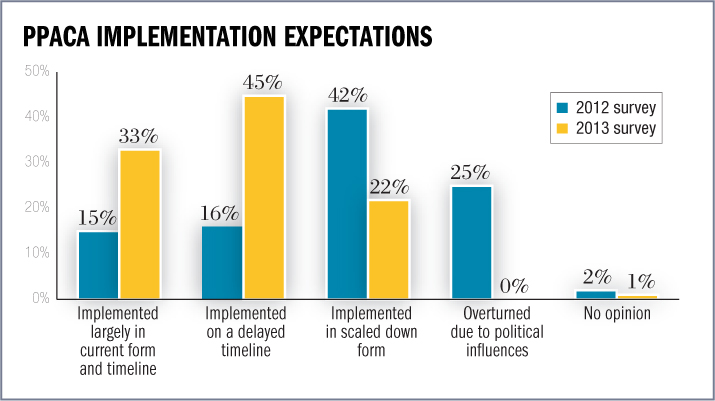

When we surveyed benefits professionals early last year, they remained dubious about the Patient Protection and Affordable Care Act, with roughly two-thirds of them predicting the legislation would be scaled down or overturned altogether. Just 12 months later—12 months that included a Supreme Court ruling in favor of PPACA and an Obama victory at the polls—they’ve changed their tune. Now nearly 80 percent of benefits professionals believe PPACA will be implemented fully sometime next time.

When we surveyed benefits professionals early last year, they remained dubious about the Patient Protection and Affordable Care Act, with roughly two-thirds of them predicting the legislation would be scaled down or overturned altogether. Just 12 months later—12 months that included a Supreme Court ruling in favor of PPACA and an Obama victory at the polls—they’ve changed their tune. Now nearly 80 percent of benefits professionals believe PPACA will be implemented fully sometime next time.

Though the formal launch of the public health care exchanges is still months away, new distribution models (including private exchanges in addition to the promised public ones) already have begun to disrupt the benefits marketplace. Producers are bracing for subsidized exchange marketplaces, rating standards, essential health benefits, and several new insurance taxes and fees, all of which go into effect in 2014.

Payers are moving in several directions. Some are strengthening their relationships with producers. Others, meanwhile, are taking more of an “arm’s length” approach, slashing commissions and letting the channel compete against emerging distribution mechanisms. The channel is in need of a fresh, new approach to maximizing value if brokers are to meet the needs of clients and insurers.

With that in mind, we took advantage of this year’s Benefits Selling/Oliver Wyman 2013 Health Care Survey, to ask nearly 400 benefits professionals how PPACA would change their business models post-2014 and what strategic changes they were considering. We asked them to predict what “value add” will look like in the post-reform world and how they’re planning to compete. Here’s what they told us.

With that in mind, we took advantage of this year’s Benefits Selling/Oliver Wyman 2013 Health Care Survey, to ask nearly 400 benefits professionals how PPACA would change their business models post-2014 and what strategic changes they were considering. We asked them to predict what “value add” will look like in the post-reform world and how they’re planning to compete. Here’s what they told us.

Disruptive threats of the PPACA

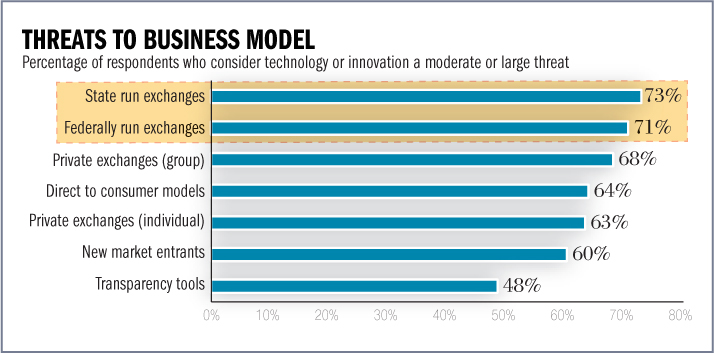

More than 70 percent of respondents believe public health care exchanges pose a moderate or large threat to their business. The exchanges, of course, boast a massive competitive advantage for consumers who qualify for subsidies, but benefits professionals also fear automated functions such as transparency tools and decision-support mechanisms will erode the value provided by brokers in their capacity as advisors.

