(Bloomberg Business) -- To lenders, millennials are like ugly-looking fruit: They may appear suspect, but on the inside they're just as good a bet as the next apple. That's roughly the takeaway of a report published Wednesday by credit rating company TransUnion, which suggests young people with student debt are not as risky an investment as they may seem.

The company reviewed credit profiles for 6 million people and found that having student loans did not prevent them from taking out other kinds of consumer debt in the long run.

"Younger consumers are doing a really good job at managing other types of credit," says Charlie Wise, a vice president in TransUnion’s innovative solutions group. "This is a surprisingly credit active, credit hungry group that seems to perform well on those loans."

Part of the reason TransUnion would like banks to believe that they are underestimating young consumers is that the company is selling risk assessment products that will help identify worthy borrowers based on more than just an impassive credit score.

"There are a lot of consumers in their twenties that are new enough to credit but haven’t established it, and therefore they are on the outside looking in when it comes to consumer loans," Wise says. "It’s missed opportunities. Just because you don’t have a credit score doesn’t mean you aren’t a good risk." For banks and other creditors to buy into the idea that they're missing out on something, they need first to believe that there is a something to miss out on.

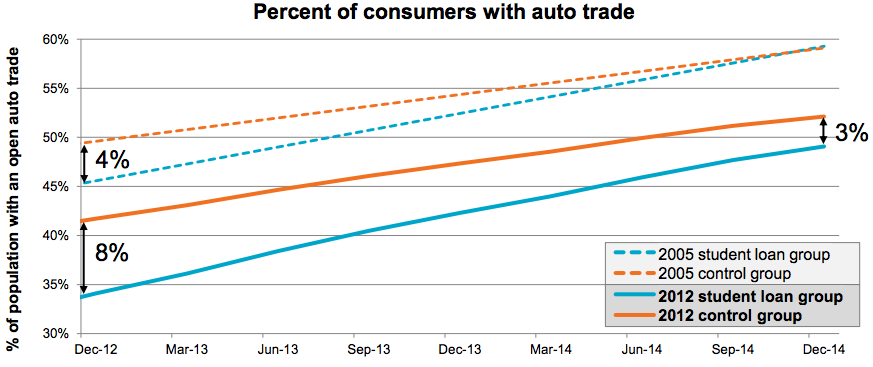

Still, the data back up that logic. The study looked at people who entered student debt repayment – which normally coincides with leaving college – in 2005, 2009, and 2012 and compared them with others their age who did not have college loans. People with student debt were less likely to have auto loans right after leaving school than those without college loans, but the student debtors caught up with their peers within a couple years for each of the three graduation years.

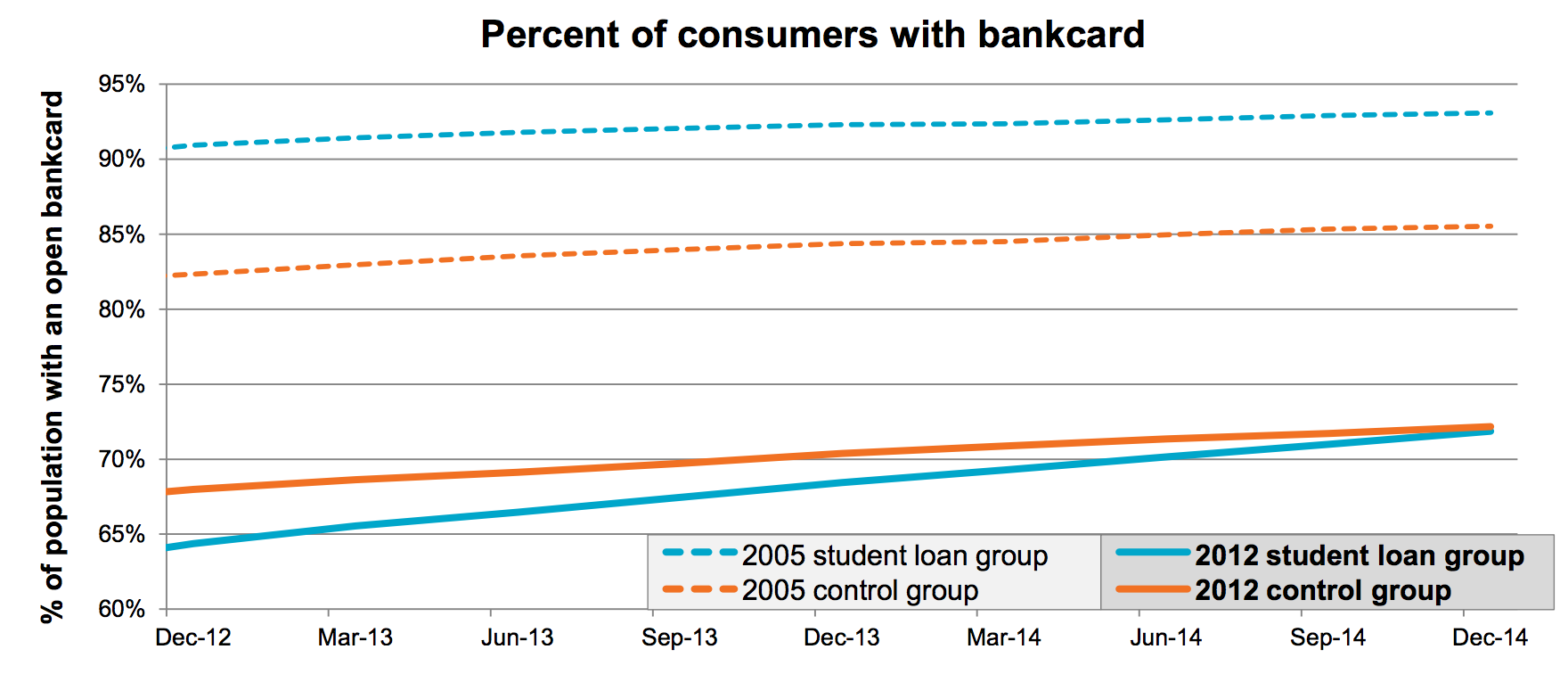

People who started repaying student loans in 2005 and 2009 were even more likely to have credit cards than those without student debt. People who began repaying in 2012 were initially less likely to have credit cards but were matching their peers within two years.

