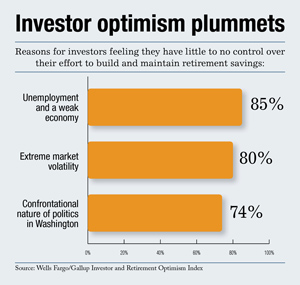

Investors are not optimistic about their ability to build and maintain retirement savings, according to the September Wells Fargo/Gallup Investor and Retirement Optimism Index. Nearly two-thirds of investors—65 percent—say they have little or no control at all over their retirement savings.

According to the index, investor optimism is almost as low as it was during the financial crisis of 2008. The overall index fell to -45, down from +33 in May. In December 2008, the index fell to -49. Its lowest point was -64 in February 2009.

"A majority of Americans feel they don't have control over their effort to build retirement savings, and this is just as worrisome as the sharp drop in investor optimism," said David Carroll, senior executive vice president and head of Wells Fargo Wealth, Brokerage and Retirement. "The reasons investors cite are all quite understandable given our environment today; yet, this lack of control coupled with overall feelings of fear could cause investors to make choices that will deter investing for the long-term."

Recommended For You

Sixty-three percent of respondents responded "no" when asked whether now is a "good time to invest in the markets," up from 43 percent in May. Even so, 42 percent of investors are still very engaged in the market saying they follow it "daily," while about a quarter (24 percent) say they monitor it weekly. When asked what they think the best place is to keep their money right now, 26 percent said stocks/mutual funds, 21 percent said savings accounts/CDs, 20 percent cited gold/precious metals, and 14 percent said under the mattress/cash.

Investors also said that the top factors affecting the investment climate are unemployment, the deficit, job growth rate and a politically divided government.

The September poll also found differences in how today's retirees are funding their retirements and how those who have yet to retire plan to do so. Current retirees are more likely to depend on employer-sponsored pensions and Social Security, while future retirees expect to rely on their own savings.

Sixty-four percent of non-retirees said they expect to rely heavily on their 401(k) when they retire, compared to 33 percent of the retired. Thirty-four percent of non-retirees expect pensions to be a major source of funding, compared to 44 percent of retirees.

Thirty-two percent of those who haven't retired yet call stock investments a major source of funding for their retirement, compared to 26 percent of the retired.

The study polled 958 randomly selected investors from across the country.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.