After 14 years in the marketplace, why are HSAs not more widely used by employers and individuals? Maybe employees and employers have some questions that aren't being answered. Here's how to help. (Photo: Shutterstock)[/caption] Health savings accounts (HSAs) have been around three years longer than the iPhone. Congress approved the innovative plans in 2003, and they became law in January 2004. So after 14 years in the marketplace, why are they not more widely used by employers and individuals? "HSAs can be confusing to consumers when they first learn about them," said Roy Ramthun (also known as "Mr. HSA"), founder and president of HSA Consulting Services in Houston. "In part, this is because of their similarities to other types of health care-related accounts, such as FSAs and HRAs, that they may have had in the past." The Employee Benefit Research Institute estimated that 2016 enrollment in high-deductible, HSA-eligible health plans was between 20.2 million and 22.6 million, and covered nearly 30 percent of employees. Although employer adoption of HSAs has increased over the past 15 years, he said, the rate of growth varies by business size. "Larger businesses are more likely to offer an HSA-qualified plan option alongside other plan choices," Ramthun said, "but smaller businesses, which typically offer only one plan choice, generally have been slower to offer HSAs. Across the landscape, about one-third of employees are now enrolled in an HSA-qualified plan. Some larger companies have moved to `full replacement', where the only plan choices offered are HSA-qualified. In these situations, virtually all of the employees are enrolled in HSA-qualified plans." The more that people learn about HSAs, the more they generally like them, said Chad Wilkins, president of HSA Bank in Sheboygan, Wis. His company provides HSAs, FSAs, HRAs and commuter benefits to 2.6 million members and 35,000 employer groups. The challenge for everyone from brokers to corporate benefits managers is to help employees make informed decisions. "Many employees select the same plan year after year, without evaluating the plan options and their circumstance," Wilkins said. "Taking a more-detailed approach to plan analysis would allow consumers to select health plans, including a high-deductible plan, that likely will save them money."

After 14 years in the marketplace, why are HSAs not more widely used by employers and individuals? Maybe employees and employers have some questions that aren't being answered. Here's how to help. (Photo: Shutterstock)[/caption] Health savings accounts (HSAs) have been around three years longer than the iPhone. Congress approved the innovative plans in 2003, and they became law in January 2004. So after 14 years in the marketplace, why are they not more widely used by employers and individuals? "HSAs can be confusing to consumers when they first learn about them," said Roy Ramthun (also known as "Mr. HSA"), founder and president of HSA Consulting Services in Houston. "In part, this is because of their similarities to other types of health care-related accounts, such as FSAs and HRAs, that they may have had in the past." The Employee Benefit Research Institute estimated that 2016 enrollment in high-deductible, HSA-eligible health plans was between 20.2 million and 22.6 million, and covered nearly 30 percent of employees. Although employer adoption of HSAs has increased over the past 15 years, he said, the rate of growth varies by business size. "Larger businesses are more likely to offer an HSA-qualified plan option alongside other plan choices," Ramthun said, "but smaller businesses, which typically offer only one plan choice, generally have been slower to offer HSAs. Across the landscape, about one-third of employees are now enrolled in an HSA-qualified plan. Some larger companies have moved to `full replacement', where the only plan choices offered are HSA-qualified. In these situations, virtually all of the employees are enrolled in HSA-qualified plans." The more that people learn about HSAs, the more they generally like them, said Chad Wilkins, president of HSA Bank in Sheboygan, Wis. His company provides HSAs, FSAs, HRAs and commuter benefits to 2.6 million members and 35,000 employer groups. The challenge for everyone from brokers to corporate benefits managers is to help employees make informed decisions. "Many employees select the same plan year after year, without evaluating the plan options and their circumstance," Wilkins said. "Taking a more-detailed approach to plan analysis would allow consumers to select health plans, including a high-deductible plan, that likely will save them money." 2 sides to HSAs

