Investors continue to be concerned about dropping real estate values and their retirement assets not lasting through their retirement, according to a new survey by Natixis Global Asset Management.

The company, which manages $748 billion in assets, surveyed financial advisors to find out how well-equipped and confident they and their clients were about meeting financial needs in retirement.

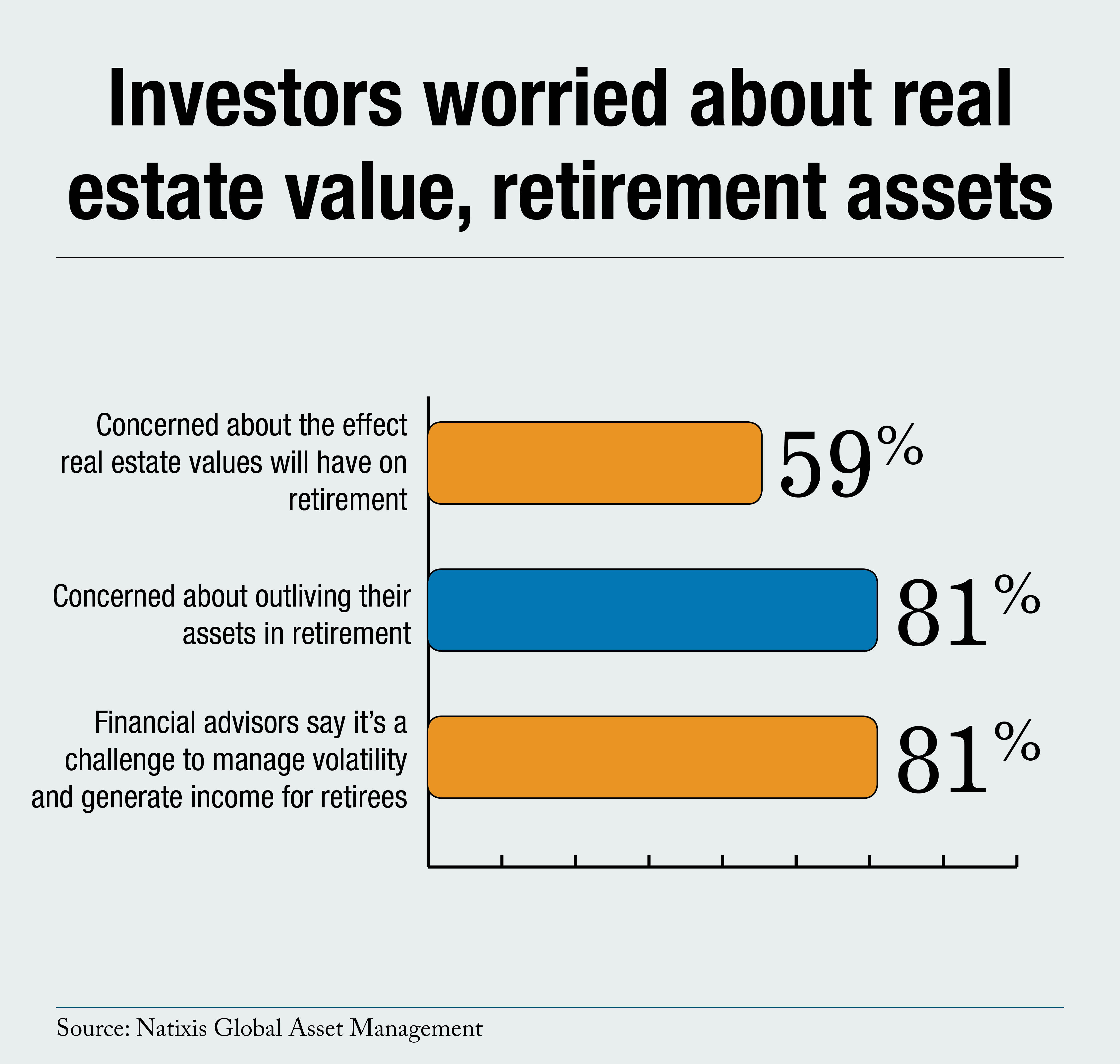

Fifty-nine percent said their clients are anxious about the effect real estate values will have on their retirement and 81 percent said their clients are concerned about living beyond their assets or not having enough income during retirement.

Fifty-nine percent said their clients are anxious about the effect real estate values will have on their retirement and 81 percent said their clients are concerned about living beyond their assets or not having enough income during retirement.

Recommended For You

Most financial advisors, 81 percent, said it is challenging to effectively manage volatility and generate sufficient income for clients who already are retired in 2012, but nearly 95 percent said they are confident that their current investment strategies will help clients better meet retirement income needs.

The current low interest rate, high volatility environment makes it difficult for investors to achieve their retirement goals, said John Hailer, president and CEO of Natixis Global Asset Management The Americas and Asia. "It's encouraging that so many advisors believe they have the tools and strategies to help clients navigate these challenges, but most advisors know there's still a long way to go in terms of building more durable portfolios," he said.

The study, released by NGAM through its Durable Portfolio Construction Research Center, is based on a nationwide survey of 163 advisors at 150 advisory firms that collectively manage about $670 billion in assets

Most of the financial advisors surveyed said their clients continue to be concerned about the long-term durability of their assets, including meeting their retirement income goals, outliving their assets and continuing declines in the value of the real estate they own

"Americans are no longer in denial about real estate values, and they recognize how this impacts their financial well-being, particularly in retirement," said Hailer. "When real estate values decline, as they have during the past several years, this has a dramatic impact on financing retirement, and Americans realize that."

Four in five advisors also reported that it will be difficult to manage volatility risk for those in retirement, with 41 percent saying it was extremely difficult.

Most advisors surveyed said they were confident over the long-term and that the challenge is in educating clients about the need to make smarter use of traditional asset classes and embrace alternative investments, commodities, hedged equities and other investments that can reduce risk in a portfolio, he said.

As far as public policy is concerned, 81 percent of advisors oppose proposals in Washington to scale back retirement savings incentives for 401(k) plans.

.

.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.