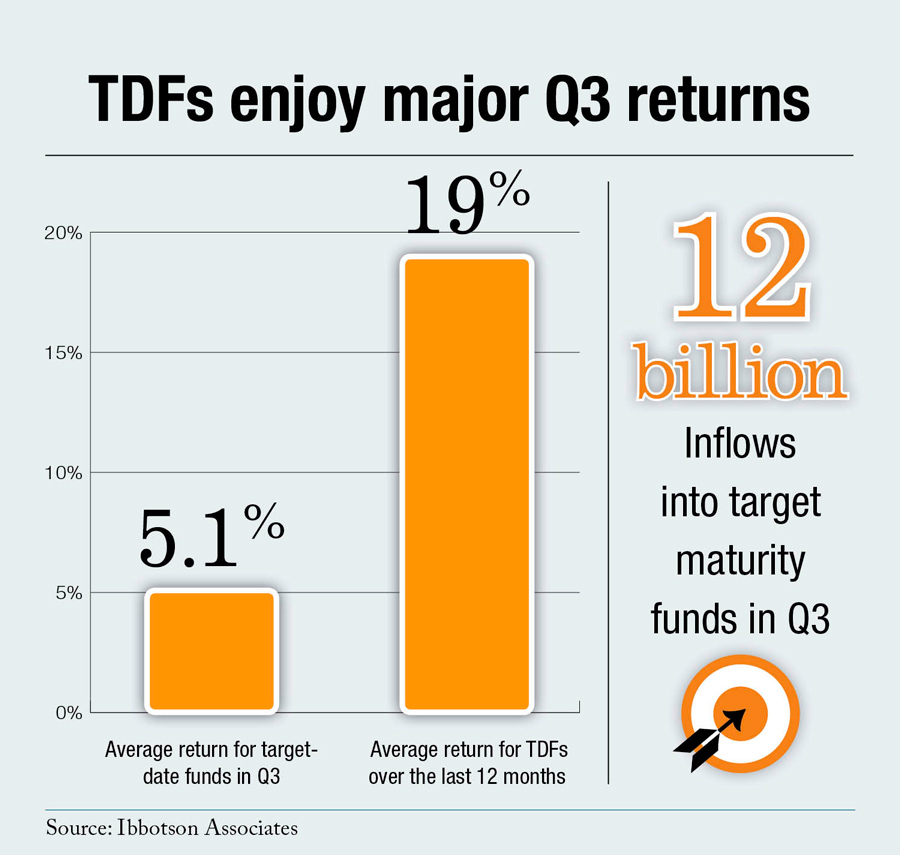

Target-date funds had a great third quarter and past 12 months, with average returns of 5.1 percent for the quarter and nearly 19 percent over the past 12 months. Flows into target maturity funds remained strong, with nearly $12 billion flowing into the category during the third quarter.

According to Ibbotson Associates, which is part of the Morningstar Investment Management division, target maturity funds continue to see total assets climb to all-time highs. As of the end of the third quarter, total assets in target maturity funds were nearly $466 billion, a 36 percent increase from a year ago, with Fidelity, Vanguard and T. Rowe Price holding around 75 percent of total assets. Other target maturity fund providers that saw large inflows include John Hancock, TIAA-CREF, JP Morgan and American Funds, all experiencing inflows of between $400 million and $700 million.

According to Ibbotson Associates, which is part of the Morningstar Investment Management division, target maturity funds continue to see total assets climb to all-time highs. As of the end of the third quarter, total assets in target maturity funds were nearly $466 billion, a 36 percent increase from a year ago, with Fidelity, Vanguard and T. Rowe Price holding around 75 percent of total assets. Other target maturity fund providers that saw large inflows include John Hancock, TIAA-CREF, JP Morgan and American Funds, all experiencing inflows of between $400 million and $700 million.

The rise in TDF returns in the third quarter can be attributed to double-digit U.S. equity returns in the fourth quarter of 2011 and the first quarter of 2012, according to Ibbotson.

Recommended For You

Ibbotson Associates provides asset allocation, manager selection and portfolio construction services.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.