With a poor economy, sad unemployment rates and that little issue called the debt ceiling to worry about, health care reform isn't the first indicator influencing decisions about employee benefits. At least that's what employers say.

According to the Benefits Selling 2011 Employer Survey, employers seem to suggest health care reform is less significant — with 72 percent of employers insisting reform is making them rethink employee benefit offerings. Overwhelmingly, employers (at 88 percent) say the economy has influenced—and continues to influence—employee benefits spending. [Read "Workers' confidence remains stagnant."]

One result economic conditions are having on employee benefits? Having employees pick up more of the tab. Lanelle McCrone, human resources generalist at the City of Naples Airport Authority, explains her employees now have to cover 10 percent of their health insurance when their company used to cover everything. And many are on the same page as McCrone: Of our survey respondents, 73 percent said their employees will have to foot more of the bill in the coming year.

Additionally, adds Jack Hyde, account executive at Fisher Brown Insurance, employers are now paying nothing for dependents.

“Employers are also cutting back on the medical benefits plans themselves, asking the employee to pay higher co-pays and deductibles,” he says.

And although the Patient Protection and Affordable Care Act requires employees' adult children up to 26 to be covered under their health plans, very few employers are doing so until it's federally required.

But it doesn't end there. Employers across the country are either cutting employees or putting the brakes on hiring.

Amber Hawkins, a small business owner (she owns and operates Your Computer Needs of Toledo, Ohio), says the economy and insurance rates are “a very high concern in my book.” Although she planned on hiring employees, she says she simply can't because of the economy.

“[If I did], I'd have to tell [employees] you'll be able to work but I won't be able to offer you this benefit or that benefit because I won't be able to pay for it. I'd rather not have any employees than do that to someone,” she says. “I don't want to hire anyone if they can't take advantage of health care that they need.”

The information from Benefits Selling's survey mirrors findings from the Society of Human Resource Management's own employer survey earlier this summer. They found a slight increase in the percentage of respondents whose benefits offerings have been negatively affected by the economy.

Eighty-five percent of respondents reported their organizations were feeling the impact of the economic downturn (27 percent reported being affected to a large extent and 58 percent to some extent), and 77 percent reported the employee benefits offerings have been negatively affected (12 percent reported being affected to a large extent and 65 percent to some extent).

“The HR job market is finally starting to bounce back after taking a big hit in 2009 and 2010, but it is still down, and most HR departments are still starved for resources. In this economy, opportunities will lag for people who need rules, structure and predictable work. Dealing with uncertainty and ambiguity is the new reality,” Bob Corlett, president of Staffing Advisors told SHRM researchers.

Last year's Benefits Selling employer survey reported virtually all employers were concerned about the impact of health care costs. A year later, there's much more going on that's impacting costs.

The stock market has been on a rollercoaster ride. At press time, U.S. stocks plunged again sharply reacting to the country losing its coveted “AAA” credit rating. That's before they bounced back. And then dropped again. Washington can't decide if the country needs more cuts or more tax increases—so nothing seems to get done besides partisan bickering.

No doubt there's fear we're near a double-dip recession. And economists warn if the economy does fall back into recession, things could be more painful than the last time around. That's in part due to the anemic state of the nation—we never recovered from the Great Recession.

Instead, the number of jobs has shrunk. The economy has 5 percent fewer jobs—6.8 million—than it had before the last recession began. The country's unemployment rate is hovering around 9.2 percent now (back then it was 5 percent). Since employers shed all the extraneous employees (along with extra work shifts) they could during the last recession, it's unclear how businesses could lay off more workers and still manage to function should another recession occur.

And still, health reform falls into the mix, both influencing, and being affected by, the nation's mounting economic woes. And don't forget, we're still waiting for most of the health care reform regulations to kick in.

“The debt deal, health care reform and the economy are so connected together that not only are we (as an agency) rethinking our position in the marketplace, but also carefully planning for ourselves and our clients' benefit costs,” says Gene Davis, president of the Life Underwriter Training Council Fellows.

The debt deal has been raising more questions and not providing answers when it comes to Medicare and Medicaid, as serious slashes to those programs are under consideration. Most think that instead of solving problems, the deal is simply putting a Band-Aid on a long-term problem.

Small businesses are being hit the hardest, feeling a one-two punch from health reform and the economy, with many terminating their entire plans in order to survive.

“Perhaps the most dramatic shift in the small business market (less than 50 employees) has been a greater movement from traditional group health benefits to individual plans, which requires no employer participation or contribution,” Davis says.

Yet, there's also some optimism. Hawkins says she thinks raising the debt ceiling could give small businesses an opportunity to rebound.

“With the rise of where the debt ceiling was, hopefully it will be more advantageous to consumers and they will have the opportunity to purchase a lot of our services and products that we offer,” she says. “In turn, hopefully I can gain employees, give them incentives and rewards they deserve and be able to afford to do so.”

But of course, not everyone is blaming the economy and pointing their finger at those in Washington. Simply said, health benefits remain expensive for employers.

“We're always looking for ways to control our benefits costs, especially health insurance premiums,” says Ernie Brubaker, treasurer of Gardner Publications in Cincinnati.

“We'd do this regardless of the economy, as it seems our premiums keep spiraling upward no matter what the economy is doing.”