And although producers have had a few legislative wins lately (for example, requirements that commissions be equal on and off the exchange), they’re still concerned about the convergence of new distribution models, MLR limits, and increased regulatory scrutiny of price.

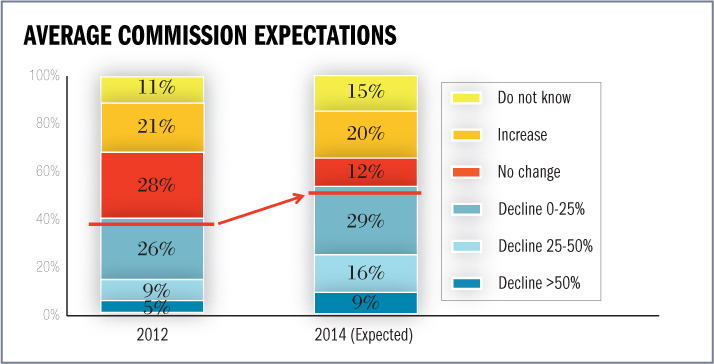

Consequently, producers expect all of these factors to continue to put downward pressure on per-unit commissions. More than half of respondents (54 percent) expect medical commissions to decline in 2014, compared to just 40 percent in 2012. About a quarter of respondents expect declines of 25 percent or more.

The payer distribution paradox

The next few years will be a confusing time for health insurance customers, thanks to a variety of PPACA-related and non-PPACA-related factors, including new benefit and rating standards, group erosion, an influx of the previously uninsured, and the rise of Medicaid. Employers and members alike increasingly will need the sort of guidance producers have provided traditionally. Payers understand that—but they also need to maintain reasonable profit margins amid the constraints of the changing marketplace. They’re working to define their distribution strategies and understand how producers fit into them, but they haven’t yet seen a clear demonstration of the long-term value of producers, and they need that to justify additional investments.

The next few years will be a confusing time for health insurance customers, thanks to a variety of PPACA-related and non-PPACA-related factors, including new benefit and rating standards, group erosion, an influx of the previously uninsured, and the rise of Medicaid. Employers and members alike increasingly will need the sort of guidance producers have provided traditionally. Payers understand that—but they also need to maintain reasonable profit margins amid the constraints of the changing marketplace. They’re working to define their distribution strategies and understand how producers fit into them, but they haven’t yet seen a clear demonstration of the long-term value of producers, and they need that to justify additional investments.

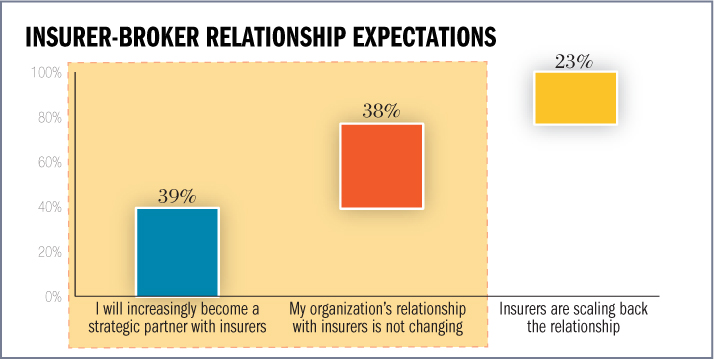

For their part, benefits professionals remain cautiously optimistic, at least in the short-term, with 77 percent predicting payers will either maintain or improve relationships with producers in 2014. But the picture is less clear in the long-run. Payers are still evaluating their options, and producers, especially in the small group and individual markets, need to determine how to differentiate themselves to meet stakeholder needs in the new post-reform market.

For their part, benefits professionals remain cautiously optimistic, at least in the short-term, with 77 percent predicting payers will either maintain or improve relationships with producers in 2014. But the picture is less clear in the long-run. Payers are still evaluating their options, and producers, especially in the small group and individual markets, need to determine how to differentiate themselves to meet stakeholder needs in the new post-reform market.

