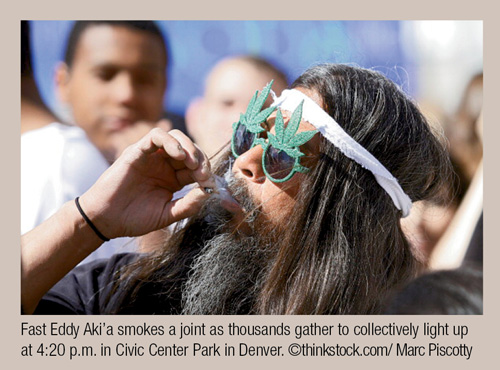

Though the legalization of recreational marijuana in Colorado and Washington is causing complications for HR departments, industry experts say it's not having a big impact on insurance and premiums — at least not yet.

Though the legalization of recreational marijuana in Colorado and Washington is causing complications for HR departments, industry experts say it's not having a big impact on insurance and premiums — at least not yet.

The fact that wwmillions of Americans now have access to legal, often very-potent weed has generally sparked no discussion or changes in the questions people are asked when they sign up for coverage, experts say.

“It's had no impact on our policies toward health insurance, nor are we discussing any aspects of that. It's a nonissue for us,” says Neil Waldron, chief marketing officer and vice president of strategic initiatives for Rocky Mountain Health Plans. “The only [time we would make a change] is if there were a regulation to come out at the state level or at the federal level related to how health insurance is or is not to be provided to people who smoke marijuana. We don't currently have a policy, and if you smoke marijuana we don't even know that, nor do we ask that.”

Recommended For You

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.