It’s not just employees who do better when they take advantage of preventive dental care, warding off expensive treatments down the road and cutting their out-of-pocket costs. But employers make out, too, saving money on group policies.

That’s according to a new study from the Guardian Life Insurance Company of America, which finds that companies that proactively urge employees to use those preventive dental benefits can cut the costs on group policies for workers.

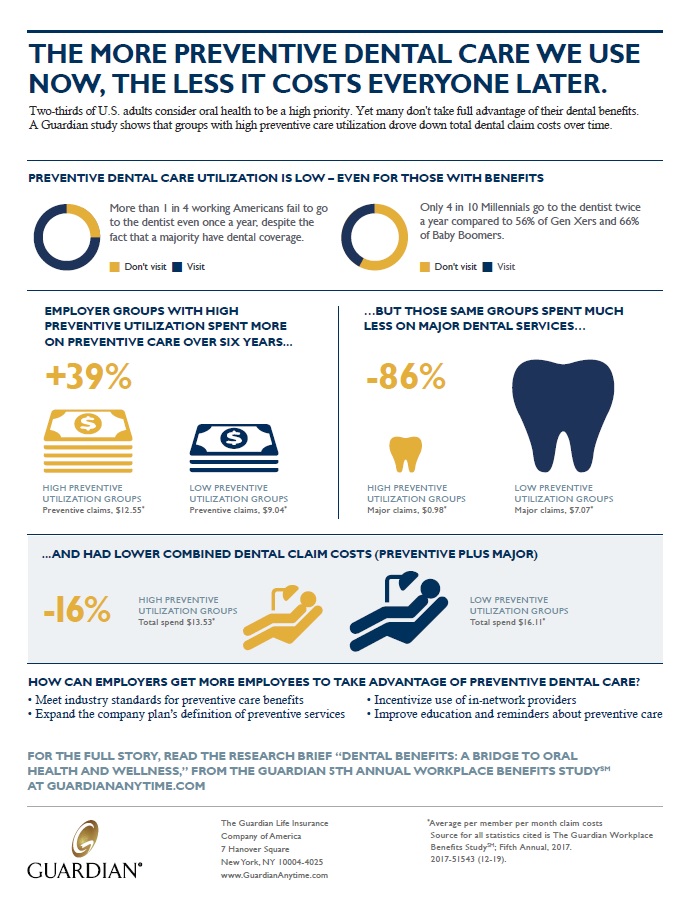

The fifth annual Guardian Workplace Benefits Study, Dental Benefits: A Bridge to Oral Health & Wellness, analyzed dental claims data from 2011–2017. It categorized employer groups based on the utilization of preventive and major services within their companies; groups were tagged as either high-preventive-utilization or low-preventive-utilization.

The study found that the high preventive-utilization employer group spent 39 percent more on preventive care over a six-year period, but 86 percent less on major and restorative dental services. That ended up translating to costs that were 16 percent lower on preventive and major dental claims costs than were incurred by the low preventive-utilization employer group.

Not only that, but seeing a dentist regularly can, according to the Academy of General Dentistry, help with early detection of potentially serious medical conditions, especially since more than 90 percent of all systemic diseases produce oral signs and symptoms.

Dr. Randi Tillman, chief dental officer at Guardian, is quoted in the report saying, "Good oral health is linked to positive overall health and self-esteem. Regular dental visits can help with certain health needs including managing diabetes, lowering heart disease risk, and contributing to a healthy pregnancy.”

With millennials among the least likely to go to the dentist twice a year, the study finds more than one in four adults fail to go at least once a year. Millennials have lots of reasons to procrastinate, too, with cost chief among them. Forty percent of adults have stalled recommended procedures or skipped exams, x-rays and tests in the past year thanks to higher out-of-pocket costs. Doing so, however, will cost them in the long run, with higher out-of-pocket expenses to cover restorative procedures.

So how can employers boost dental usage among employees (and thus drive their own costs down)? The study suggests they meet industry standards for preventive care benefits; expand their plan’s definition of preventive services; incentivize the use of in-network providers; and enhance plan member communication.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.