) Negotiate health care costs whenever possible

You may be able to save up to 30 percent your medical bills by negotiating with your medical care provider.

If you end up uninsured after the COBRA subsidy, you'll no longer automatically benefit from the discounted rates that doctors and hospitals agree to accept as payment in full from many insurance companies. That means the charges listed on your medical bills may be substantially higher than others are expected to pay.

Talk to your doctor or your hospital's billing department to see if you can negotiate a discount for your care by paying up-front or creating a payment plan. Persons with health savings accounts or enrolled in plans with high cost-sharing may also benefit by negotiating medical costs. Visit Healthcare Blue Book to learn more and find suggested prices for many standard medical services. (Source: eHealthInsurance)

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.