Republican gains may boost short-term health rules first, strategist predicts

FlexBenefits CEO Jeff Smedsrud doesn’t expect the biggest Affordable Care Act changes to show up until 2026.

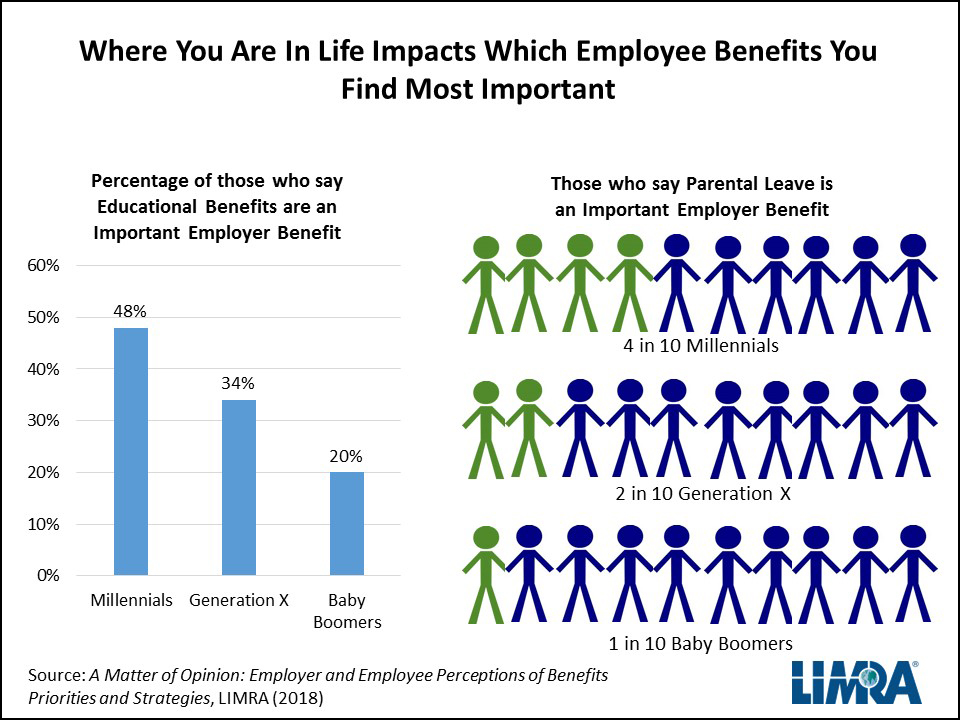

Education is the key to success. It’s a message millennials have grown up hearing, and one they’ve taken to heart. New research from LIMRA finds that education benefits are a top priority for this generation, with 48 percent reporting it as an important employer-provided benefit. In comparison, the study, A Matter of Opinion: Employer and Employee Perceptions of Benefits Priorities and Strategies, found just 34 percent of Gen Xers and 20 percent of Boomers consider education benefits important.

The differing views are likely attributable to each generation’s life stage. Older generations are focusing more on retirement and financial planning. Gen Xers and Boomers put more stress on disability insurance (50 percent and 63 percent) than their younger coworkers (33 percent). Meanwhile, with many millennials starting families, 4 in 10 see parental leave as an important benefit.

Related: Benefits and the job offer: 5 tips for millennials, 5 for HR pros

Already have an account? Sign In Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

FlexBenefits CEO Jeff Smedsrud doesn’t expect the biggest Affordable Care Act changes to show up until 2026.

Some large health insurers have backed federal efforts to crack down on potential rivals to fully insured group health insurance, but the Trump administration seems likely to end efforts to restrict the major medical insurance alternatives.

People need a more user-friendly way to navigate the complex health care system. While consumers can easily find information online for everyday purchases, health care navigation remains difficult.

Guide

Sponsored by Zelis

The Do's and Don'ts of Improved Data Accuracy

Inaccurate provider data can lead to frustrated clients and stress on your business relationships. These are the top do’s and don’ts to ensure the data you rely on as a benefits advisor is as accurate and helpful as possible.

Guide

Sponsored by LifeSecure Insurance Company

7 Must-Haves That Employers (and Employees!) Want in Workplace Benefits in 2025

Employers are revamping their benefits strategies--but are they offering what employees truly want? Discover the seven key elements shaping workplace benefits in 2025 to help your clients enhance satisfaction, retention, and enrollment.

Guide

Sponsored by Nonstop Administration and Insurance Services, Inc.

Guide: Redefining the Role of the Broker

In 2025, you are uniquely positioned to make a real difference for your clients--both financially and in the wellness of their employees. Full of tips ranging from goal setting to relationship building, this is your guide to being a better partner this year, and beyond.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.