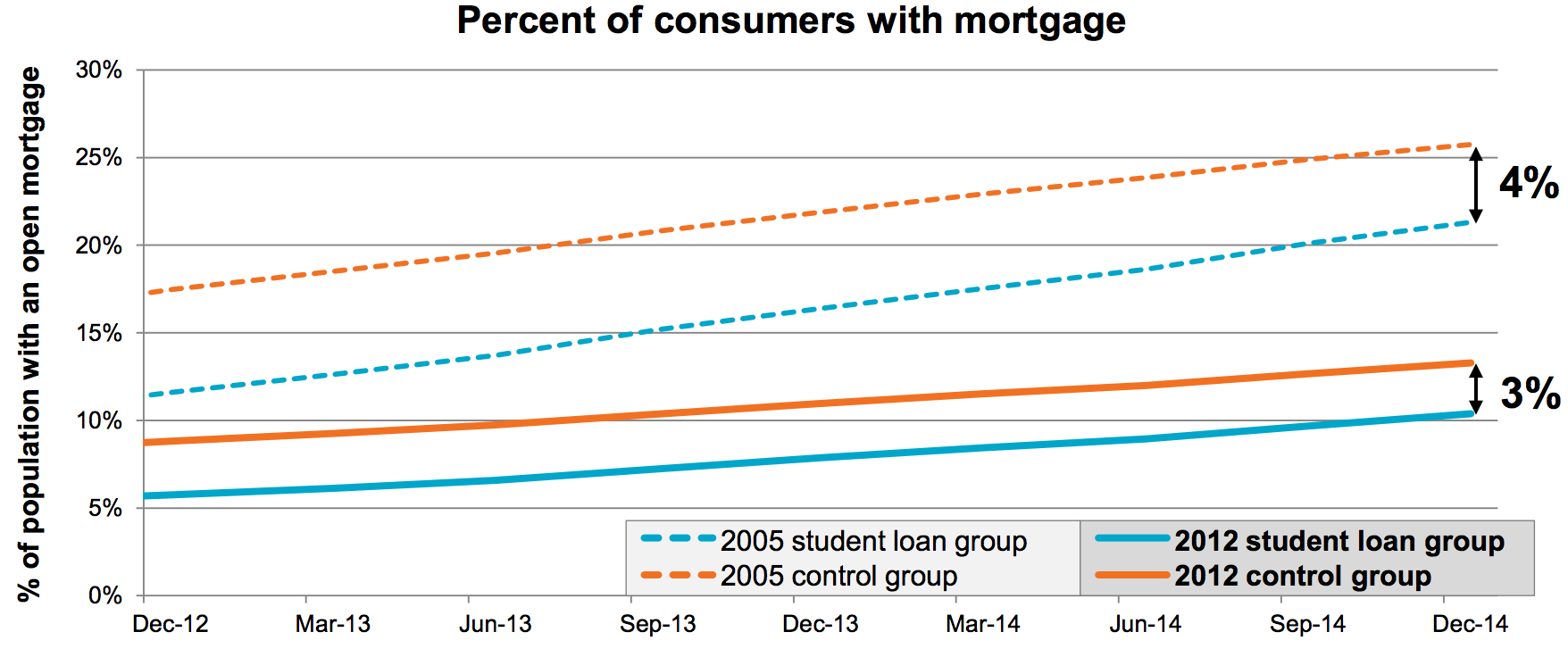

The home loan picture was a little less rosy. All three groups of student borrowers did inch closer to the mortgage rates of their unencumbered peers over time, but not by much.

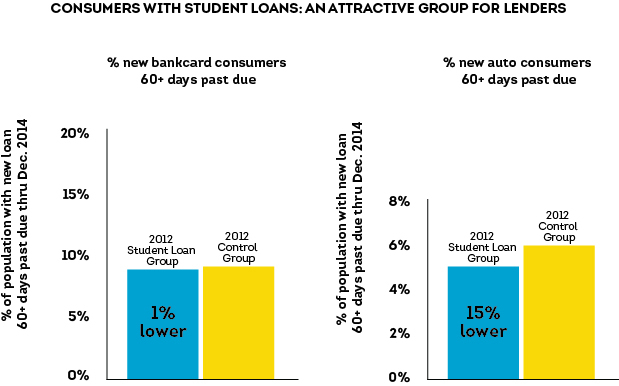

The single most encouraging chart of all, for creditors and millennials alike, is the one below. People who have student loans were no worse than people without it at managing their other debt. The youngest student debtors who also had credit cards and auto loans were actually less likely than rest of their age group to be 60 or more days late on payments. TransUnion says that delinquencies on mortgages were identical for both groups.

The message for young people, Wise says, is that "they may be underestimating their own capabilities." If you can stomach the anxiety of more debt, it can probably stomach the anxiety of you.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.