Staring at a subway advertisement, Steve Rousseau pondered upending the delicate balance of his personal budget. The ad promised a lower interest rate and smaller payments for student debtors who were willing to refinance. Rousseau, 27, is five years out of college. He has about $15,000 left to pay on private and federal loans that helped fund a diploma from Hofstra University. What to do?

Related: Millennials short on savings

Weeks after seeing the promotion, he has chosen to do nothing. “Going to the private sector for financial advice, especially with student debt, feels fraught,” he explained. “There aren’t government resources that could clearly explain the proper way to manage student debt that would be more trustworthy.”

The vast majority of student debtors are in Rousseau's shoes: About 62 percent are familiar with student loan refinancing, but more than two-thirds haven't refinanced, according to a poll of 1,001 American student debtors.

Related: What voluntary brokers need to know about millennials student debt

For undergraduates who finished college in 2014, the average student debt total was $28,950, an amount generally split between private loans and government loans. (The latter come with such perks as income-driven repayments.)

There's no overarching reason why they don't refinance, though 20.1 percent pointed to the federal loan option that ties payment amounts to what they're earning, and they didn't want to risk losing it.

Related: 6 positive trends in student debt

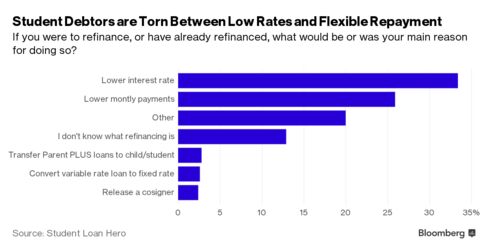

The study found that those who did want to refinance were hoping for a lower interest rate, with 33.4 percent saying that this was their primary motivation. But when asked if they would be willing to give up the income-driven repayment option for the more attractive rate, the results were murkier.

The majority, 39.4 percent, said they weren't sure that a low interest rate was worth the trade-off. An additional 35.9 percent said it definitely wasn't worth it. Only 24.7 percent said they'd prefer a low interest rate.

"You really sacrifice the flexibility if you were to refinance," explained Tyler Dolan, a financial planner with the Society of Grownups, a Brookline, Mass., financial literacy group. "You might be able to find a lower interest rate, but that's not the only consideration."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.