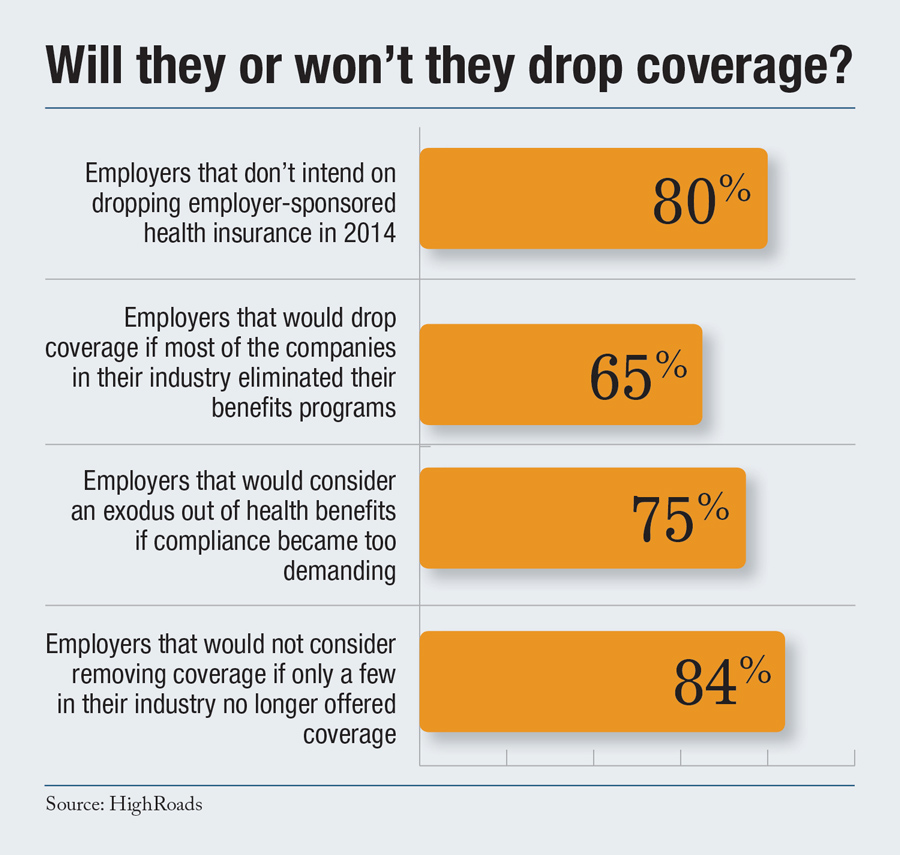

Most employers don't plan on dropping health insurance for employees in 2014, according to a new survey. But, if the "other guy" drops coverage, companies say they're likely to follow suit.

A HighRoads study finds 80 percent of employers don't intend on dropping employer-sponsored health insurance in 2014, once health insurance exchanges are in place and workers have an alternative marketplace to shop for affordable coverage. However, a majority – 65 percent – say they would drop coverage if most of the companies in their industry eliminated their benefits programs.

If only a few in their industry no longer offered coverage, 84 percent of employers would not consider removing coverage.

Recommended For You

Increased regulation may be a breaking point, though, for companies already struggling with higher benefits costs. Seventy-five percent of companies say they would consider an exodus out of health benefits if compliance became too demanding.

HighRoads surveyed nearly 70 employers, 30 percent of which represents the health care and hospital industry, a spokesperson said.

HighRoads offers benefits plan pricing and information, benchmarks, and benefits management. It's the latest HR/benefits service firm to gauge employers on their forecasts for 2014 and beyond. In August, benefits provider and consulting firm Towers Watson found one in 10 midsize and large employers expect to stop offering coverage.

A McKinsey study published this summer tipped off the controversial discussion on employers' decisions to continue offering coverage after health insurance exchanges are established by state or federal regulators, or choose to pay a penalty of $2,000 per full-time employee, which would hit companies that have 50 or more employees.

The HighRoads Pulse Study also found that most employers (91 percent) said they would not consider eliminating some benefits coverage currently offered based on the complexity of the new Summary of Benefits and Coverage (SBC) requirements.

A little more than half (58 percent) of respondents said they were prepared to produce SBCs by the original March, 2012 deadline.

Originally, the Patient Protection and Affordable Care Act required health plans and health insurance issuers to provide participants with a summary of benefits and coverage no later than March 23, 2012. But a recent FAQ issued by the Departments of Health and Human Services, Labor, and Treasury states that plans and issuers are not required to comply with the provision until final regulations are issued – a date which is undetermined at this time.

"Based on these survey results, SBCs have not caused a great concern among organizations," said Kim Buckey, SPD Practice Lead, HighRoads. "This is partly a reflection of current communications practices—many employers are already providing a level of communication close to that required by the SBC regulations—and partly a reflection of HR departments embracing technology. By using automation to leverage existing data, they are better able to respond to required changes. That will enable timely compliance once the new deadline is determined."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.