Professional athletes are often targeted by people who want to take advantage of their good fortune. Family, friends and strangers all gravitate to them with their hands out. It is hard to say no and it is very easy to trust people you have known all your life over business professionals you just met.

That's why the National Football League Players Association started its Registered Player Financial Advisor program 10 years ago. It wanted to ensure that its athletes were not being taken advantage of and had someone with a good reputation helping them plan for their futures, pay their bills and save for retirement.

Advisors who want to participate in the program must pay an initial $2,000 application fee and $500 a year thereafter. They must have been a practicing financial advisor for a minimum of five years and have no complaints or lawsuits filed against them because of financial decisions they made.

Recommended For You

[In related news, read about the NFL referees' union and its fight for pensions ... and the controversy over replacement officials.]

The NFLPA can't recommend any advisors, per U.S. Securities and Exchange Commission rules, but it hosts a list of approved advisors on its website that members can access. They then can choose who they want to work with. NFL contract advisors, also known as agents, also must register with the program, especially if they are doling out financial advice or encouraging their players to participate with a specific financial advisor in the program.

And while its motives were good, the Registered Player Financial Advisor program hasn't always been successful. According to The New York Times, hedge fund manager Kirk Wright, who was convicted in May 2008 of 47 counts of fraud and money laundering for taking more than $150 million in investments from clients that included several former NFL players, was allowed on the list of approved NFL financial advisors even though liens had been filed against him.

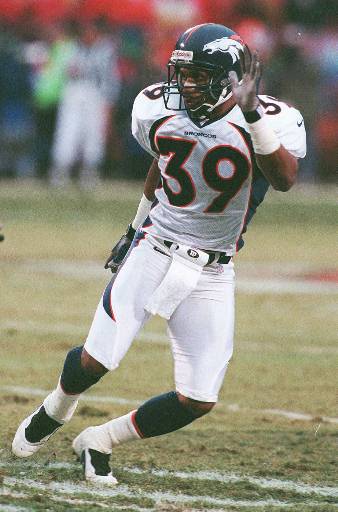

Steve Atwater and Blaine Bishop, who had investments with Wright, filed a civil lawsuit against the National Football League Players Association saying that the registered advisor program didn't do a good enough job in vetting the people allowed to participate in it. Other big names that had money with Wright included Terrell Davis, Ray Crockett (left), Al Smith, Clyde Simmons and Rod Smith.

Steve Atwater and Blaine Bishop, who had investments with Wright, filed a civil lawsuit against the National Football League Players Association saying that the registered advisor program didn't do a good enough job in vetting the people allowed to participate in it. Other big names that had money with Wright included Terrell Davis, Ray Crockett (left), Al Smith, Clyde Simmons and Rod Smith.

Before the NFLPA Registered Player Financial Advisor program was founded, 78 NFL players lost more than $42 million in a four-year period due to fraud, according to the Times.

From an advisor's standpoint, the program is well run and a good option for anyone who wants to work with professional athletes.

Risk Paradigm Group LLC in Austin, Texas, chose to participate in the NFLPA's program after it began working with some professional athletes.

"We saw the NFLPA provided extra material as relates to professional football players and as it relates to industry news, what is going on with collective bargaining agreements and so forth," said Adam Reinking, regional director and partner for Risk Paradigm Group and son of the company's managing director and partner Mark Reinking, who is the registered advisor with the NFLPA.

"You can't pick up a sports page and not read about a pro athlete going broke because of overspending, getting bad advice or doing things we coach our athlete clients not to do," he said.

Pro athletes have major trust issues, he said. Many times they are young and have no experience dealing with a lot of money. A lot of players don't finish college to play professional sports, Reinking said.

Injuries (such as the Rams' Rodger Stafford) can shorten an NFL career, which only last 3.5 years on average (AP Photo/Carlos Osorio)

"High schools don't educate people about finances, credit cards, what debt means to them or how to buy a house. Even when they move on to college, kids major in things where they never have to take any kind of finance course at all. They enter this arena disadvantaged because of the education they had," he said.

That background makes many of them want to trust people they've always known, and sometimes that gets them into some sticky situations. Many people, with no financial background at all, come to their friends with wild schemes, looking for investors.

"The big problem is when you start trusting friends or family with no qualifications," Reinking said. Players can get into private equity investments, like opening a restaurant or bar or doing some venture capital investing with friends who say they have a great idea for a new product or way to distribute music or whatever the investment opportunity is.

"Oftentimes it is not put together well. Opportunities not put together by a professional have got an uphill battle. Usually there is no written business plan and it's essentially coming to them with their hand out, wanting to get money from the success of the athlete," he added.

Many times, advisors to these athletes find themselves in the position of telling these people no. It is easier for athletes to refuse to give money based on a financial advisor's recommendations rather than just saying no, Reinking said.

"The NFLPA does a great job of supporting advisors in the program with important dates, educational materials, [letting us know] when free agency begins and things of that nature," he said. The organization also hosts educational events for new players so they can get to know some of the financial advisors who are available to them.

[For more information on other benefits available to NFL players - and players in other big-league sports, read Retirement benefits of professional athletes]

Reinking, who played college basketball at UC San Diego and Hawaii Pacific University, said that he knows what it is like to live on a college athlete's stipend. He received $700 a month and lived off meal cards. It is difficult for people coming from that scenario, with no extra money to spare, to suddenly start receiving $15,000 to $1 million a week, depending on their contract.

Overspending is a major problem with individuals who came from nothing. The NFL, along with other professional sport organizations, do offer retirement plans for their players, but none of them provide a ton of money. It is up to the players to manage their earnings and their retirement savings accounts to make them work going forward.

In the NFL at least, their peak earnings time is a very small window, Reinking said. The average NFL career lasts around 3.5 years, he said. The goal of Reinking, and other financial advisors, is to take that 3.5 years of earnings and stretch it out over another 50 years of living and retirement.

"That's one of the reasons so many athletes go broke. They get into unsustainable spending habits because they felt the money was not going to stop coming in," he said. They never expect that they will play one game, ruin a knee or experience another debilitating injury and have their entire career wiped out in an instant.

"It can and does end very quickly," he said. That's why Reinking and his associates introduce the idea of life after sports at their first meeting with pro athlete clients.

"We gauge their interest in what they would like to do outside of football or basketball. We sit down with them and try to help them build a game plan, if they don't have one already," Reinking said.

Many of Risk Paradigm Group's athlete clients work on their next careers during the off season, by getting additional education. It helps to have a professional talking to them and helping them understand that the money will only be there for a short time so they need to make the most of it.

For more information, please read:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.