Why is it important to align target date fund glide paths with retirement income goals? Employers today face significant challenges in maintaining a competitive benefits program that includes helping employees achieve financial wellness in retirement. As fewer employers offer defined benefit plans, there is an increasing reliance on defined contribution (DC) plans, placing the responsibility of saving and investing for retirement largely on employees. This shift in responsibility for saving and investing for what could be 25–30 years in retirement has left many employees struggling and overwhelmed.

Our research indicates:

-

Half of participants may not be invested appropriately for their age.1

-

More than half of all employees are likely not on track to cover their basic lifestyle expenses—health care, food, and housing—in retirement.2

If employees are not on track to retire, employers may face increasing challenges in managing their workforce strategy.

Leading employers are focused on designing plans for retirement income replacement. You can serve clients well by making sure that they're thinking about income.

An increasing number of employers are taking a pension-like approach and designing DC plans with a targeted retirement income replacement level in mind, often stated as a percentage of a worker's final preretirement salary.

With 6 in 10 workers relying on their DC plan as their primary savings vehicle,3 designing one that generates sufficient income during retirement is critical. Progress is under way; the percentage of employers designing DC plans with a specific income replacement goal rose to 18% in 2015, up from 4% in 2013.4

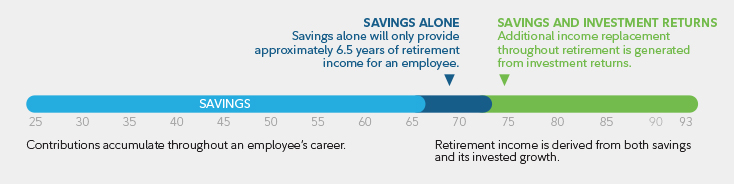

Saving and investing are both critical to achieving adequate income replacement.

5See disclosures for methodology and assumptions. No income replacement rate is guaranteed by any Fidelity target date fund.

For employees, the combination of saving and investing is critical to achieving an appropriate level of income replacement. As highlighted above, savings alone will only provide approximately 6.5 years of retirement income for an employee who could live 25–30 years or more in retirement. That's a significant shortfall. Educating participants on the proper savings amounts and appropriate investments is crucial to having enough money to last throughout retirement and maintain a desired standard of living.

Ensure the goals of a DC plan and target date funds are aligned.

As a default investment option, target date funds play a critical role in plan design. One important—and often overlooked—consideration is ensuring that the target date fund's underlying assumptions and glide path, or strategic asset allocation, are aligned with a DC plan's income replacement goal.

Employee dependence on target date funds means that your plan sponsor clients should carefully evaluate the long-term goals of their fund and their DC plan.

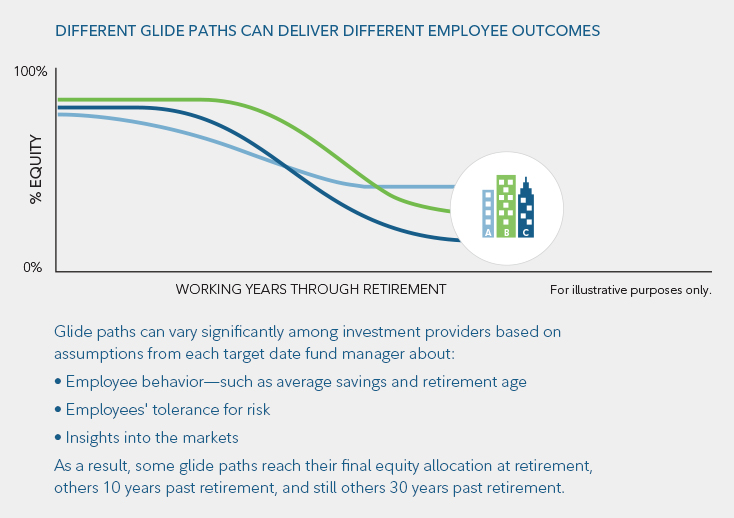

No two target date fund glide paths are alike.

For plan sponsors, selecting the appropriate target date fund and corresponding glide path in a DC plan is very much an active decision, and requires the target date fund provider to offer full transparency into the glide path methodology and assumptions. Employers can serve their employees well by evaluating and monitoring the glide path of the target date fund in their DC plan to determine whether it was developed with specific key drivers in mind and derived through rigorous research and analysis.

