A historically bad flu season has sent Americans to the doctor in droves -- and given a boost to companies across the health-care business.

Hospitalization rates for flu have reached record levels, according to the Centers for Disease Control and Prevention. The rapid spread of the illness is worrisome, with a higher-than-normal number of deaths related to flu and pneumonia, including 53 children.

For care providers and other companies all along the pharmaceutical supply chain, it has led to higher revenue from increasing hospital visits and drug sales.

Margins for flu treatments, widely available in generic form, are razor thin. But the surge in demand caused by this year’s outbreak has helped improve results at drug distributors such as McKesson Corp., which move medications from the factory to the pharmacy, and for drug retailers including CVS Health Corp., which have seen more consumers pick up prescriptions.

Laboratory companies such as Quest Diagnostics Inc. are also receiving a boost as more sick patients are being sent by their doctors for tests and blood work.

The effects are unlikely to ebb soon. More than 7 percent of people in the U.S. who visited a health-care provider during the week ending Jan. 27 went due to flu-like illness, a weekly level not seen since the 2009 swine-flu pandemic. This year’s flu vaccine has been unusually ineffective, and the season has shown no sign of subsiding.

“Everyone that has a theoretical benefit from the flu is calling it out as it has been a modest tailwind,” said Jefferies LLC analyst Brian Tanquilut, who expects companies to see an even bigger benefit in the current quarter.

Fatal flu

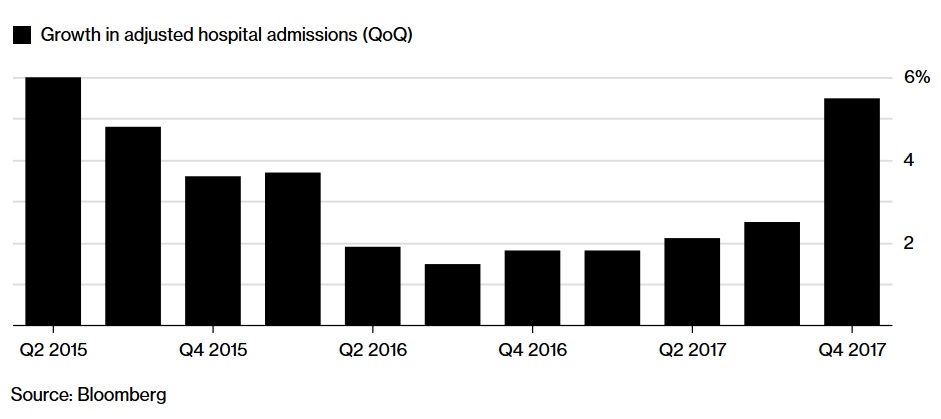

Admissions at HCA Healthcare hospitals are up the most since the 2014-2015 flu season

For some companies, the flu outbreak is turning what threatened to be a relatively dismal period on its head.

On Thursday, CVS said its operating profit for the first quarter will be better than previously projected as it fills more prescriptions for flu treatments.

‘Exceptionally strong’

“The exceptionally strong flu season across the country has had a major factor in this improved outlook,” CVS Chief Financial Officer David Denton said on a earnings call.

The hospital business, which has been struggling in the face of competition from walk-in clinics and other outpatient treatment options, has also been granted a temporary reprieve from its longer-term decline by the flu.

HCA Healthcare Inc., the first major U.S. hospital chain to report earnings this quarter, said its admissions rose 5.5 percent in the period -- the most since the 2014-2015 flu season, another year with a severe flu outbreak. Executives of the Nashville-based company said that the flu contributed 0.5 percent to total admissions in the quarter ending Dec. 31.

Since then, the flu has only spread. The hospitalization rate in the last week of January was higher than during the same week in 2015, according to the CDC.

Tenet Healthcare Corp. and Community Health Systems Inc., two other major for-profit hospital systems that had been struggling prior to the flu outbreak, will report quarterly results later this month.

Pandemic purchases

A ramped-up response to the outbreak could further spur sales of vaccines and other flu treatments. On Thursday, New York Governor Andrew Cuomo told state health officials to provide financial support to counties responding to the disease. Laboratory-confirmed flu cases were up 35 percent in the state since last week, with hospitalizations rising 2 percent.

Flu treatments are not a highly profitable product for distributors, but they still drove a portion of sales for the pharma middlemen. McKesson, based in San Francisco, got a push from “some tailwinds” due to the flu, according to Chief Executive Officer John Hammergren.

“The flu market has been something that has also benefited us,” Hammergren said on a conference call earlier this month. “It’s an important part of the value proposition both in retail as well as in the ambulatory or physician office setting.”

Tim Guttman, the chief financial officer of Chesterbrook, Pennsylvania-based drug distributor AmerisourceBergen Corp., said on a conference call that the flu slightly affected the December quarter, and further spurred sales in January.

For pharmaceutical giants like the U.K.’s GlaxoSmithKline Plc and France’s Sanofi, vaccine sales have surged. Glaxo saw flu-vaccine sales increase 86 percent in the last quarter, while Sanofi sold 21 percent more flu vaccines last quarter.

“We delivered a strong performance in flu vaccines,” said Olivier Brandicourt, Sanofi’s CEO. “This was driven by pandemic purchases in the U.S.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.