A recent study of Generation X and younger Baby Boomers has found that only one-third are very confident of having enough money to live on during retirement, cover medical expenses and pay for their children's higher education.

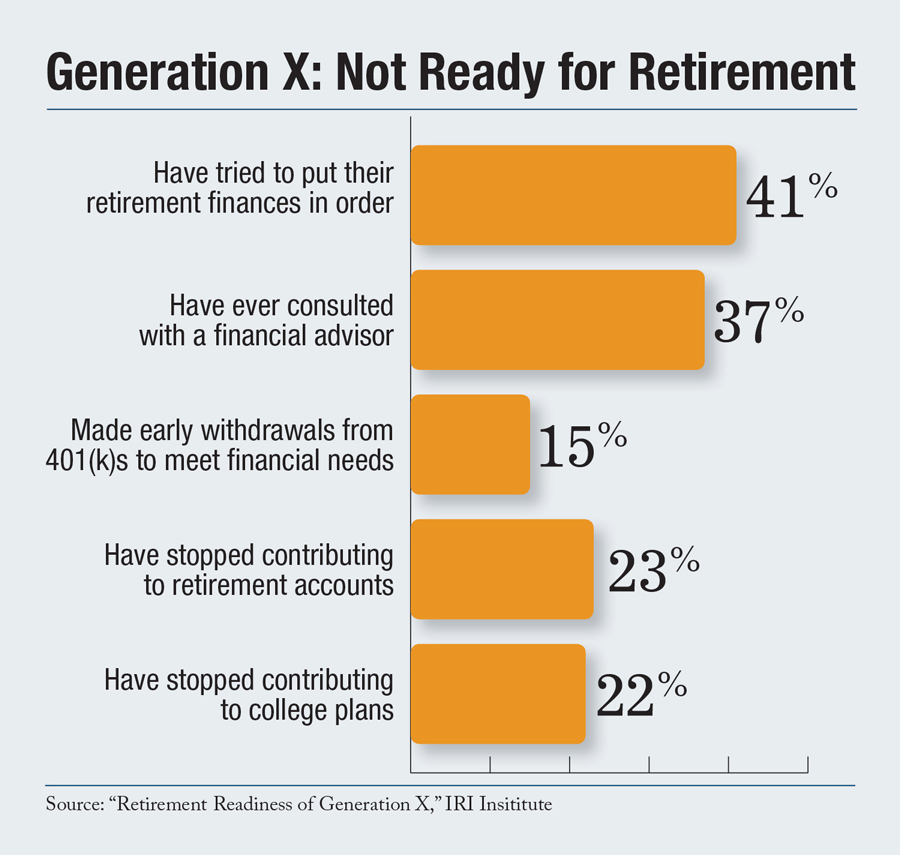

The report, "Retirement Readiness of Generation X: An Overview of the Next Generation of Retirement Investors," by the Insured Retirement Institute, found that only 41 percent of GenXers have tried to figure out how much money they need to save for retirement, and those who have saved for retirement have saved less than $100,000.

Gen X was hit particularly hard by the poor economy. Fifteen percent of GenXers made early withdrawals from their 401(k) plans, 23 percent stopped contributing to their retirement accounts and 22 percent stopped contributing to college savings plans.

Recommended For You

According to the study, women, single GenXers and younger Baby Boomers need more guidance about retirement, as 21 percent of this group needed to dip into their retirement savings in the past year. Fifty-four percent of female GenXers rated themselves as having little to no investment knowledge, compared to 37 percent of men.

The report also found that married GenXers were more confident in their retirement savings than single GenXers.

Very few GenXers have consulted with a financial advisor, 37 percent. Among single GenXers, that figure is 20 percent. The IRI defines Generation X as Americans born from 1965 through 1981, which numbers 70 million people. If you include the youngest Boomers, that figure increases to 83 million.

Most of the GenXers interviewed for the study said they expected to retire at about age 64, which would mean they need enough money to last at least 20 years, the report said.

The Insured Retirement Institute is a not-for-profit organization that specializes in annuities, insured retirement strategies and retirement planning.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.