BOSTON (AP) — It's easy to overlook what's important when it comes to saving money. Many people would sooner clip a toothpaste coupon than review their retirement accounts to assess whether they can minimize investment fees.

Consider the potential savings from choosing low-cost investments and having the good fortune to participate in a 401(k) plan that charges relatively low administrative fees.

Let's say you have $20,000 in a retirement account. If you assume you can earn a net return of 6.5 percent a year — 7 percent from investment gains, minus a relatively modest 0.5 percent in fees and charges to run the plan — the account would grow to $70,500 in 20 years. Boost the fees to 1.5 percent, and the account will grow to just $58,400. That's $12,100 less because of a percentage point difference in fees and charges.

Let's say you have $20,000 in a retirement account. If you assume you can earn a net return of 6.5 percent a year — 7 percent from investment gains, minus a relatively modest 0.5 percent in fees and charges to run the plan — the account would grow to $70,500 in 20 years. Boost the fees to 1.5 percent, and the account will grow to just $58,400. That's $12,100 less because of a percentage point difference in fees and charges.

Recommended For You

"It's not until the differences are laid out in terms of dollars that people actually take a step back and say, 'Wow, I should do something about this,'" says Bo Lu, CEO of FutureAdvisor, a Seattle-based firm that assesses 401(k) plans.

The problem is that 401(k) fee disclosures are typically ignored or quickly tossed aside. That's because the charges can be so complex, numerous and hard to find that they're nearly impossible to add up.

[See also: "Time to shop for a new 401(k)?"]

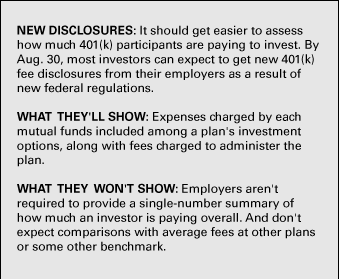

But this summer, 401(k) accountholders should keep a close eye on their mailboxes and email. They'll receive new fee disclosures from their employers containing much greater detail about what they're paying to invest in these tax-advantaged plans.

The various costs will be consolidated into one document — albeit one lacking an at-a-glance summary of how much you pay overall. Most investors will get disclosures running seven to 12 pages, says Dave Gray, a vice president with investment manager Charles Schwab. Expect documents that are "wordy, with a bit of complexity," he says." What it really is is a price list."

Most investors can expect to get the new disclosures by Aug. 30. Employers must send the disclosures once a year, and more frequently if the employer makes midyear changes to the plan affecting costs.

The disclosures are the result of 401(k) regulations set by the Labor Department. Beginning this month, investment companies that administer 401(k)s are providing new disclosures to employers that sponsor the plans. Employers must then share their own disclosures with employees, detailing plan costs that participants bear.

There are 4 key items investors should look for in the documents. First up: Investment fees.

Image credit: Kromkrathog

1. INVESTMENT FEES

These are fees paid to the managers of each mutual fund that an investor chooses. These managers — often called "investment advisers" in disclosures — select stocks, bonds or other investments that 401(k) assets are invested in. These fees make up at least two-thirds of overall plan costs, so details about these charges are the most important to review.

The disclosures will show the expenses charged by each investment option in the plan. Each mutual fund has a specific expense ratio — the ongoing expenses to cover operating costs, expressed as a percentage of a fund's assets. An expense ratio will be listed, along with an equivalent dollar amount for every $1,000 invested. "That number for many folks is going to be quite eye-opening," Schwab's Gray says. To determine what you're paying, you'll need to tally the expenses for all of your specific investments.

It's not a simple matter to determine what constitutes high fund expenses because costs can vary widely. Funds investing in U.S. stocks typically charge less than those specializing in foreign stocks, and bond funds typically cost less than stock funds. Index funds seek to match the market rather than beat it, and generally charge lower fees than managed funds because they don't rely on professionals to pick stocks or bonds. A study by the Investment Company Institute, an industry group, found that investors in stock index funds paid an average 0.14 percent in expenses last year, while investors in managed stock funds paid 0.93 percent, nearly seven times as much.

If you're looking to cut costs, and realize you've invested in funds charging high fees, consider making some adjustments. Most plans allow such changes with minimal hassle or expense.

Next: Administrative costs

Image credit: Arvind Balaraman

2. ADMINISTRATIVE COSTS

These may come as a surprise because they cover back-office operations that many investors don't know they're paying for. Among them are costs to provide online account access and to track daily changes in the values of investments offered in the plan. Then there are custodial costs for the bank entrusted with holding plan assets. Some plans also offer investment advice that can be costly.

Even with easier access to data on these expenses, investors will have little basis for deciding whether the administrative costs are too high. That's because the disclosure rules don't require that a plan's costs be presented in comparison with average fees at other plans, or some other benchmark. Comparisons are difficult because several different companies may play roles in administering a plan, leading to layers of fees shared among the plan provider, the employer and participants.

Next: Transaction costs

Image credit: adamr

3. TRANSACTION COSTS

These include charges to borrow from a 401(k) and make withdrawals. Also review commissions and charges at plans that enable participants to trade individual stocks within their account or select other investments not offered as options within their plan.

Image credit: Stuart Miles

4. WHERE TO GET HELP…OR COMPLAIN

Look for phone numbers and websites where you can get more information. Many providers have already created sites to provide more clarity (and contacts to get more information, such as Guardian's Understanding Plan Fees site).

If you're still dissatisfied, team up with co-workers to assess your company's plan. If there's a consensus that the plan falls short on expenses or investment options, collectively approach company officials overseeing the plan to see if changes can be made. At a small employer, that may be the treasurer or CEO, while at a larger company it's often the human resources or benefits staff.

"You're probably going to be in this 401(k) for a long time, so it's your right to continually ask questions," says Greg Carpenter, CEO of Employee Fiduciary, a Mobile, Ala.-based adviser to companies offering 401(k)s. "The disclosure you get shouldn't be the end of your employer's commitment to you. So don't be afraid to make noise."

More articles about making the right 401(k) decisions:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.