Delivering more value

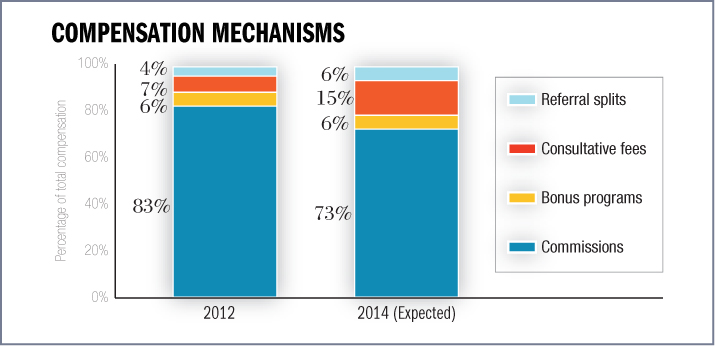

Respondents expect total compensation to become increasingly dependent on consultative fees as commissions continue to come under pressure. In response, producers are starting to make some hard decisions on the direction of their business, including what products they’ll sell and what services they’ll offer in the future.

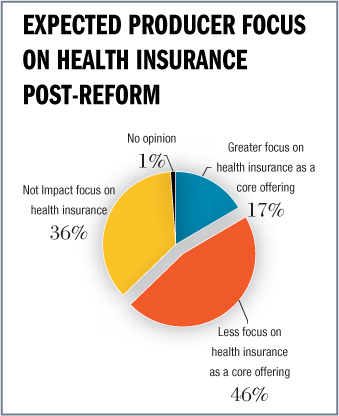

In this year’s survey, 46 percent of respondents said they expected to place less emphasis on health insurance as a core offering in the post-reform market.

For those who continue to stay involved in health insurance, producers say that different service models and strategies will be the key to maintaining current business levels. They plan to focus on providing more value to employers and payers to capture additional volume and diversify into new revenue sources.

Producers are considering several new value-added roles, including:

Producers are considering several new value-added roles, including:

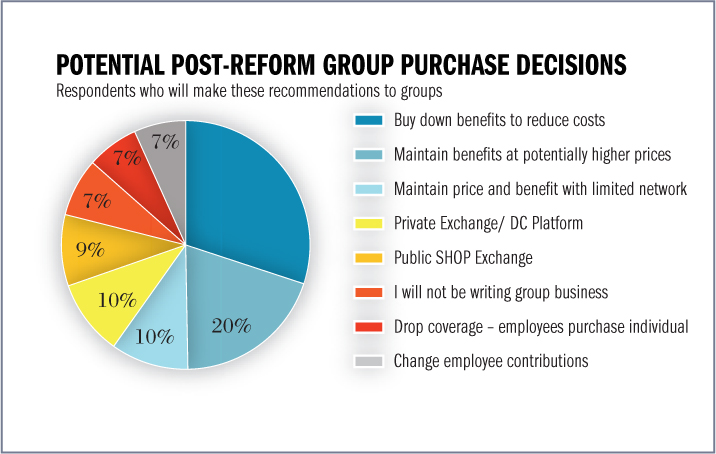

- Group reform consultant: In this role, the producer will consult clients prior to renewal, allowing them to better understand how reform will affect cost and coverage. Nearly half of producers expect to make non-traditional benefit recommendations to group customers in 2014. This approach is largely a higher touch expansion of current producer roles, but it hinges on deep PPACA expertise while incorporating analytical tools and scenarios to help customers make optimal decisions.

