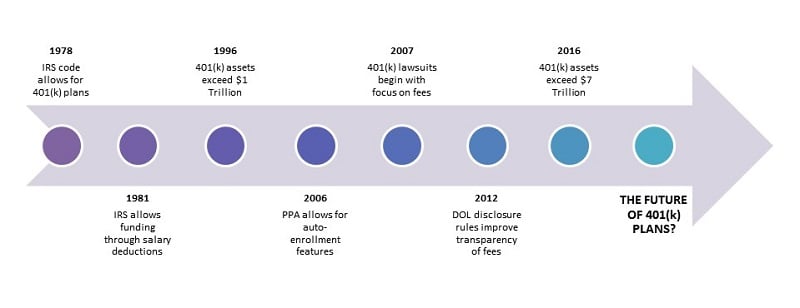

America's 401(k) plans have changed and evolved significantly since their beginnings in the early '80s. Those changes have primarily focused on fixing the two key components of the U.S.'s retirement problem: 1) lack of savings, and 2) high fees that eat away at returns.

Today's trends continue to focus on these problems and will likely shape the future of the 401(k) and American retirement savings. So what does the future 401(k) look like? While nobody knows exactly, here are some thoughts on what has changed and where we see things going.

Recommended For You

Early trends

In the early days of the 401(k) plan, evolutionary trends were primarily focused on improving savings rates and included the addition of salary deferrals and non-discrimination testing, which compels companies to offer retirement benefits to more employees.

Increases in employee savings were further bolstered by the Pension Protection Act in 2006 allowing for the addition of auto-enrollment and auto-escalation, which have shown to improve savings rates and retirement outcomes for employees.

Current Trends

Current trends have continued to focus on improving savings rates but have shifted substantially to focus on understanding and eliminating unnecessary fees; especially after the Department of Labor's 2012 fee disclosure rules and changes.

Increased fee transparency is helping employers and employees understand the true costs of their retirement plan including administrative, investment, and advisory fees paid directly or indirectly. As a result, we've seen the following trends in full force over the last few years:

Lawsuits & fiduciary outsourcing: Consistent legal victories in 401(k) lawsuits have established a precedent of company liability and these suits are now popping up faster than dandelions.

Not only do we foresee this trend increasing over time, but we also see it moving down-market to smaller plans. Companies are now looking for ways to mitigate these risks by outsourcing fiduciary roles.

Index funds & lower fees: One of the main targets of 401(k) lawsuits is high investment fees and related conflicts of interest. With these risks, and a growing number of studies supporting passive vs. active management, more companies are adopting fund lineups that minimize fees and still offer a diversified investment approach using low-cost index funds.

Administrative fees are also compressing with technology and more low-cost providers are entering the market to capitalize on the underserved small-plan space.

Robo-advisors & financial education: With the use of index funds becoming so prevalent, many companies are opting for a robo-advisor in lieu of a financial advisor. As a result, we're also seeing a shift in the role of financial advisors on plans who are now focused more on financial education and asset allocation and less on picking performance winners and timing the market.

Payroll & HR integration: The growing trend of fully integrated Human Resources Information Systems (HRIS) has extended to the benefits space, and 401(k) solutions are falling in line. This will likely continue to become a more important factor in the 401(k) decision process as companies choose a provider.

The Future

What does the future hold for 401(k) plans? Here is our best guess at what's to come:

The 401(k) will grow in importance: As companies compete for talent in an ever-escalating benefits war, retention will become more important. Few employee benefits allow you to retain employees better than a 401(k) plan because of plan features like eligibility and vesting schedules.

Additionally, as the market exists currently, you can only access the benefits of a 401(k) plan through your employer, as opposed to health and insurance benefits which can now be accessed privately by any individual.

These factors and others such as diminishing pension programs and a dubious future for social security, are likely to increase the importance of the 401(k) relative to other benefits.

The emergence of more fiduciary and bulk buying models: As the rate of 401(k) lawsuits continues to escalate, companies will be looking for ways to mitigate their fiduciary risk through fiduciary outsourcing. A few of these models already exist through national providers like Mercer in large plan space and BenefitGuard in the SMB market.

The pending Senate Finance Committee's proposal for the Retirement Enhancement and Savings Act of 2016 also aims to approve and promote similar models such as pooled employer plans (PEPS), which will give further support and traction to the growth of full-fiduciary and bulk buying models.

The marriage of health & wealth with HSA integration: 401(k) integration is not likely to stop with payroll and HRIS systems. The next and most probable integration for 401(k) plans is with their financial cousin, the Health Savings Account plan.

The HSA is the most tax-deferred retirement savings vehicle in the country, and over time, employees will start to see it less as a spending account and more as a 401(k) for their health, since balances can be invested. Consequently, HSA and 401(k) plans are likely to see future integration including single-sign-on capability, joint balance viewing, and integrated investment lineups to aid employees in their 401(k) and HSA savings efforts from a single platform.

Financial wellness as a defining feature: You can only lower fees so far, and already, the focus on fees is beginning to yield to helping employees save more money. It's likely that there will be a renewed focus and/or even mandates related to features like auto-enrollment and auto-escalation.

Additionally, financial wellness solutions that help employees build budgets, reduce spending, pay off debt, and start saving more will emerge as stand alone, bolt-on, or 401(k) integrated solutions. Many financial advisory firms and 401(k) providers are already building and rolling out solutions in this space like Questis, Financial Finesse, and even Dave Ramsey.

The 401(k) exchange: State mandated retirement plans are already in motion in California, Oregon, Connecticut, and Illinois amongst others, and are likely just the beginning.

It's very likely that this could spread to a national level and we could end up with both state and national 401(k) exchanges with the possibility of all employers being required to adopt a retirement plan that allows employees to save tax-free dollars for retirement.

How successful would these programs be? With market demand for financial wellness, HR and HSA integration, and increased education in a complex space that is continuously evolving, we're hopeful, but not overly optimistic of what government programs will provide in comparison to private market solutions.

Without a crystal ball, it's difficult to know what lies ahead, but it appears, at least for the time being, that the 401(k) is here to stay, and it and today's trends will play a clear role in shaping the future of American retirement savings.

Will fiduciary and bulk buying models, HSA integrations, financial wellness offerings, and government-run exchanges be defining evolutions in the 401(k) market? Only time will tell, but either way, we're excited to be a part of it.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.