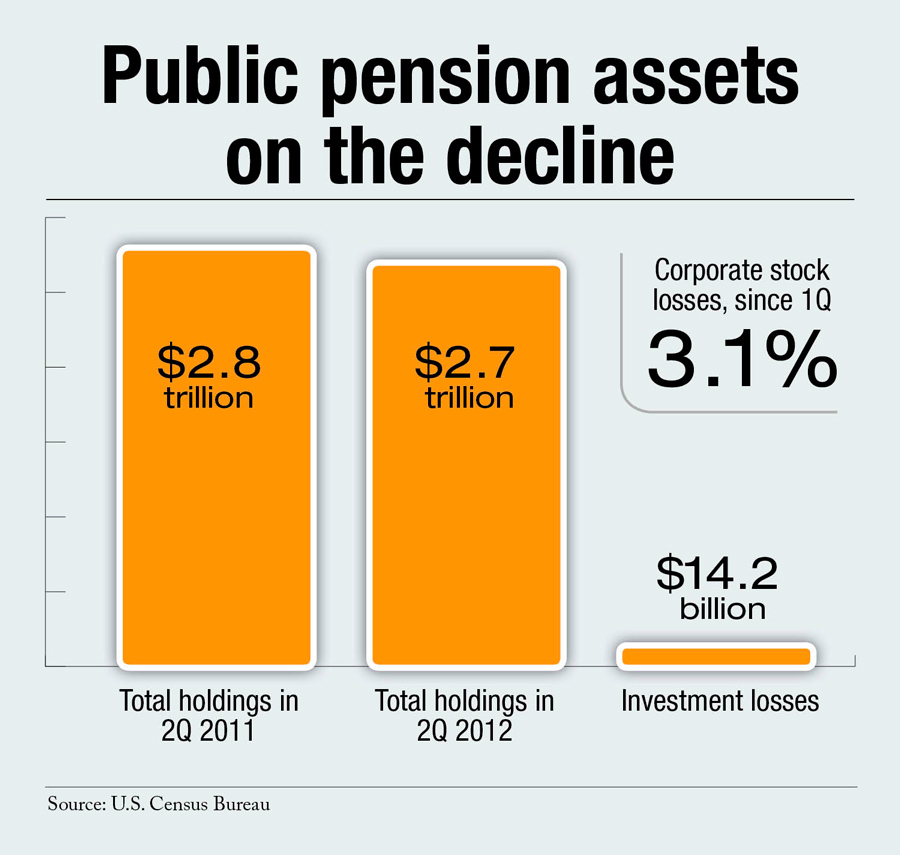

For the 100 largest public employee-retirement systems in the country, total holdings and investments totaled $2.7 trillion in the second quarter of 2012, a decrease of 1.7 percent from $2.8 trillion last quarter, according to new data by the U.S. Census Bureau.

Year over year, there was a decrease of 2.1 percent from $2.8 trillion in the second quarter of 2011.

Losses on investments totaled $14.2 billion. Federal government securities reached the highest level in over 10 years at $244.2 billion, second only to when they peaked in the first quarter of 2001 at $246.2 billion.

Corporate stocks decreased 3.1 percent from the first quarter of 2012, from $974.7 billion to $944.7 billion. Corporate stocks year-to-year were up 3.9 percent from $909.5 billion in the second quarter of 2011. Corporate stocks comprised more than a third of the total cash and security holdings of major public pension systems for the current quarter.

Corporate stocks decreased 3.1 percent from the first quarter of 2012, from $974.7 billion to $944.7 billion. Corporate stocks year-to-year were up 3.9 percent from $909.5 billion in the second quarter of 2011. Corporate stocks comprised more than a third of the total cash and security holdings of major public pension systems for the current quarter.

Corporate bonds also decreased quarter-to-quarter, dropping 1.1 percent from $370.9 billion to $366.7 billion in the second quarter. Year-to-year, corporate bonds decreased 15.6 percent from $434.4 billion in the second quarter of 2011. Corporate bonds comprised 13.5 percent of the total cash and security holdings of major public pension systems for the current quarter.

International securities decreased 7.9 percent from the second quarter of 2011 to the second quarter of 2012, from $550.4 billion to $507.2 billion. Year-to-year, international securities decreased 3.1 percent from $523.3 billion in the second quarter of 2011. International securities comprised 18.7 percent of the total cash and security holdings of major public pension systems for the current quarter.

Federal government securities, which comprised 9 percent of the total cash and security holdings of major public pensions systems for the second quarter, reached the highest level in over 10 years, with an 8.8 percent increase from the same quarter last year. Federal securities year-to-year increased 34.2 percent from $182 billion in the second quarter of 2011.

Government contributions quarter-to-quarter decreased 11.5 percent, from $24.1 billion to $21.4 billion in the second quarter of 2012 and a year-to-year decrease of 4.9 percent, from $22.5 billion in the second quarter of 2011.

Employee contributions increased 10.7 percent quarter to quarter, from $9.3 billion to $10.3 billion in the second quarter of 2012. There was a year-to-year decrease of 5.7 percent from $10.9 billion in the second quarter of 2011. Government contributions to employee contributions had a 2.1 to 1 ratio this quarter, with government contributions comprising 67.5 percent and employee contributions comprising 32.5 percent of total contributions.

Total payments decreased 2.9 percent quarter to quarter, from $55 billion to $53.4 billion in the second quarter of 2012. There was a year-to year increase of 1.6 percent from $52.6 billion in the second quarter of 2011.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.