Did I say Cigna was King of Midsize? Because I think I have them confused with someone else. Next to Anthem (who's the smallest overall), Cigna actually has the poorest market share on midsize plans – but don't count them out, they make money with the big boys.

Cigna has been around in its current form since the 1980s – its predecessor Connecticut General Life Insurance having been incepted in 1965 by the governor of Connecticut.

Geography

Recommended For You

Cigna has good saturation in New England, and a heavy presence in Colorado and Arizona. They run a full-service HMO with satellite clinics around Phoenix, so the Arizona element is not that surprising.

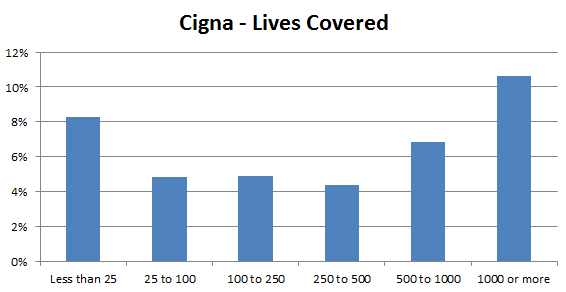

Lives Covered

What is very surprising is their market control. In the small to midsize market they are the smallest next to Anthem, only controlling around 4-6% of the market. They have good presence among very small policies, but what's really astounding is their dominance of the 1,000+ participant market: almost 11%. That's a solid first place finish (second place Kaiser only controls 9% of the market).

Premiums

They have the lives, but they don't have the money. It's no surprise that they control so much of the smaller market, but what's shocking is that they're in next-to-last place in dollars where they're number one in participants.

Commissions

Dollar for dollar, Cigna pays the best commission per premium ($0.04 per dollar). However, per life covered their commissions were actually by far the lowest, falling almost 75 percent below the average.

Cigna is an oddball. An experiment in Arizona, dominance by lives but middling by dollars, awful or stellar commissions depending on how you measure it. It's a carrier of contrasts.

Next week, Kaiser is the Kaiser of the small plan.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.