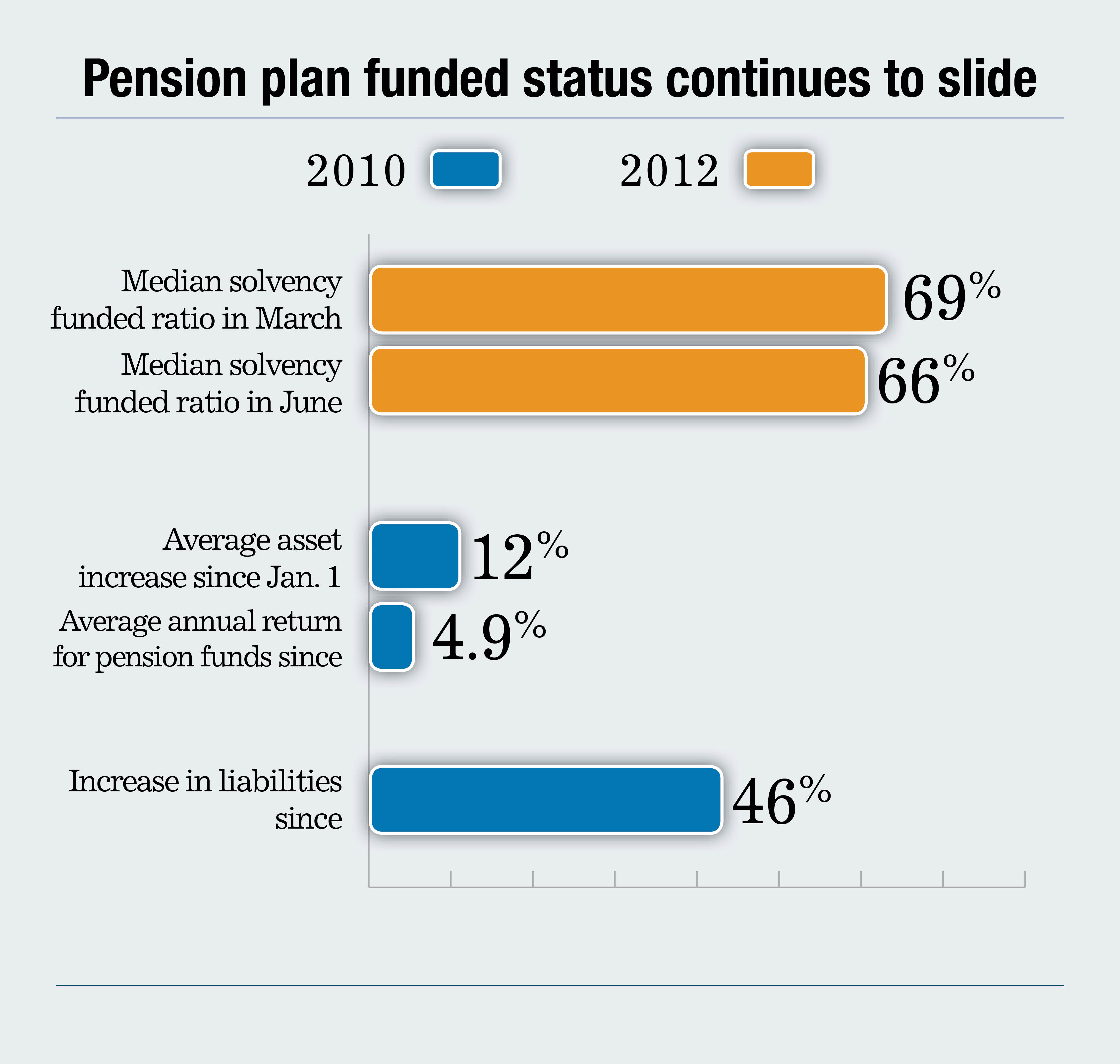

The financial status of pension plans continued to deteriorate in the second quarter of 2012. Negative equity returns and a decrease in interest rates were the main reasons for the slide, according to Aon Hewitt. The median solvency funded ratio for a large sample of pension plans has decreased from 69 percent at the end of March 2012 to 66 percent at the end of June 2012.

Despite significant cash contributions to pension plans this year, the funding position of plans has still gone down from the beginning of the year.

About 97 percent of pension plans in this sample had a solvency deficiency. The solvency funded ratio measures the financial health of a defined benefit pension plan by comparing the amount of the assets to total pension liabilities in the event of a plan termination.

About 97 percent of pension plans in this sample had a solvency deficiency. The solvency funded ratio measures the financial health of a defined benefit pension plan by comparing the amount of the assets to total pension liabilities in the event of a plan termination.

Recommended For You

According to the data, assets only increased by 12 percent from Jan. 1, 2010, despite significant contributions over that time period. A typical pension fund earned an average annual return of 4.9 percent over this period, caused by disappointing equity markets performance: 2.3 percent for the Canadian stock exchange 9.4 percent (in Canadian dollars) for U.S. equities and -1.6 percent (in Canadian dollars) for international equities.

While asset returns have remained low, it is the 46 percent increase in liabilities that has caused much of the current solvency crisis. This has been mainly caused by the significant drop in long term interest rates over the period.

"A 1 percent drop in long-term interest rates will increase liabilities by about 18 percent for a typical pension plan," said Thomas Ault, an associate partner and actuary with Aon Hewitt in Vancouver, "which is why the decline in interest rates since the start of 2010 has had such a dramatic effect on solvency liabilities."

Aon Hewitt is the global leader in human resources solutions. The company partners with organizations to solve their most complex benefits, talent and related financial challenges, and improve business performance.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.