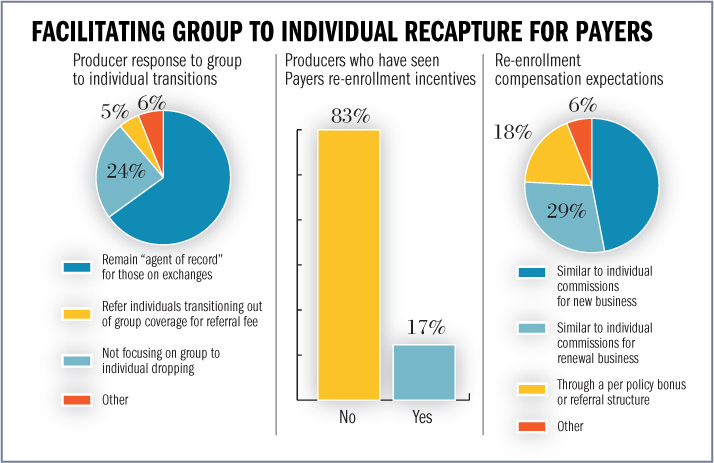

- Group-to-individual facilitator: PPACA’s affordability provisions and subsidies should lead to significant migration from group to individual coverage post-2014. And that will give producers a potential new role in helping to manage member transitions. Although preserving group coverage is still the top priority, it’s no surprise that producers welcome the opportunity to help clients and payers shift eroding group coverage to individual. Nearly two-thirds of agents said they hoped to remain the agent of record for group members who moved to individual coverage. And although only about 20 percent of respondents have yet seen specific group-to-individual re-enrollment strategies from payers, expect that number to rise: Payers are actively evaluating 2014 retention strategies for segment transitions.

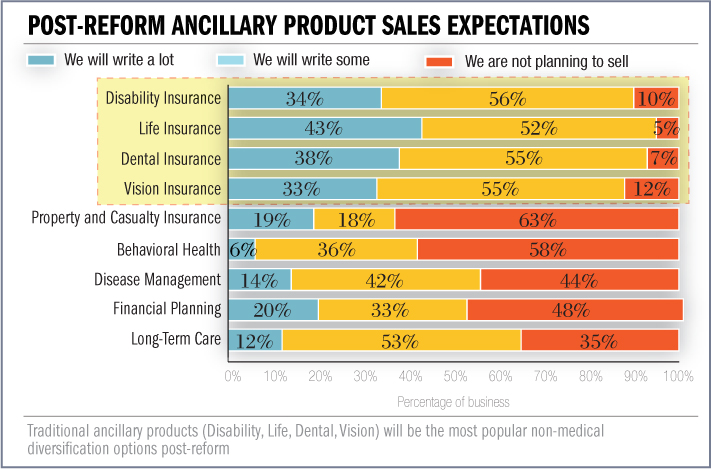

- Value-added integrator: Given that the PPACA will increasingly commoditize core medical products in the small-group and individual markets, producers hope to capture additional value by diversify their revenue base. They plan to offer customers a broader, more integrated suite of benefits with goal of selling adjacent coverage options and helping clients find integrated, holistic product bundles. In our survey, producers pointed to life, disability, dental, and vision insurance as the supplementary products they expected to sell the most of in 2014.

Key leadership questions

Although the shape of the 2014 market is becoming increasingly clear, there is still a plethora of questions producers need to answer if they hope to compete effectively. These questions include:

- How quickly will my market shift to new retail distribution mechanisms?

- Will my state implement an effective public exchange marketplace? If so, what is my role within this new channel?

- Should I develop my own private exchange capabilities?

- How will new value-based payer/provider relationships and care models such as ACOs affect my business?

- How will big box retailers like Wal-Mart, Target, Rite Aid, etc. change the way health care is bought and sold?

- Will consolidation be required to provide value-added services at scale and effectively compete in this new environment?

Because local markets will respond differently, no single blanket strategy will work for all producers. Developing the right strategy will require a deep understanding of a local market’s current and future dynamics, a keen awareness of current position and organizational gaps, and the flexibility to adapt to payer and customer needs as the market evolves.

Looking ahead

The next 12 months will be a time of significant change, and producers believe they can play a vital role in advising stakeholders how to navigate it. They expect to provide value-added services to their clients, connecting client demand with the best options the new market offers.

The next 12 months will be a time of significant change, and producers believe they can play a vital role in advising stakeholders how to navigate it. They expect to provide value-added services to their clients, connecting client demand with the best options the new market offers.

But success will not come easy. With continuing commission compressions, new disruptive distribution models, and well-capitalized innovators eager to enter a large and broken healthcare space, only the nimblest producers will find a place in the future market. Those unwilling to adapt, and those that cannot demonstrate that they provide high value to all stakeholders, will be increasingly marginalized and ultimately forced to exit health care altogether.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.