Employers are making the improved financial wellness of their employees a priority in 2013.

A new survey by Aon Hewitt, the global human resources solutions business of Aon plc, found that to help employees save and prepare for retirement, employers are taking steps to ensure workers understand the financial resources they need to retire, while also offering more sophisticated defined contribution plan features that make investing easier and more accessible.

Aon Hewitt surveyed more than 425 U.S. employers, representing 11 million employees, to determine their current and future retirement benefits strategies. According to Aon Hewitt, workers need 11 times their final pay to meet their financial needs in retirement, but the average U.S. worker has a savings shortfall of 2.2 times pay.

Aon Hewitt surveyed more than 425 U.S. employers, representing 11 million employees, to determine their current and future retirement benefits strategies. According to Aon Hewitt, workers need 11 times their final pay to meet their financial needs in retirement, but the average U.S. worker has a savings shortfall of 2.2 times pay.

Recommended For You

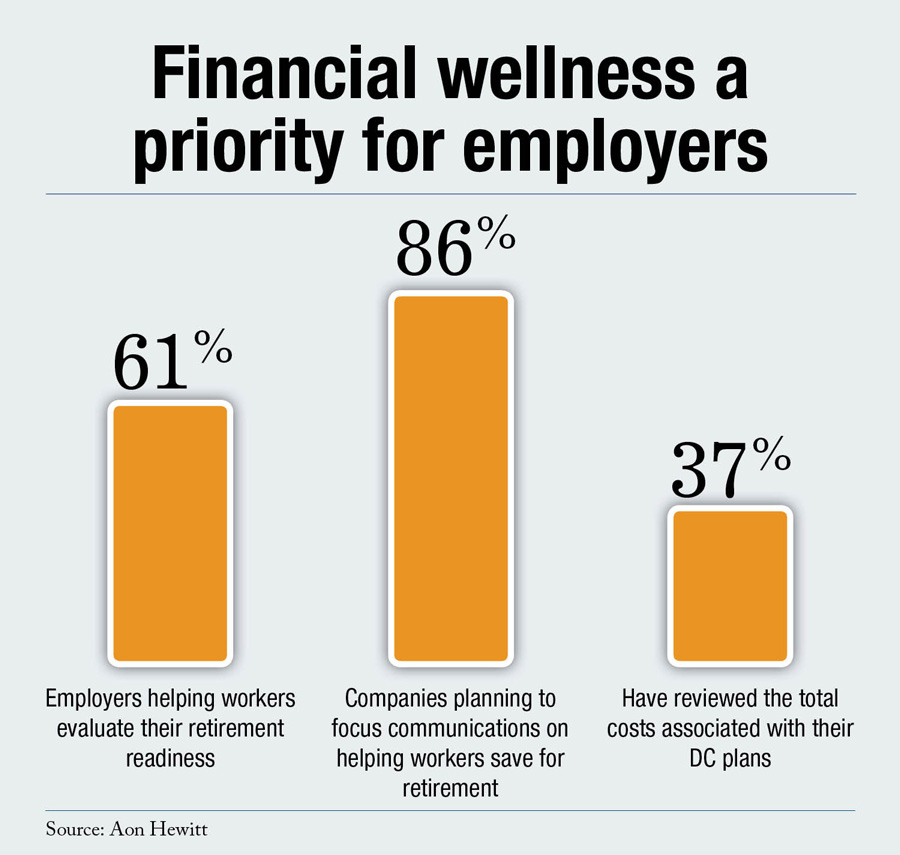

The survey also showed that to help bridge the gap, 80 percent of employers are making financial wellness a top priority in 2013. Sixty-one percent are looking beyond current participation and savings rates and are helping workers evaluate their retirement readiness, up from 50 percent in 2012. Additionally, 86 percent of companies plan to focus communications initiatives on helping workers evaluate and understand how much they need to save for retirement.

"Employers understand that financial wellness is more than what workers are doing today in terms of savings in their retirement programs—that it's evaluating whether their long-term investment strategies are positioning them to be ready when it comes time to retire, and whether other priorities are getting in the way," said Patti Balthazor Björk, director of Retirement Research at Aon Hewitt. "Helping workers get an accurate picture of their future needs and whether they are on track to meet those needs, and helping them create a roadmap for achieving those goals is paramount."

In addition to focusing on financial wellness, Aon Hewitt's survey shows employers are making plan design changes to their DC plans to help workers better manage their money once they reach retirement. The popularity of retirement income solutions—or annuities—continues to rise. Currently, 28 percent of companies offer in-plan retirement income solutions—including professionally managed accounts with a drawdown feature, managed payout funds, or insurance or annuity products that are part of the fund line-up. This is nearly twice the percentage of employers (16 percent) that offered these solutions in 2012. Of those employers that do not currently have these options, 30 percent said they are likely to add them in 2013.

"Retirement income solutions offer employees a way to receive regular, scheduled payments from their DC plan much like what they would have seen from a traditional DB plan. These solutions have become increasingly attractive to workers because they enable them to manage their retirement income in a predictable way once they reach retirement," said Björk. "However, some employers are hesitant to add these features in part because of administrative and fiduciary challenges associated with implementation. Additionally, some companies are waiting to allow the market to mature and products to evolve further."

Other key findings:

- 52 percent of companies will use podcasts and 42 percent will use text messages to communicate and educate their workers on their retirement benefits in 2013.

- The percentage of plan sponsors that plan to use social media channels to communicate with workers has tripled from 6 percent in 2012, to 18 percent in 2013.

- 37 percent of employers have recently reviewed the total DC plan costs (fund, recordkeeping, and trustee fees). Among those who have not, 95 percent are likely to do so in 2013.

- 35 percent of employers completed a review of DC fund operations, including fund expenses and revenue sharing; 87 percent plan to do so this year.

- 31 percent of employers recently changed their DC plan fund lineup to reduce costs. More than half (52 percent) of the remaining companies may do so in 2013.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.