WHERE BROKERS FIT IN

With high costs and general uncertainty, it's likely employers are going to need help navigating their way through this poor climate. So, want to know what employers really think about you? Here's what we found out:

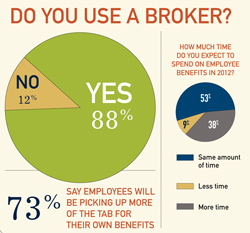

You're important. About 88 percent of employers say they utilize a benefits broker or agent in their workplace. For many employers, you are simply a valued mediator between them and their employees. “I would never have the time to negotiate annual health, dental and vision benefits,” McCrone says. “I completely depend on my broker to do so. I talk with my broker weekly and they also administer new hires and any changes directly with my benefit providers.” But maybe brokers should be a little bit worried (as if they hadn't been already): Almost 80 percent say their broker works on commission.

Enrollment can't be done without you. Our survey shows 49 percent of employers say their brokers help conduct enrollment, while 36 percent say they completely conduct their enrollment. Still, 15 percent say brokers have nothing to do with their enrollment—information brokers can take into consideration. Statistics from HighRoads show that both employers and employees are dealing with enrollment passively, rather than actively—and that's a risk. This means there's even more room for growth.

They're satisfied with your communication skills. About 87 percent say they are satisfied with the amount of communication they have with their broker. But there's still room for improvement: 11 percent say they wish they communicated more often with their broker. Just two percent say they wish you'd bother them a little less. The majority of employers say they communicate with their brokers multiple times per year (32 percent), with 20 percent saying they communicate multiple times a week, 18 percent saying multiple times a month, 11 percent once a month, 8 percent once a week, 6 percent on a daily basis and 6 percent saying once a year.

What you do is important. Yes, employee benefits really do matter. When asked what their employees consider to be the most important benefit to them, they, not surprisingly, said health insurance. Seventy-eight percent say employees consider overall coverage (HMOs, PPOs) the most important. Second is consumer-driven health care (HSAs, HRAs) at 15 percent. That leaves a little room for executive benefits such as life insurance (2 percent) and dental coverage (1 percent). Although there are some fears about employers dropping or reducing coverage, statistics show employees are more loyal to employers that offer good benefits. Additionally, good benefits—including programs fostering wellness and health—have proven very effective at improving productivity at work.

Your products are time-consuming. Although the majority of employers say they'll spend the same amount of time on employee benefits in 2012, 38 percent say they'll spend more time on them in the coming year. Nine percent say they'll spend less time. According to researchers, the recession and weak economy has kept health spending in 2010 “historically low” because more Americans have avoided and delayed medical treatments. Job losses cutting the number of people covered by employer-sponsored insurance, too, caused health spending to increase only by 3.9 percent. This won't be the case in the coming years, though, researchers warn. The biggest spending increase is expected in 2014, when most aspects of the new health reform bill kicks in. The report projects that national health spending will grow 8.3 percent in 2014, up from a projected 5.5 percent growth rate in 2013. If researchers are predicting accurately, employers will likely be spending more time (and money) on health benefits.

CONSUMER-DRIVEN POPULARITY

As far as plans employers are implementing to benefits packages, there's a growing trend of consumer-driven care: 78 percent told us their company has considered expanding the use or implementation of consumer-driven plans. Our 2010 report revealed “CDHC is the answer to end frustration” in regards to reform.

“CDHC is good for the sick and the healthy, the poor and the wealthy,” Greg Scandlen said at last year's Benefits Selling Expo. “Consumer-driven plans lower costs, allowing families to plan for the future; they also increase participation in wellness and prevention, and improve compliance and health.”

And it seems the trend isn't slowing down as employers look to spend less money but provide strong, alternative and innovative care.

“We were early adopters of dental direct reimbursement, which is really self-funded dental insurance and really isn't insurance per se, but rather a claims funding/reimbursement mechanism. This allowed us to be early adopters of a high-deductible health care plan (with HSA), which we've had for 4-5 years,” Brubaker explains of his company's CDHC care. “We're investigating switching from a fully-insured HDHP to a self-insured HDHP, in an effort to rein in costs. If we are comfortable that the appropriate stop-loss/reinsurance mechanisms can be put in place to prevent a catastrophic claims year from impacting our bottom line, we may well make the switch.”

Roughly 58 percent of respondents say their company has implemented—or plans on implementing—a wellness or disease management program to contain costs. Health savings accounts are also becoming more prevalent: 44 percent of employers say they offer health savings accounts; 56 percent don't. Of those that do offer HSAs, most employers (48 percent) say just 1-25 percent of their employees take advantage of the benefit. Twenty-one percent say 26-50 percent of their employees take advantage of the HSAs, followed by 51-75 percent (14 percent) and 76-100 percent (17 percent).

SHRM also reported the same—that HSAs are becoming more common, while HMO plans continue to lose popularity. Additionally, we found 53 percent of employers say they offer flexible working benefits.

Retirement benefits are still a common employee benefit, with 70 percent of employers reporting they offer those retirement benefits. But things didn't quite pick up from last year: 72 percent of employers say they haven't been able to reinstate a reduced matching contribution, if they had done so. That's not news retirement savers want to hear. With the fragile economy and the stock market plunge, many Americans are seeing their 401(k)s shrink dramatically. Last year's survey revealed employees want help from employers with their financial situations.

“Right now, I see what's happening as an opportunity for growth,” Hawkins says. “I'm trying to be as optimistic as possible in spite of everything. My hope is that the worst is over and the best is yet to come.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.