Express Scripts Holding Co.’s chief executive said he’s open to a deal with a health insurer or partnering with Amazon.com Inc.

CEO Tim Wentworth’s pharmacy benefits company has been battered by departing clients and the vague specter of Amazon’s entry into the drug business.

If a major insurer was interested in a deal, “I would be open to it,” Wentworth said on the sidelines of a conference in New York sponsored by Forbes. “We don’t need to sell to be very successful in the future, but we are always open to others who may all of sudden conclude they want what we have."

He said the company isn’t actively seeking a large deal or sale.

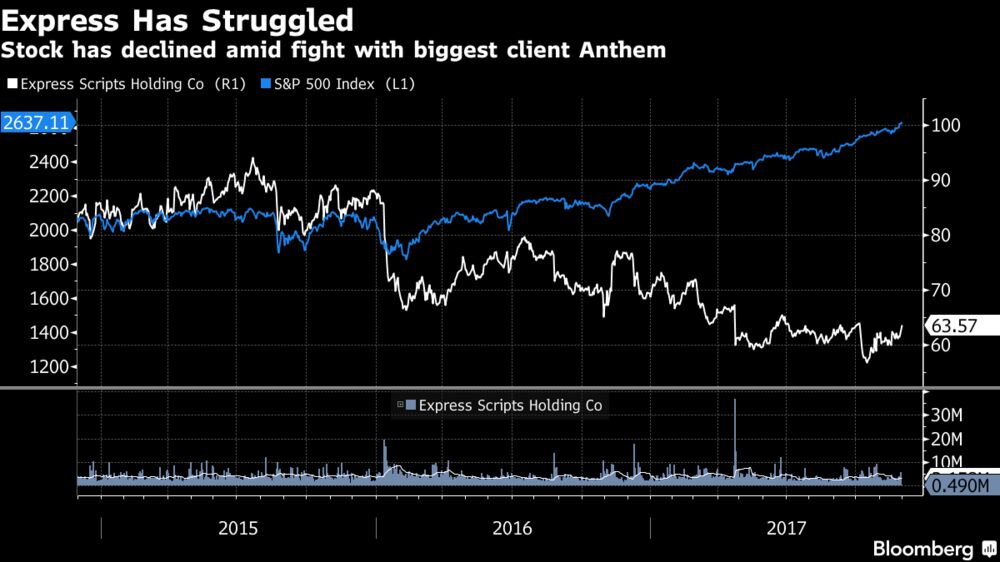

Express Scripts was up 1.3 percent to $63.70 at 9:44 a.m. in New York. The company’s stock is down 7.9 percent this year after its biggest client, insurer Anthem Inc., said it would end its relationship with the pharmacy benefit manager over a dispute about drug prices and rebates.

Health-care companies and investors have been grappling with what would happen if Amazon used its substantial might to enter the drug distribution, benefits or retail business. The online retailer has made no clear moves to do so, so far, and hasn’t commented publicly on its intentions.

“I am not so sure Amazon gets in in the end,” Wentworth said. “I am sure they are looking at it, they must be.”

Express Scripts contracts with employers and insurers to administer drug benefits for millions of Americans. It’s not attached to a retail drugstore or major insurer, as rivals CVS Health Corp. and UnitedHealth Group Inc. are.

Wentworth said the company’s independent model could benefit if a reported deal between CVS and insurer Aetna Inc. is finalized, and if Amazon.com entered the pharmacy market, as the company would able to capitalize on the shift in the market.

“The disruption is an opportunity,” said Wentworth. CVS and Aetna haven’t confirmed their deal talks.

Express Scripts, for example, could add Amazon as part of its pharmacy network, he said. It could also work with the retailer to give cash-paying patients access to rebates from drugmakers, a market he said has been “fairly poorly served up until now.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.