The U.S. Bureau of Labor Statistics has released its annual report from the National Compensation Survey on Health and Retirement Plan Provisions in Private Industry in the United States, 2010 (August 2011, Bulletin 2770).

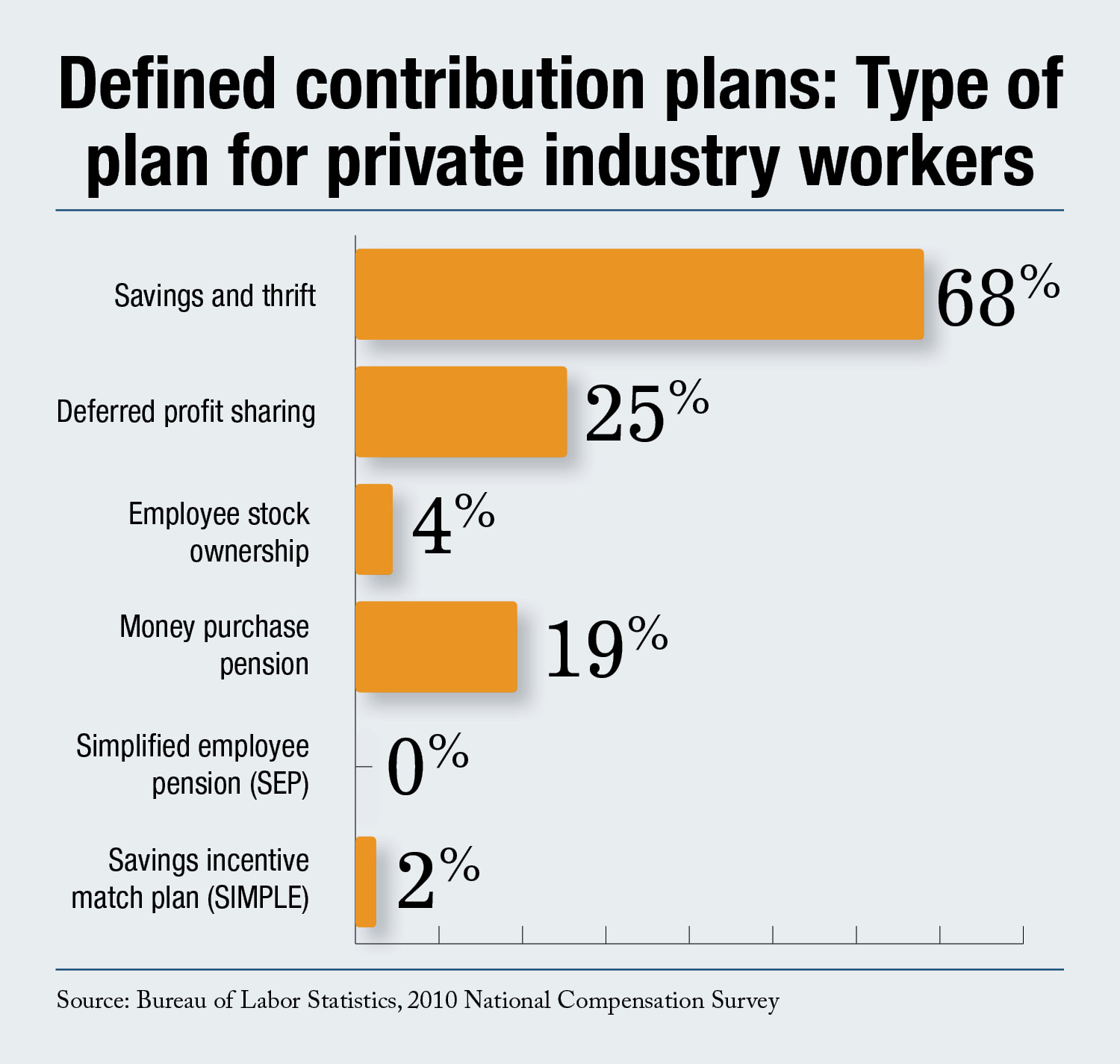

The survey was based on a sample of approximately 3,200 establishments. Among the data published for health benefits, the report finds that defined contribution plans take many forms; 68 percent of workers participating in a defined contribution plan are in a savings and thrift plan. Other types of defined contribution plans include deferred profit sharing, employee stock ownership, money purchase pension, simplified employee pension (SEP), and savings incentive match plan (SIMPLE).

Looking at all workers participating in defined contribution plans, 86 percent contribute with a 401(k) pre-tax contribution while 23 percent contribute with a Roth 401(k) contribution. (In some cases, employees contribute to both, so the total is greater than 100 percent.)

Looking at all workers participating in defined contribution plans, 86 percent contribute with a 401(k) pre-tax contribution while 23 percent contribute with a Roth 401(k) contribution. (In some cases, employees contribute to both, so the total is greater than 100 percent.)

Recommended For You

Among the data published for defined benefits are the eligibility requirements, which show that, of employees participating in defined benefit plans, 81 percent are in plans that are open to new employees. Approximately two-thirds of participants were covered by a traditional benefit formula, such as a percent of terminal earnings.

The remainder had non-traditional formulas, most often cash balance plans. In addition to these data highlights, the BLS report includes much more data in 40 tables with estimates broken out by worker, establishment, and geographic characteristics. The complete report can be found at: http://www.bls.gov/ebs/#bulletin_details.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.