Although more than half of plan sponsors offer target-date funds in their defined contribution plans, only half of those are using TDFs as their default, according to a new survey by AllianceBernstein L.P.

The research also shows that plan participant use of and satisfaction with TDFs continues to grow, even in the face of several years of stock market underperformance.

In its eighth annual survey of plan participants and third biannual survey of plan sponsors, AllianceBernstein offers a comprehensive look at the behaviors, concerns and trends related to DC plans.

Recommended For You

"Even in the wake of a continuing decline of Social Security and defined benefit plans as primary sources for retirement income, our recent research shows that many plan sponsors are still struggling to find the best way to structure their DC plans," says Joe Healy, head of AllianceBernstein's Defined Contribution Client Experience. "While more and more sponsors recognize the benefits of offering an age-based, asset-allocation investment solution to their participants, they fail to realize valuable fiduciary protections by not designating these funds as their plan's default."

"Even in the wake of a continuing decline of Social Security and defined benefit plans as primary sources for retirement income, our recent research shows that many plan sponsors are still struggling to find the best way to structure their DC plans," says Joe Healy, head of AllianceBernstein's Defined Contribution Client Experience. "While more and more sponsors recognize the benefits of offering an age-based, asset-allocation investment solution to their participants, they fail to realize valuable fiduciary protections by not designating these funds as their plan's default."

Qualified default investment alternatives (QDIAs) provide safe harbor protection for plan sponsors and often offer better asset allocation for participants than they might have if they constructed their allocation on their own. However, this year's survey shows that many sponsors offering TDFs are underutilizing these default benefits.

Of the 50 percent of sponsors offering a TDF, but not using it as the default, 83 percent have no default at all or are still using a stable value, equity or bond fund as their default.

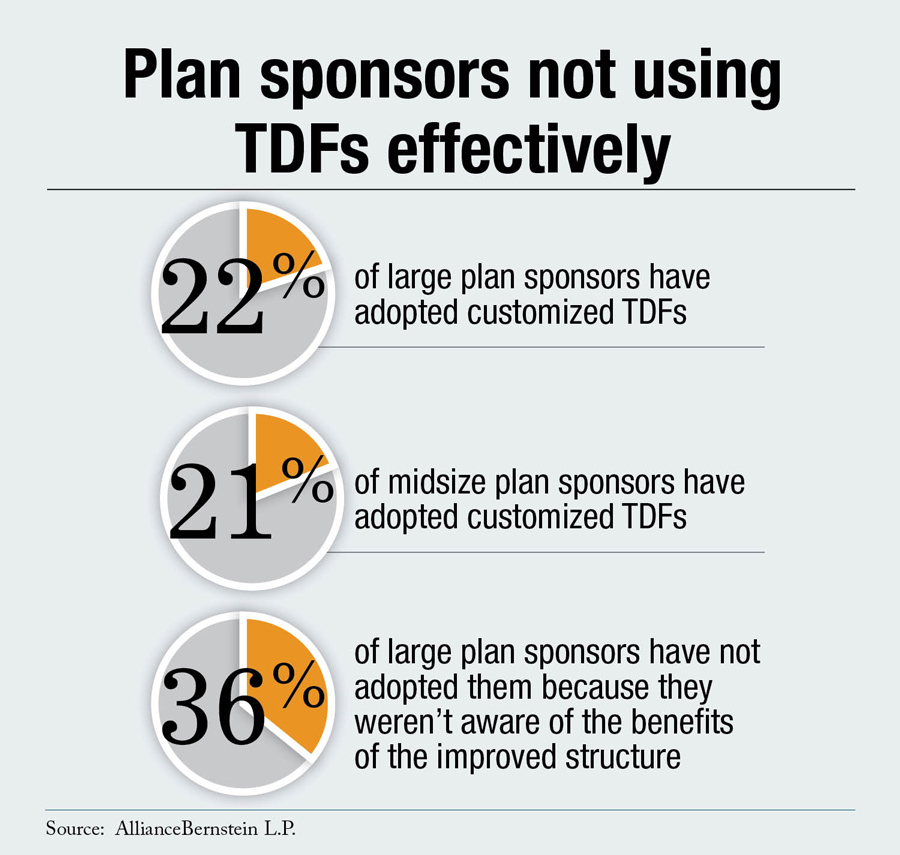

It also found that the majority of midsize and large plan sponsors are failing to leverage their assets to provide more specialized or customized TDFs.

Of those surveyed, only 22 percent of large plan sponsors and 21 percent of midsize plan sponsors reported that they have adopted customized TDFs. Thirty-six percent of large plan sponsors said they haven't adopted customized TDFs because they weren't aware of the benefits of the improved structure.

The size of the plan's assets directly impacts sponsors' goals for TDFs. Out of the plan sponsors surveyed, 54 percent of large plans and 43 percent of midsize plans said the goal of their TDF is to ensure that savings last through participants' retirement years versus only 32 percent of sponsors of small plans (those with less than $1 million in assets). Forty-one percent of small sponsors said the goal of their TDF is to ensure a minimum acceptable level of savings at retirement. Many sponsors were more concerned with increasing participation rates, with 37 percent of midsize plan sponsors and 28 percent of small and large size plans saying they were concerned about participation rates.

Large plans had the highest participation rate, with 86 percent.

Of plan participants surveyed, 38 percent considered themselves to be active investors, with 39 percent of those saying they use TDFs. Sixty-two percent of participants consider themselves accidental investors and 27 percent of those said they use TDFs.

"It's striking that despite the almost polar opposite behavioral differences between active and accidental investors, both groups give TDFs high marks. It certainly suggests that sponsors can stave off behavioral biases and encourage savings by defaulting people into easy-to-understand investment solutions like TDFs that also provide sophisticated asset-allocation features to satisfy savvy investors," Healy said.

AllianceBernstein is a leading global investment management firm that offers high-quality research and diversified investment services to institutional investors, individuals and private clients in major world markets.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.