A large number of financial professionals plan to ramp up their retirement income planning practices over the next few years, according to a new study by the Principal Financial Group.

The "2011 Best Practices in Retirement Income Planning Study" focuses on financial professionals who serve qualified retirement plans. The report provides insight into how plan advisors will serve the growing baby boomer market.

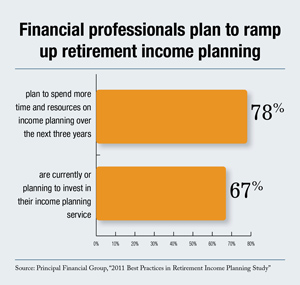

Six out of 10 plan advisors already provide retirement income planning services to retirement plan participants, according to the study. The vast majority, or 78 percent, plan to spend more time and resources on income planning over the next three years and nearly 70 percent say they are, or will be, investing for growth in their income planning service. Thirty percent say they will focus on better planning tools.

Six out of 10 plan advisors already provide retirement income planning services to retirement plan participants, according to the study. The vast majority, or 78 percent, plan to spend more time and resources on income planning over the next three years and nearly 70 percent say they are, or will be, investing for growth in their income planning service. Thirty percent say they will focus on better planning tools.

Recommended For You

"Retirement income planning is a fast-growing revenue source for many financial professionals. This study provides valuable insight into best practices for those who want to tap into this vast opportunity—whether they are just getting into income planning or want to improve their current practice," said Tim Minard, senior vice president of retirement investor services for The Principal.

More than one-third of plan advisors are missing out on an opportunity to serve the retirement income planning business because they are not being notified when participants leave the plan, either through retirement or leaving employment, the study found.

When asked to evaluate retirement income products, plan advisors favor options that can be personalized to each retiree's situation.

"Clearly the vast majority of plan advisors believe as we do that there is no one-size-fits-all approach to retirement income planning," said Minard.

The study was conducted with PLANADVISER in June 2011 on behalf of the Principal Financial Group. A total of 249 financial professionals serving qualified retirement plans responded to the survey, which results in a 6.2 percent margin of error.

The Principal Financial Group offers businesses, individuals and institutional clients a wide range of financial products and services, including retirement, investment services and insurance through its diverse family of financial services companies.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.