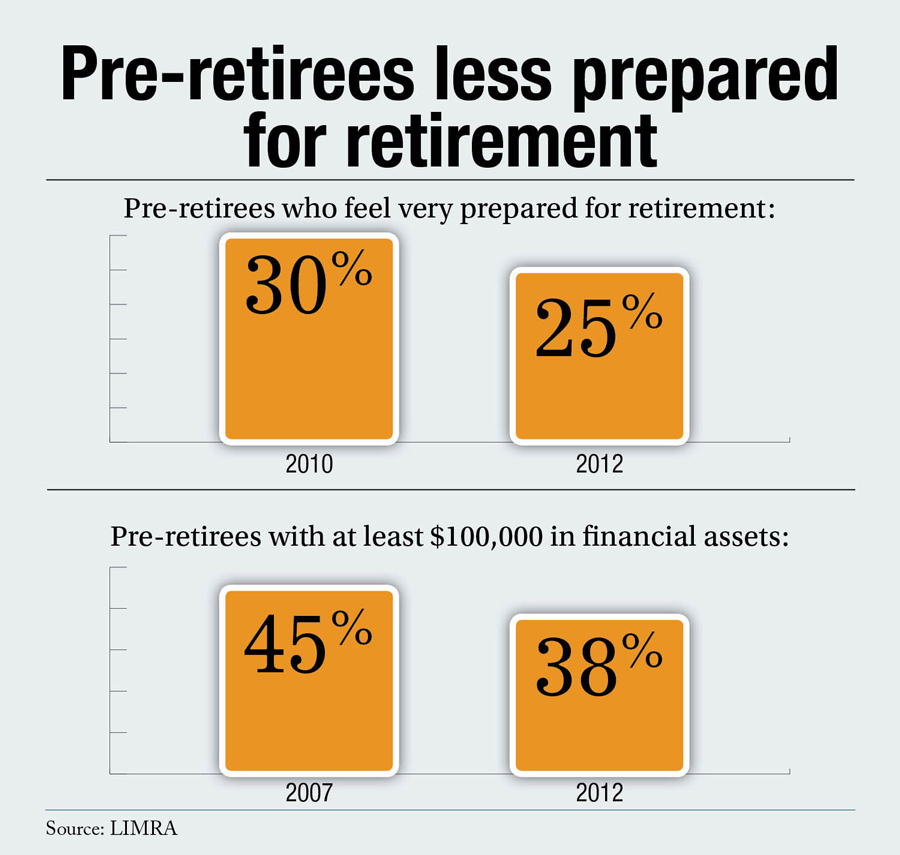

One quarter of the 33 million pre-retirees living in the U.S. feel very prepared for retirement, according to a new study by LIMRA. In 2010, that number was 30 percent.

"Pre-retirees' circumstances have not improved over the past several years with fewer pre-retiree households having $100,000 or more in financial assets (45 percent in 2007 to 38 percent in 2010)," said Matthew Drinkwater, associate managing director of Retirement Research. "Even more troubling, our survey revealed that pre-retirees have unrealistic expectations regarding how much income they will need and their ability to work in retirement."

On average, surveyed pre-retirees believed they would need less than two-thirds of their current income during retirement. This is less than the 70 to 80 percent level commonly recommended. In addition, pre-retirees said they would need to withdraw 9 percent of their assets annually to pay basic living and discretionary expenses. Based on historical investment returns, this withdrawal rate will result in some pre-retirees running out of money in retirement, which is likely to last 20 or more years.

On average, surveyed pre-retirees believed they would need less than two-thirds of their current income during retirement. This is less than the 70 to 80 percent level commonly recommended. In addition, pre-retirees said they would need to withdraw 9 percent of their assets annually to pay basic living and discretionary expenses. Based on historical investment returns, this withdrawal rate will result in some pre-retirees running out of money in retirement, which is likely to last 20 or more years.

Recommended For You

The study also found that two-thirds of pre-retirees expect to work in retirement. Prior LIMRA research indicates that this is improbable as less than a third of current retirees report having jobs. In addition, almost half of current retirees retired before they planned — half involuntarily — often due to layoffs or personal or family illness.

"It is important for pre-retirees to recognize that they might be forced to retire before they planned or be unable to work in retirement — diminishing their accumulation years and requiring them to stretch their savings for longer periods than planned," Drinkwater said. "Pre-retirees should take advantage of opportunities to save more while they are working and should take steps now to minimize the impact of earlier-than-planned retirement."

Men are more likely than women to consider themselves very prepared for retirement (30 percent vs. 23 percent). Not surprisingly, pre-retirees with household incomes of $100,000 or more were more likely to feel very prepared than pre-retirees in general (40 percent vs. 27 percent). However, even among wealthier pre-retirees (those with at least $500,000 in household financial assets), just over half said they were very prepared.

Pre-retirees who worked with financial advisors were twice as likely to rate themselves as very prepared as those who do not (39 percent vs. 20 percent). Prior LIMRA research found that individuals who work with an advisor are more likely to save at a higher rate for retirement.

"The importance of a financial advisor cannot be overlooked," said Drinkwater. "Our study indicates that pre-retirees not only are ill-prepared for retirement but also often have misguided ideas on how much income they will need and whether they can rely on income from jobs held in retirement. A financial advisor can provide the reality check pre-retirees need to make a sound retirement plan."

LIMRA, a worldwide research, consulting and professional development organization, helps more than 850 insurance and financial services companies in 73 countries increase their marketing and distribution effectiveness.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.