A new Investment Company Institute study of participant activity in 401(k) plans shows that individuals are still committed to saving for their retirement, despite market volatility.

The study, "Defined Contribution Plan Participants' Activities, First Half 2011," looked at recordkeeper data from nearly 24 million defined contribution plan participant accounts. It found that only 1.6 percent of defined contribution plan participants stopped contributing in the first half of 2011, compared to 1.7 percent in 2010.

It also found that the number of individuals taking withdrawals from their accounts stayed the same as in 2010, at 2.1 percent, and loan activity edged up slightly, "a pattern of activity that also was observed in the wake of the bear market and recession earlier in the decade," the report stated. Hardship withdrawals were slightly higher in 2011, compared with 2010. At the end of June 2011, 18.3 percent of DC plan participants had loans outstanding, compared to 18.2 percent at the end of 2010.

Recommended For You

Most plan participants kept their asset allocations as stock values went up and down and up again during the first half of the year. From January through June, 6.4 percent of DC plan participants changed the asset allocation of their account balances, and 6 percent changed the asset allocation of their contributions. These levels of reallocation activity were slightly lower than the reallocation activity observed during the same time frame a year earlier.

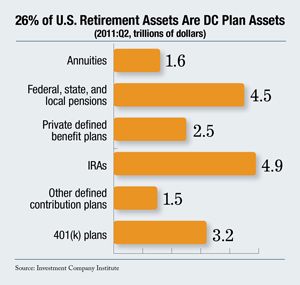

Defined contribution plan assets made up more than one-quarter of the total retirement market, or 26 percent, and almost one-tenth of U.S. households' aggregate financial assets at the end of the second quarter of 2011, the report found. ICI has been tracking participant activity through recordkeeper surveys since 2008.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.