The annual Benefits Selling/Eastbridge Voluntary survey was conducted during March and April of this year, and almost 300 producers responded, representing a combination of employee benefit brokers, traditional voluntary brokers, enrollment companies and agents. The overarching conclusion from the survey is that voluntary is now front and center for many brokers, regardless of the type.

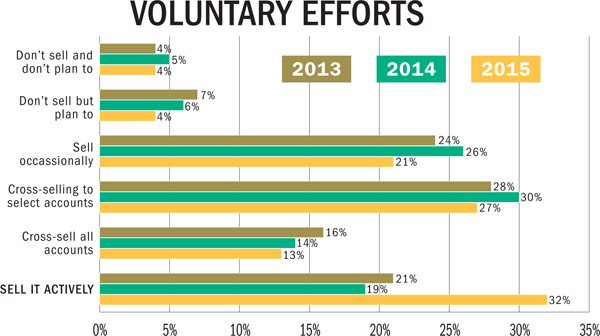

Over the last three surveys, there has been a steady increase in the sales activities related to voluntary. Just 8 percent of the respondents this year do not sell voluntary and half of those plan to do so in the future. However, the most notable change is the increase in the percentage of brokers describing their marketing efforts as “selling it (voluntary) actively” from just 19 percent in 2014 to 32 percent in the most recent survey.

As predicted several years ago, medium-sized employee benefit brokers and the classic worksite brokers are looking more and more similar. They often respond the same way to:

-

The increase in new voluntary cases

-

Voluntary products offered most frequently

-

How they chose their carriers for voluntary

-

Enrollment methods used

-

Carriers used

Still, there are some differences in the volume of voluntary sold (both the number of cases and the annualized new business premium) as well as their described level of effort for voluntary and their acceptance of non-traditional voluntary products. This article looks at these similarities and differences in more detail.

The similarities

When asked if the number of voluntary/worksite cases they write annually has changed over the last one to three years, 70 percent of brokers said it has increased. Close to one-fourth described the increase as significant.

The top five most frequently sold voluntary products are the same regardless of broker type, although the ranking and percent naming them as a most frequently sold product may be different.

Classic worksite brokers named universal life/whole life as a most frequently sold product at the same percentage as they named dental insurance, so for classics both products tied for the number 5 position.

When asked about their top voluntary carriers, the mid-sized EBB and the Classics agreed more than they disagreed. The most frequently named carriers by both broker types were:

-

Aflac

-

Unum

-

Colonial

-

Allstate

For benefit brokers, Guardian rounded out the top five while classics named Transamerica and Trustmark. (Trustmark and Unum were named by the same number of classic brokers.)

When asked if their top most frequently used carriers have changed over the last few years, about half of both types said they have varied. The top reasons for the change were the same for both types of producer.

When it comes to enrollment, there still are some differences but the similarities are growing. About one-third of broker types use a group meeting followed by one-on-one meetings. Internet usage by benefit brokers is up significantly from the prior study but unchanged with the classics.

The majority of both types of brokers surveyed said they typically use a carrier's enrollment platform to handle their enrollments. Benefit brokers are more likely to say they don't use any type of technology platform while classics are somewhat more likely to use a third-party platform.

The differences

Not surprisingly, there are still differences in the amount of voluntary sold. The classic worksite brokers sell significantly higher amounts than do the benefit brokers. More than half of the benefit brokers in our survey sold less than $50,000 of annualized new business premium while only 23 percent of the classics sold that level. In fact, almost one-quarter of the classics sold over $1 million of voluntary in 2014.

While both classics and benefit brokers said they are writing more new voluntary cases than they were one to three years ago, we do see that classic worksite brokers still write a higher volume of new voluntary cases each year than do benefit brokers.

Similarly, there are differences in the number of carriers used for their voluntary business over the course of a year. While the most common answer for both types of brokers was “2 to 3 carriers,” classics tend to use more voluntary carriers. Only 26 percent of benefit brokers use more than three carriers compared to almost half of the classics.

As mentioned earlier, there is growing similarity in the most frequently sold voluntary products. However, that does not hold for the “non-traditional” voluntary products. Except for “wellness programs” (which are likely associated with medical insurance), classics are more likely than benefit brokers to sell non-traditional products. ID theft coverage saw the biggest jump in the percentage of brokers selling that product. Last year, just 32 percent of all brokers sold ID theft coverage whereas the percentage is up to 63 percent for classics and 48 percent for benefit brokers.

There also are differences between these brokers in terms of what types of enrollers are used. Classics are much more likely to have their own in-house enrollers while the benefits brokers are much more apt to use carrier enrollers. Classics also use contract enrollers and/or enrollment companies more often.

In summary

While there are still different segments of producers in the voluntary market space, we are seeing some blurring, most notably the between the classic worksite broker and the mid-size or middle-market employee benefits broker segments. Both of these broker types are selling employer-funded and employee-funded products these days, but the classics sell more voluntary while the benefits brokers still sell more of the employer-funded. However, the days of these two co-existing peacefully in the same account are probably numbered. As competition continues to increase in the voluntary marketplace, it will become increasingly important for these two broker types to differentiate themselves and to show employers how they alone can meet the full spectrum of employee benefit needs.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.