In a year when the Standard & Poor's 500 Index reached new records on a regular basis, the best-performing stock is a relatively small provider of dental products.

Align Technology Inc., the maker of the clear teeth-straightener Invisalign, is on pace to become the index's winner this year with a 136 percent increase as of Dec. 28. With estimated revenue of $1.49 billion in 2017, the San Jose, California-based company's sales have almost doubled in just three years as popularity of its smile-correcting products grew. It remains tiny within the S&P 500, where average annual sales are $22 billion.

The drivers of growth: American teens, and China. Wall Street is betting Align has more room to grow in 2018, especially after the shares declined this month: 11 of the 12 analysts covering the stock recommend buying it, with one advising to hold it. Their average 12-month price target is $273.73, based on data compiled by Bloomberg, which would be a 21 percent increase from current levels.

Recommended For You

Good health

In a testament to how good a year 2017 was for some health-care stocks, four health companies are among the S&P 500's 20 biggest gains, three of them businesses with less than $3 billion in annual revenue.

Biotechnology company Vertex Pharmaceuticals Inc. is on pace to more than double this year, the third-largest increase on the S&P 500, driven in part by takeover speculation. Health insurer Centene Corp., DNA-sequencing firm Illumina Inc., and robotic surgery company Intuitive Surgical Inc. are also in the top 20.

Contrast that with 2016, when only one health-care stock was among the S&P 500's 20 biggest winners. But the sector accounted for seven of the 10 biggest declines last year, including Vertex and Illumina, compared with one this year.

Health-care winners

In a record year for the S&P 500 Index, two health-care companies are among the index's 10 best-performing stocks.

Sector losers

On average, health-care stocks' gains were in line with the S&P 500, with a 21 percent rise in the 62-member S&P 500 health-care index. The rally makes declining stocks stand out all the more: Only nine companies ended the year lower than they started in the S&P 500 health-care index.

The biggest health-care loser is Envision Health Corp., a struggling provider of services like surgery and medical imaging. It slumped 45 percent while being a target of a shareholder activist. Botox maker Allergan Plc follows with a 22 percent decline for the year, dragged down in part by its stake in struggling Israeli drugmaker Teva Pharmaceutical Industries Ltd. and by concerns of upcoming competition.

Data compiled by Bloomberg

As of Dec. 28, 2017

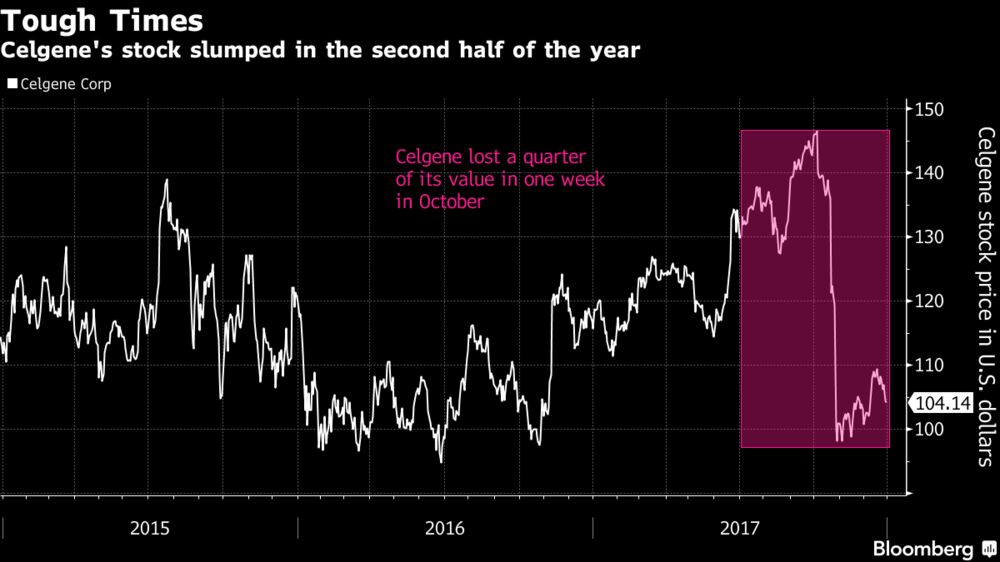

Celgene Corp. found itself near the bottom after a tough second half of the year. The stock lost more than a quarter of its value during a five-day stretch in October, after a highly anticipated drug for Crohn's disease failed a late-stage trial and the drugmaker cut its 2020 profit target.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.