This exercise in chart-making was inspired in part by an account, from an excellent new profile by Politico's Mike Grunwald of White House Office of Management and Budget Director Mick Mulvaney, of a May meeting between Mulvaney and President Donald Trump:

"Look, this is my idea on how to reform Social Security," the former South Carolina congressman began.

Recommended For You

"No!" the president replied. "I told people we wouldn't do that. What's next?"

"Well, here are some Medicare reforms," Mulvaney said.

"No!" Trump repeated. "I'm not doing that."

"OK, disability insurance."

This was a clever twist. Mulvaney was talking about the Social Security Disability Insurance program, which, as its full name indicates, is part of Social Security.

But Americans don't tend to think of it as Social Security, and its 11 million beneficiaries are not the senior citizens who tend to support Trump.

"Tell me about that," Trump replied.

"It's welfare," Mulvaney said.

"OK, we can fix welfare," Trump declared.

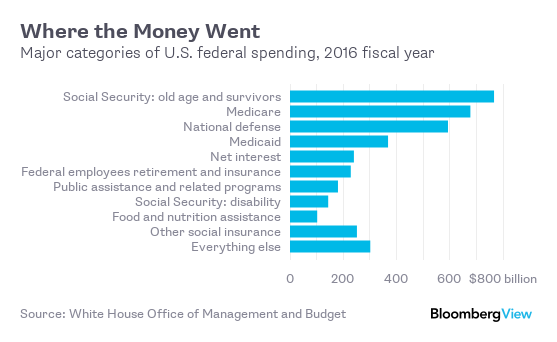

You can see from the chart why Mulvaney — whose agency compiled the data used in it – would have brought up Social Security (the non-disability kind) and Medicare first.

Between them they account for 37 percent of federal spending. Social Security disability insurance takes 3.7 percent. That doesn't mean disability insurance couldn't stand some reforming.

It's just a much smaller pot of money.

Understanding where federal tax dollars go is one of the perennial failures of civic education in the U.S. The classic case is foreign aid: Poll respondents usually think it accounts for one-quarter or more of government spending, when in fact it was 0.9 percent in 2016.

When CNN asked about a bunch of different spending categories in 2011, respondents did better, putting foreign aid at 10 percent of federal spending and getting Social Security and Medicare's spending percentages almost right.

But they greatly overestimated the cost of other social programs and defense. If you added up the median spending estimates on all 10 federal programs that they were asked about, it came to 147 percent of total federal spending.

The great majority of U.S. government spending goes to what's best described as social insurance, with Social Security and Medicare leading the way.

All the spending categories that a politician hoping to garner votes from those 62 and older could conceivably get away with labeling "welfare" – disability insurance plus Medicaid plus public assistance and related programs plus food and nutrition programs plus various health-care programs targeted at those with lower incomes — add up to another 24 percent of federal spending.

Social insurance programs of all kinds (including retirement benefits for the military and other federal employees ) made up 70.5 percent of spending in 2016, defense 15.4 percent, and interest on the debt 6.2 percent.

This left just under 8 percent for everything else the government does.It is as BlackRock's Peter Fisher described back when he was a Treasury undersecretary in 2003:

Think of the federal government as a gigantic insurance company (with a sideline business in national defense and homeland security).

It wasn't always this way, of course. In the decades that followed World War II, defense was the government's biggest spending category, and the rest of spending was split more or less evenly between what the OMB labels as "human resources" (social insurance plus education) and everything else.

Since then, social insurance payouts, with Social Security and Medicare leading the way, have come to dominate government spending.

Just because they're big doesn't necessarily mean they're bad: Insurance is an economically useful thing, and in some cases government seems to be pretty good at providing it.

Social Security has far lower administrative costs than other public and private retirement plans. Medicare seems to be more efficient than private health insurance, too, although there are those who say it's complicated.

These areas are, however, inevitably going to be prime targets for would-be budget cutters. Because nowadays, they're where the money is.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.