The Republican tax plan proposes to eliminate a decades-old rule that’s been blamed for fueling the meteoric rise of executive compensation at U.S. companies, and could upend popular retirement-savings programs used by scores of high-placed corporate leaders.

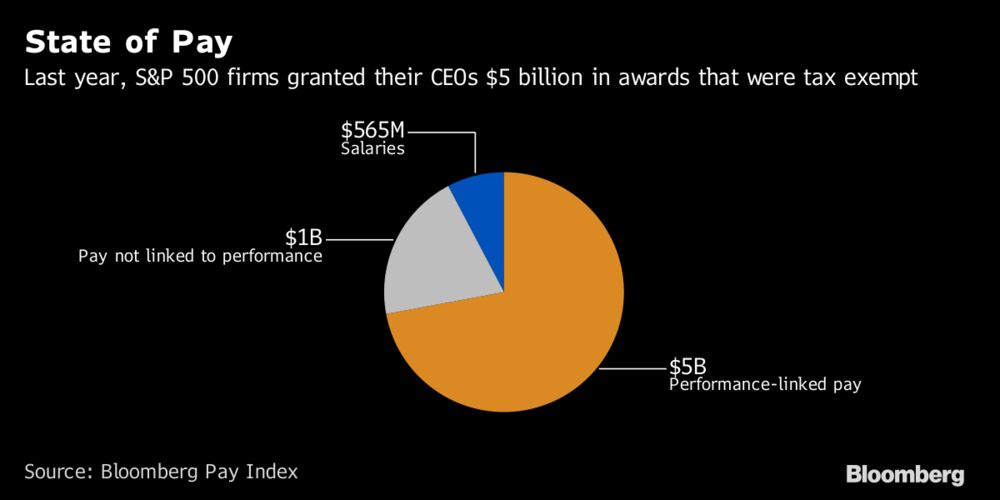

Under current law, businesses can write off as much as $1 million in compensation expenses for chief executive officers and four other top-paid bosses, plus any amount beyond that if it’s tied to performance targets. The Republican proposal unveiled Thursday would keep the $1 million threshold but eliminate the exemption for pay linked to results, denying companies the option to write off large equity awards.

Related: Pay data reporting rule rolled back by White House

A repeal of the exemption for performance-linked pay would tweak former President Bill Clinton’s much-ridiculed attempt to curb spiraling executive paychecks through legislation, often blamed for having the opposite effect. While paying top bosses would get more expensive, the change likely will have “minimal to zero effect” on compensation levels, said Ian Levin, a partner at law firm Schulte Roth & Zabel.

“It’s sort of throwing out the baby with the bath water,” Levin said about the new rule, which lawmakers estimate will boost government revenue by $9.3 billion over a decade. “I would have thought you’d scrap it altogether and put something better in place.”

Businesses can generally deduct employee compensation expenses from their taxable income. The Clinton administration’s rule, enacted in 1993 and tucked into Section 162(m) of the U.S. tax code, set the write-off threshold. The exception was made for pay tied to performance, based on the idea that leaders should be rewarded only if their companies and shareholders also do well.

The rule had unintended consequences. It established a salary of at least $1 million as a benchmark for CEOs at major public companies, and prompted boards to make stock options and restricted shares key ingredients of executive pay. About 57 percent of S&P 500 chief executives have salaries of more than $1 million, according to data compiled by Bloomberg.

Average reported compensation for CEOs in the index rose to $9.1 million from $3.7 million in the first decade after the law was passed, according to a 2005 Harvard Law School study. In 2016, the average had risen to $14.6 million, according to the Bloomberg Pay Index, which values compensation as of a company’s fiscal year-end, not the day it’s granted. The figures can therefore differ from what appears in regulatory filings.

The Republican plan could also drastically change the use of so-called non-qualified deferred compensation plans, which function as super-sized 401(k) plans for executives at hundreds of U.S. companies.

Under current law, participants can contribute salary and other awards to the plans free of taxes, invest the money and defer tax payments until years later when it’s withdrawn.

The bill calls for contributions to be taxed as soon as the money is at “no substantial risk of forfeiture,” potentially meaning as soon as any vesting restrictions lapse. Salaries and bonuses that come without vesting hurdles will therefore get taxed right away. That leaves executives without the benefit of being taxed later in life, when they’re likely past their top-earning years and would fall in a lower tax bracket.

The change could eliminate all voluntary contributions by executives to deferred compensation plans, said Heidi O’Brien, a partner in the executive-rewards practice at consulting firm Mercer. It’s estimated to raise $16.2 billion over a decade.

It’ll apply to new amounts earned and deferred after 2017, while existing balances will be subject to the new rule by 2026. Many companies will likely start phasing out their plans before then, according to Mike Francese, a partner in the employee benefits and executive compensation group at Covington & Burling.

About 360 companies in the S&P 500 have such plans in place for executives, according to data from Equilar Inc. They provide leaders another option to save for retirement, which might encourage them to remain on the job. Some also believe they help executives keep a long-term focus since the plans are unfunded and payouts come straight from the company’s coffers.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.