The voluntary market is constantly changing, but the degree of change the last five years has occurred faster than ever before. It's not your father's market when it comes to benefits. Employers are offering a wider variety of benefits and benefit types that were not typically offered in the past. This article explores this trend and gives insights into the types of new, non-traditional benefits that you may want to have in your bag of benefits.

Over the last five to eight years, employer attitudes towards voluntary benefits have changed. Gone are the days when employers had limited payroll deduction slots and only offered those benefits in which most employees were interested. Today's employers are open to offering benefits that some employees need and want, even if it's not the majority. With this comes several ancillary changes taking place. First, more voluntary products are being offered. Today, about one-third of employers offer six or more voluntary products. Half offer between three and five.

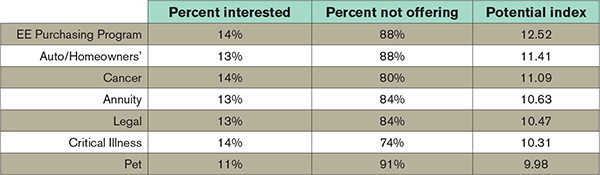

Secondly, we are seeing sales of different types of products. Disability and life are still top sellers, but other products like accident, hospital indemnity, and critical illnesses are growing faster than the leading products. In addition, more non-traditional products are being offered. In a recent survey of brokers, 40 percent or more indicated offering:

-

Wellness programs

-

Discount health programs

-

Legal plans

-

ID theft insurance

Recommended For You

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.