Americans are cutting back on their non-essential spending, according to a new survey by investing company Scottrade, Inc. The survey found that saving for retirement is becoming important, so people are doing more comparison shopping, using coupons and cutting back on things like new clothes and entertainment.

"Americans are simply looking for ways to save more and spend less," said Kim Wells, Scottrade's executive director of product development and chief marketing officer. "They are feeling a financial pinch in more areas of their daily routine – from filling their gas tanks to heating their homes. These behaviors demonstrate that people are more mindful of their financial situations."

Uncertainty about future circumstances is compelling nearly all Americans to take action, according to the sixth annual survey of consumer attitudes and behaviors regarding retirement and retirement planning.

Recommended For You

To reduce their financial concerns this year:

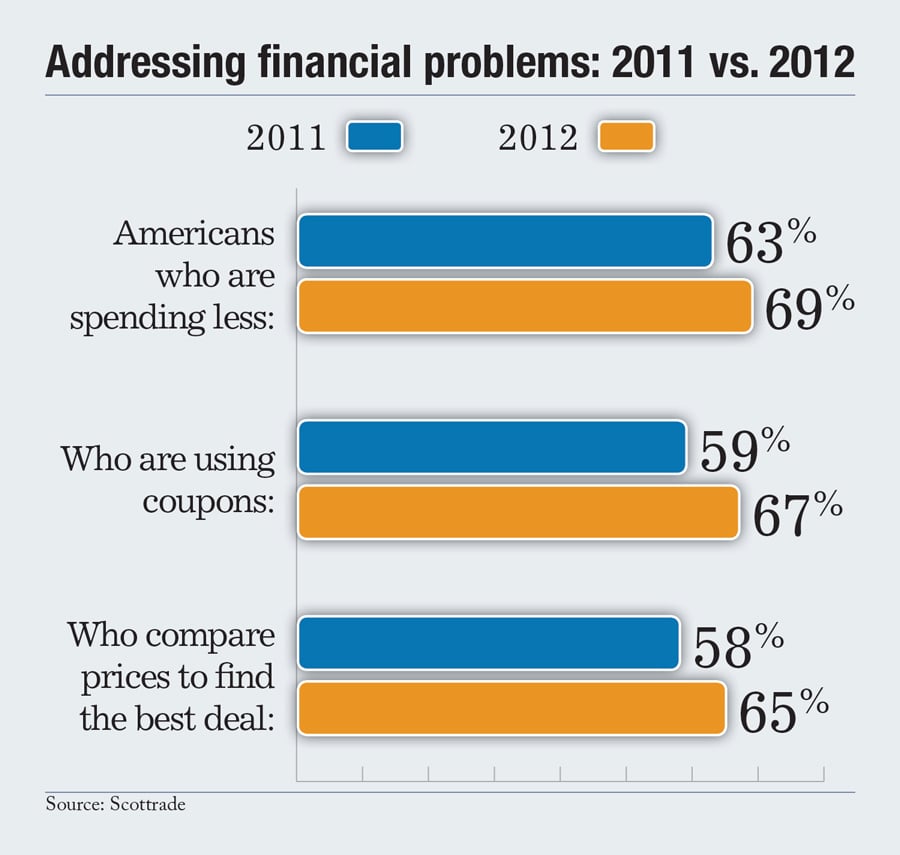

- 69 percent are spending less, compared to 63 percent in 2011;

- 67 percent are using coupons, compared to 59 percent in 2011; and

- 65 percent compare prices to find the best deal, compared to 58 percent in 2011.

"By understanding that they shouldn't overpay, more Americans are comparing prices to find better deals for themselves," Wells said.

The survey data indicates Americans are worried about debt. Forty percent of those surveyed said that non-mortgage debt was keeping them from saving more for retirement, compared to 33 percent in 2011. The trend is expected to continue, with 34 percent stating that non-mortgage debt will cause them to save less for retirement in 2012.

Only 5 percent of Americans recommend saving 2 percent or less annually for retirement, yet 55 percent of Americans reported saving 2 percent or less in 2011. And the trend of under-saving should continue as 33 percent plan to save 2 percent or less in 2012.

Despite these concerns, the majority of Americans, 72 percent, said they are confident in their own abilities to plan for retirement. Overall, 61 percent of respondents expect to be able to completely retire – and not work again – between the ages of 45 and 74. Fifteen percent of the survey's respondents have already retired, with the majority doing so between the ages of 45 and 74.

The survey was commissioned by Scottrade and conducted online by Synovate. Fielded with a nationally representative sample of 1,000 respondents from Jan. 5-9, 2012, the survey examined attitudes, behaviors and trends related to retirement. All participants were at least 18 years of age and were involved in making investment decisions in their households.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.