Baby Boomers may not be able to work as long into retirement as they believe, according to new research by the Insured Retirement Institute. Nearly two-thirds of Boomers say they are counting on employment during their retirement years as a source of income, several studies have found that half of workers leave the workforce prematurely.

"About half of retirees leave the workforce earlier than they planned because of, among other issues, health concerns or a lack of employment opportunities," IRI President and CEO Cathy Weatherford said. "As we live longer, it's becoming more commonplace to accept the idea that we have to work a few extra years. And rightfully so. But Boomers must reevaluate their plans and develop contingencies in case they cannot work as long as they intend. This evaluation requires identifying alternative sources of lifetime income."

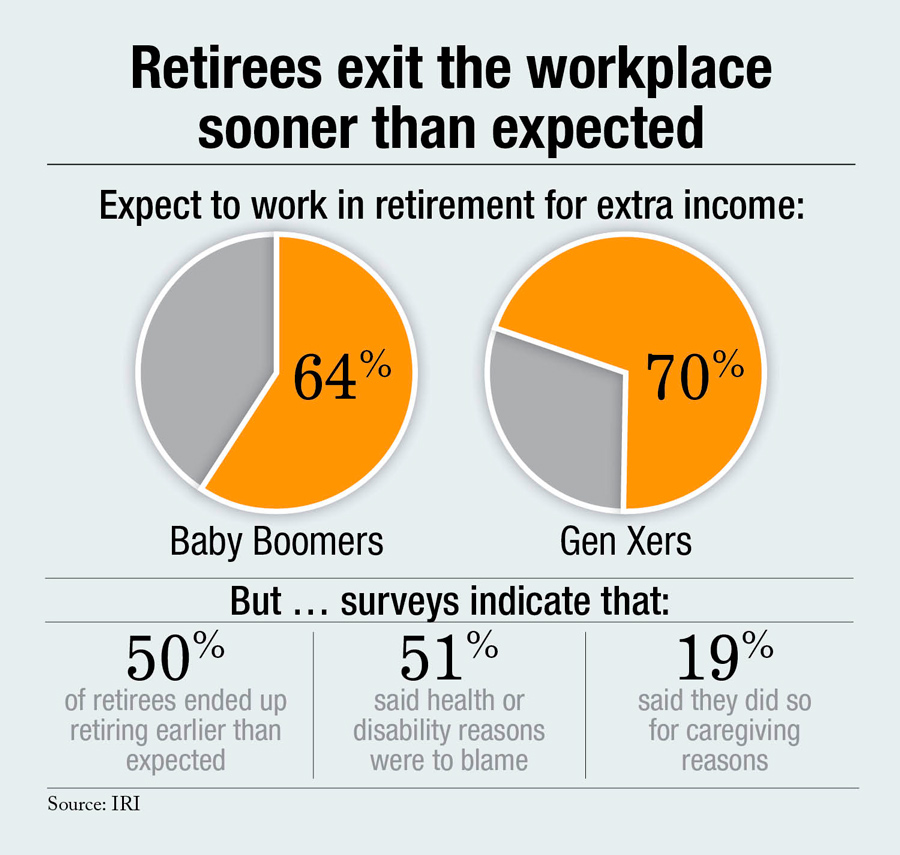

Sixty-four percent of Baby Boomers and 70 percent of Generation Xers felt that they would continue working in retirement to gain extra income. According to the IRI data, 35 percent of Baby Boomers plan to work into their late 60s and beyond, with 12 percent of Boomers planning to work into their late 60s and another 23 percent planning to work to age 70 or older. Labor force participation rates in 2010 reveal that only 17.9 percent of those aged 65 and older were still in the workforce, according to the Bureau of Labor Statistics.

Sixty-four percent of Baby Boomers and 70 percent of Generation Xers felt that they would continue working in retirement to gain extra income. According to the IRI data, 35 percent of Baby Boomers plan to work into their late 60s and beyond, with 12 percent of Boomers planning to work into their late 60s and another 23 percent planning to work to age 70 or older. Labor force participation rates in 2010 reveal that only 17.9 percent of those aged 65 and older were still in the workforce, according to the Bureau of Labor Statistics.

Recommended For You

The Great Recession had a major impact on Americans making changes to their retirement plans. The losses incurred to retirement savings plans and reduced value of housing has forced many Americans to postpone their retirement and/or rethink the relationship between work and retirement.

In its research, the IRI showed that working later can be a component of retirement income, it should not be relied upon as the data show pre-retirees expectations do not match retiree's experience. That has a lot to do with when a person decides to leave their career work, phased retirement and working for pay while in retirement.

In 2012, 50 percent of surveyed retirees reported they retired earlier than planned. Fifty-one percent of those said it happened because of health or disability reasons, 21 percent said it was because of changes at their employer or downsizing and 19 percent said it was to take care of family care giving responsibilities.

According to the IRI, working a few extra years beyond full retirement age can have a major impact on a person's retirement readiness. According to one study, 66 percent of individuals are ready for retirement at age 66. If those people waited until they were 70, their retirement readiness increases to 89 percent.

Thirty-eight percent of workers over the age of 50 expressed interest in a phased retirement program and of those who said they were interested, 78 percent stated such a plan would encourage them to work past their expected retirement age.

The Insured Retirement Institute (IRI) is a not-for-profit organization that for twenty years has been a mainstay of service, commitment and collaboration within the insured retirement industry.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.