Employee benefit brokers continue to embrace voluntary products as a central part of their sales activities. But not all brokers are developing these new capabilities at the same rate and interesting differences are emerging. In addition to segmenting brokers by size, we’ve been asking them whether they tend to mix and match products from different carriers in accounts. Specifically, we ask them whether they prefer to use one carrier in order to offer bundled discounts, prefer to use one carrier for administrative ease, or whether they prefer to mix carriers in order to bring best-of-breed products in each category.

In other words, does their value proposition lead with pricing, administrative ease or overall product quality? Arguably, these approaches could correspond to their perceptions of their key customer: employer, plan administrator or employee. We consider the employee to be the first priority and the more sophisticated voluntary approach. One segment, the mid-size sophisticated broker, is pulling away from the pack.

In addition to selling multiple carriers in order to focus on product quality, these brokers have the most balanced criteria for selecting carrier partners, and are most likely to have voluntary goals for their salespeople. They’re most likely to use third-party enrollment platforms and professional enrollment companies. These are often the hallmarks of firms that take a strategic approach to voluntary rather than considering it a simple product line extension of their current benefit offerings.

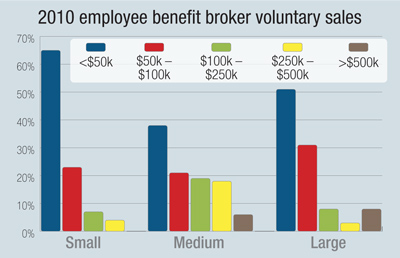

Their approach is starting to create distance between their results and those of the competition. Medium-sophisticated brokers now sell more cases per salesperson and a greater percentage of their account sales include both core and voluntary coverages. And though they are medium in size, a greater percentage of their salespeople now sell higher premium voluntary cases than the large-size segments.

We all need to study the practices of those who are taking the lead and learn from their successes.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.