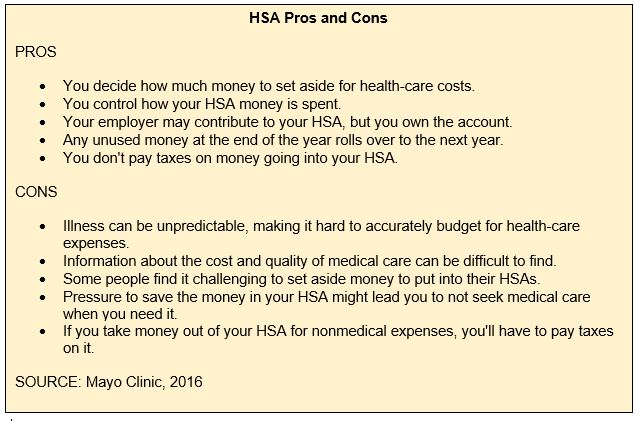

As with most employee benefits, there are two sides to the HSA coin. Below are pros and cons of HSAs (information courtesy of Mayo Clinic):  An HSA-qualified plan provides two key benefits to employers, Ramthun said: A one-time reduction in the health-plan base premium and a slower year-on-year premium growth rate. "The employer can (and should) reinvest their premium savings by making contributions to their employees' HSA accounts," he said. "Doing so stimulates engagement by employees. Employees typically also realize savings from lower health plan premiums, which they also can contribute to their HSA accounts. In some cases, the savings realized by the employer and employee exceed the deductible faced by the employee." Employers also benefit when employees take more ownership over health-care decisions. "Studies have shown that individuals with HSAs care more about how much health care costs, are more likely to plan and budget for their expenses, use more preventive care services and engage in company wellness programs," Ramthun said. "These have additional benefits for both employer and employee." Employees will see savings in their tax bills as well as medical expenses, Wilkins added. "HSAs are the only triple-tax advanced account in existence, meaning funds are contributed tax-free, grow tax-deferred and can be withdrawn tax-free to pay for IRS-qualified medical expenses during an individual's working years and in retirement," he said. "This is a significant advantage over traditional retirement options, which are subject to income tax when withdrawn. Using HSA funds to pay for medical expenses will better enable individuals to make the most of their financial resources."

An HSA-qualified plan provides two key benefits to employers, Ramthun said: A one-time reduction in the health-plan base premium and a slower year-on-year premium growth rate. "The employer can (and should) reinvest their premium savings by making contributions to their employees' HSA accounts," he said. "Doing so stimulates engagement by employees. Employees typically also realize savings from lower health plan premiums, which they also can contribute to their HSA accounts. In some cases, the savings realized by the employer and employee exceed the deductible faced by the employee." Employers also benefit when employees take more ownership over health-care decisions. "Studies have shown that individuals with HSAs care more about how much health care costs, are more likely to plan and budget for their expenses, use more preventive care services and engage in company wellness programs," Ramthun said. "These have additional benefits for both employer and employee." Employees will see savings in their tax bills as well as medical expenses, Wilkins added. "HSAs are the only triple-tax advanced account in existence, meaning funds are contributed tax-free, grow tax-deferred and can be withdrawn tax-free to pay for IRS-qualified medical expenses during an individual's working years and in retirement," he said. "This is a significant advantage over traditional retirement options, which are subject to income tax when withdrawn. Using HSA funds to pay for medical expenses will better enable individuals to make the most of their financial resources."

4 ways to respond to common HSA concerns: a midpoint slideshow

How do Wilkins and Ramthun respond to common concerns about HSAs?

2 basic steps to making HSAs work

Two basic steps can make an HSA an effective option for managing both employee health and the bottom line. The first step is doing the proper homework before opting for an HSA. "There are many elements to consider when evaluating health plans, including monthly premiums, deductible, out-of-pocket maximum, employer contributions, co-pays, coinsurance, income, marginal tax bracket, ability to save and medical needs," Wilkins said. "It is important to do the math or use plan comparison-calculators to evaluate health-plan options." The second step is to maximize value following enrollment. "Consumers can do this by educating themselves on how their plan works – cost-sharing amounts, in-network providers and covered services – how they will pay for planned and unplanned medical expenses, and how they will save for health-care expenses in retirement," he said. "Ultimately, these steps will help individuals own their health and health-care finances." As with any employee benefit, there is no substitute for a trusted broker partner. "HSAs have some important rules to keep in mind, so seek advice from knowledgeable people so that you can take full advantage of an HSA," Ramthun said "There is no better account available than an HSA to help you with the rising cost of health care."