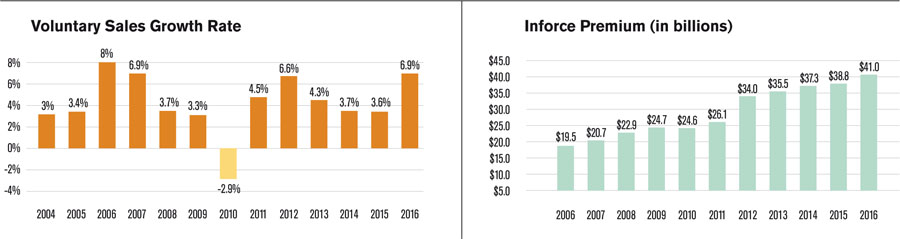

According to our annual U.S. Voluntary/Worksite Sales Report, new business annualized premium (voluntary sales) increased again last year. Total sales for 2016 were $7.630 billion, up almost 7 percent over 2015 sales. The graph at left shows the industry's sales since 1997.

This grow rate is the highest realized since 2007 (although 2012 came close) and stems primarily from increased productivity (sales) per broker, rather than simply new brokers entering the market. (Currently, 90 percent to 95 percent of all benefit brokers sell voluntary.) The graph at bottom left shows the growth curve between 2004 and 2016.

In terms of market share, the top five carriers for 2016 were the same as in 2015, and include:

-

Aflac (19 percent)

-

MetLife (11 percent)

-

Unum (7 percent)

-

Colonial Life (6 percent)

-

Allstate Benefits (5 percent)

Recommended For You

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.