Make sure your client's plan is designed to help drive better employee outcomes. Consider the following to help make sure plan design and investment choice are aligned:

-

Review DC plan design and use behavioral data to identify where employees need help. Consider implementing plan design features and investment choices that promote strong participation, higher savings rates, and appropriate asset allocation.

-

Make sure the DC plan and the glide path of the target date fund are designed with a similar income replacement goal. This alignment can help ensure a cohesive approach to retirement planning.

-

Ensure plan design and target date fund selection conversations happen together. Bring together key stakeholders from across the organization to align plan design and target date fund selection with retirement program goals.

Learn more about Fidelity target date funds and the importance of income replacement in glide path design. Download charticle now.

Before investing in any mutual fund, please carefully consider the investment objectives, risks, charges, and expenses. For this and other information, call or write Fidelity for a free prospectus or, if available, a summary prospectus. Read it carefully before you invest.

Investing involves risk, including the risk of loss.

1Based on Fidelity analysis of 21,200 corporate DC plans (including advisor-sold DC) and 13.5 million participants as of 6/30/2015. For “not age appropriately allocated” purposes, the participant's current age and equity holdings are compared with an example table containing age-based equity holding percentages based on an equity glide path. The Fidelity Equity Glide Path is an example we use for this measure and is a range of equity allocations that may be generally appropriate for many investors saving for retirement and planning to retire around ages 65 to 67. It is designed to become more conservative as participants approach retirement and beyond. The glide path as of 12/31/13 begins with 90% equity holdings within a retirement portfolio at age 25 continuing down to 24% equity holdings at age 93. Equities are defined as domestic equity, international equity, company stock, and the equity option of blended investment options. The indicator for asset allocation is determined by being within 10% (+ or –) of the Fidelity Equity Glide Path and capped at 95% equity. We assume self-directed account balances (if any) are allocated 75% to equities, regardless of participant age, so this indicator has limited applicability for those affected participants. For purposes of this metric, participants enrolled in a managed account are considered to be age appropriately allocated. Diversification and/or asset allocation do not ensure a profit or protect against loss.

2Fidelity Investments Retirement Savings Assessment, 2015.

3Participants in an Employment-Based Retirement Plan: Employee Benefit Research Institute, as of 2011.

4Fidelity Investments online surveys of 500+ employers; March 2013 and April 2015.

5Chart is a hypothetical example based on a set of assumptions to illustrate the limits of income replacement that can be achieved through regular savings contributions alone (dark blue bars), and the need for an expected return on investment to achieve a desired level of income replacement over a longer retirement horizon (green bars). For the purposes of this chart, the following assumptions are presumed: investor starts contributing at age 25 through age 66, and receives annual salary increases equal to 1.5% over this period. Light blue bars represent an increasing percentage of investor contributions from 8% to 13% of salary from age 25 through age 66 (includes company matching funds). Dark blue bars represent the expected income replacement provided solely by the contribution amounts, equal to approximately 50% of one's final preretirement salary through the early years of retirement. Green bars represent the expected income replacement needed through a target date portfolio's investment returns, equal to approximately 50% of one's final preretirement salary through age 93. A hypothetical internal rate of return (IRR) equal to approximately 4.5% in real terms is assumed (required investment return to have savings equal income replacement needs). This hypothetical illustration is not intended to predict or project the investment performance of any security or product. The IRR is a rate of return used in capital budgeting to measure and compare the profitability of investments. Past performance is no guarantee of future results. Your performance will vary, and you may have a gain or loss when you sell your shares. For many investors, these assets will be combined with other complementary sources of income (e.g., Social Security, defined benefit plan benefits, and personal savings). Source: Fidelity Investments.

Target date funds are designed for investors expecting to retire around the year indicated in each fund's name. The funds are managed to gradually become more conservative over time as they approach the target date. The investment risk of each target date fund changes over time as the fund's asset allocation changes. They are subject to the volatility of the financial markets, including that of equity and fixed income investments in the U.S. and abroad, and may be subject to risks associated with investing in high-yield, small-cap, and foreign securities. Principal invested is not guaranteed at any time, including at or after the funds' target dates.

For plan sponsor and institutional use only.

Fidelity Institutional Services Company, Inc. 500 Salem Street, Smithfield, RI 02917

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

©2016 FMR LLC. All rights reserved. 762863.2.0

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.