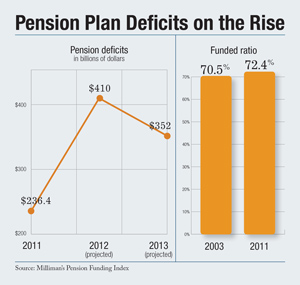

Milliman's Pension Funding Index showed that the 100 large defined benefit pension plans it tracks increased their pension deficit by $236.4 billion in 2011, as corporate pensions faced record underfunding.

In December alone, these pensions experienced a $59.7 billion decrease in pension funded status. The funded status decline for the month of December was primarily due to higher liabilities based on a decrease in corporate bond interest rates that are the benchmarks used to value pension liabilities. The funded status decline was partially offset by positive investment performance during December.

"This was an unusually dispiriting year for these 100 pensions," said John Ehrhardt, co-author of the Milliman Pension Funding Study. "Assets treaded water this year, producing an anemic $12.3 billion increase in value as record low interest rates increased pension liabilities by $248.7 billion."

Recommended For You

While 2011 was a bad year, the year-end 72.4 percent funded ratio still could not eclipse the record of 70.5 percent set in May 2003.

"If the Milliman 100 PFI companies were to achieve the expected 8 percent (as per the 2011 Pension Funding Study) median asset return for their pension plan portfolios and the current discount rate of 4.25 percent were to be maintained during years 2012 and 2013, we forecast the funded status of the surveyed plans would increase," according to the study. "This would result in a projected pension deficit of $410 billion (funded ratio of 75.9 percent) by the end of 2012, and a projected pension deficit of $352 billion (funded ratio of 79.6 percent) by the end of 2013."

Milliman is one of the world's largest independent actuarial and consulting firms. For the past 11 years, Milliman has conducted an annual study of the 100 largest defined benefit pension plans sponsored by U.S. public companies. The Milliman 100 Pension Funding Index projects the funded status for pension plans included in the study.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.