As the employee benefits market grows even more commoditized, brokers are constantly looking for ways to differentiate. One of the best way a broker can stand out from the crowd and build long-lasting client relationships is to become an advisor or partner in the employer’s business.

An important aspect to becoming that trusted advisor is helping clients create a big-picture employee benefits strategy that will attract and retain top talent. I know that many, if not most brokers suggest ancillary coverages to clients. The problem, as we know, is that many employers ignore that advice. In this article, I’ll lay out some undeniable statistics about the ancillary benefits market that you should be sharing with your clients, as well as lay out a strategy for more effectively selling ancillary.

The “ancillary disconnect”: employers are falling short

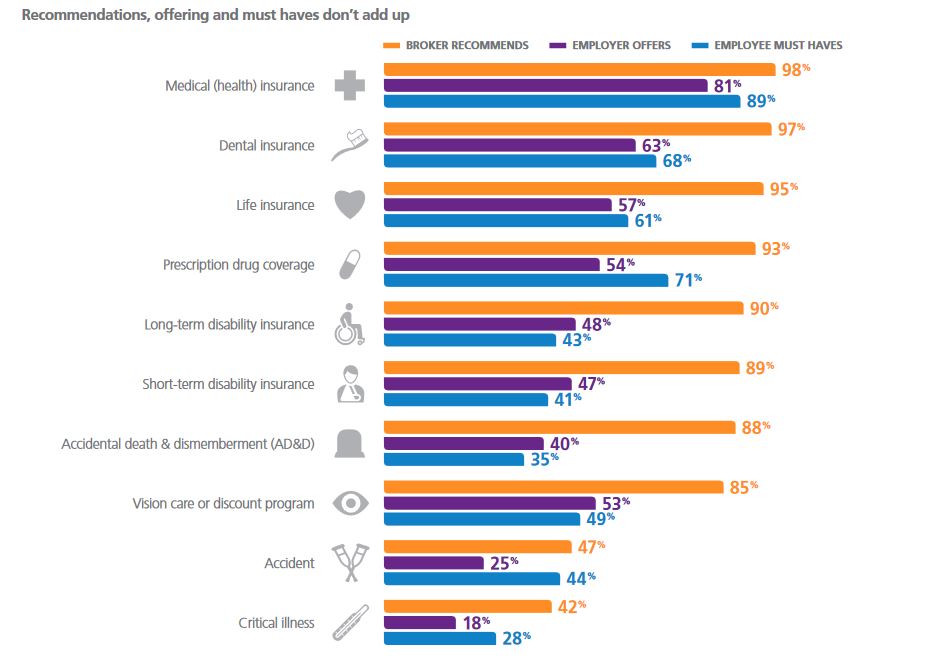

A telling MetLife study looks at ancillary from the point of view of broker, employer and employee. It’s here where the disconnect lies. Brokers are recommending ancillary benefits, and employees feel that many ancillary coverages are “must-haves”... but employers aren’t delivering (see infographic below -- click to enlarge):

Here are a few examples from the study:

-

Dental: 98% of brokers recommend it, 89% of employees consider it a must-have, but only 81% of employers offer dental coverage. Though that employer percentage is high, companies still need to do better here.

-

Accident: 47% of brokers recommend it, 44% of employees consider it a must-have, but only 25% of employers offer accident insurance coverage. This gap is concerning; almost half of employees feel this option is essential to offer, but only 25% of employers do so.

-

Prescription Drugs: 93% of brokers recommend it, 71% of employees consider it a must-have, but only 54% of employers offer prescription drug coverage. This is also a startling disconnect.

Why the disconnect? Employers are focused on managing benefits costs, as health care costs continue to rise, so expanding their benefits package isn’t their first priority. Brokers need to remind clients of the employee demand, and emphasize that not offering a comprehensive benefits package can actually cost them money in turnover and lost productivity.

Actions are louder than words and employees are acting

Employees are a valuable asset, so companies need to understand what keeps them engaged and what motivates them to accept a new job (or change jobs). Benefits play a huge role here.

Let’s start by looking at employee engagement today, according to a 2016 Gallup report:

-

33% of employees are engaged, love their job and feel fulfilled

-

51% of employees are neutral; they are “just there”

-

16% of employees are actively disengaged, miserable and toxic for the workplace

Obviously, employers want to move more of the neutral employees to feeling engaged. Benefits can play a big role in keeping employees happy, as evidenced by a Glassdoor survey:

-

48% of employees would change jobs for more benefits

-

60% of employees say that their overall benefits package is a major factor in accepting or declining a new job offer

-

80% of employees would choose additional benefits over a pay raise

These insights are ones you should be sharing with employees. Helping attract the best employees (and retain them) will add trust and loyalty to your client relationships.

We’ll take a look in the next section at strategies for presenting ancillary, but a good start is to suggest to your clients that they undergo an employee survey. Share these statistics with your client, and then help them craft an employee survey to discover the demand for various benefits.

Make ancillary part of the big picture

We saw from the statistics above that brokers are encouraging employers to offer ancillary benefits, but often the client doesn’t listen. I feel that part of the problem is how ancillary is presented to clients (and prospects).

From speaking with hundreds of brokers and employers, I’ve found that brokers often will present medical (and maybe Rx) plan options first, making that the focus of the meeting. Once the medical plan(s) and contribution strategies for those plans are nailed down, the broker then opens a discussion on ancillary.

This approach often fails for a couple reasons. First, the employer has just made their major medical decisions and settled on a budget and contribution strategy. Discussing ancillary after that makes the employer revisit what they will spend on benefits; if the budget was tight on major medical, they’ll likely decide to skip ancillary.

The other problem with this approach is that it can feel to clients as an add-on, an upsell and/or something of less importance that is mentioned at the end of the meeting. A common scenario is that medical is presented using an impressive presentation or technology tool, and then ancillary is discussed with spreadsheets—an obvious disconnect in the client’s mind.

The solution to both of these issues is to present ancillary in conjunction with medical and Rx options. By integrating all coverage options into the discussion, the employer can see costs and employee impact on a bigger scale, and can make more informed decisions about the comprehensive benefits package they are offering.

Constructing a presentation this way can be accomplished in multiple ways, including modern technology tools that make it easy for employers to see impact and make decisions.

Clearly, ancillary coverages are an essential part of today’s employee benefits package, and employees aren’t shy about choosing companies that offer what they’re looking for (even if it means switching jobs). How will you apply this knowledge to your next renewal meetings?

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.