Rallying around retirement income: Advisors are educating plan sponsors

Only 58% of plan sponsors believe participants are on track with their retirement savings, which is why most (82%) advisors are recommending a retirement income solution to DC clients, according to a Blackrock survey.

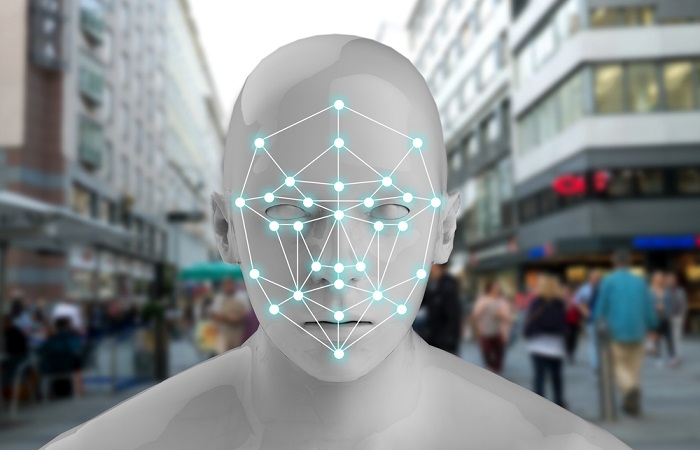

The fund basically is a juiced up alternative to the $2.4 billion Robo Global Robotics & Automation Index ETF, ticker ROBO. (Photo: Shutterstock)

The fund basically is a juiced up alternative to the $2.4 billion Robo Global Robotics & Automation Index ETF, ticker ROBO. (Photo: Shutterstock)

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.