Repeat users of financial wellness programs showed substantial improvements in key areas, including handling their personal cash flow and maintaining an emergency fund to cover unexpected expenses. (Photo: Shutterstock)

Repeat users of financial wellness programs showed substantial improvements in key areas, including handling their personal cash flow and maintaining an emergency fund to cover unexpected expenses. (Photo: Shutterstock)

More workers are making good use of their employer's financial wellness program, returning again and again and reaping more benefits as a result, according to Financial Finesse's Financial Wellness Think Tank's 2017 Year in Review.

Among employers that have offered a financial wellness program for at least three years, repeat users made up 58 percent of the population, up significantly from 33 percent in 2016 – the first time repeat users outnumbered first-time users, according to the study.

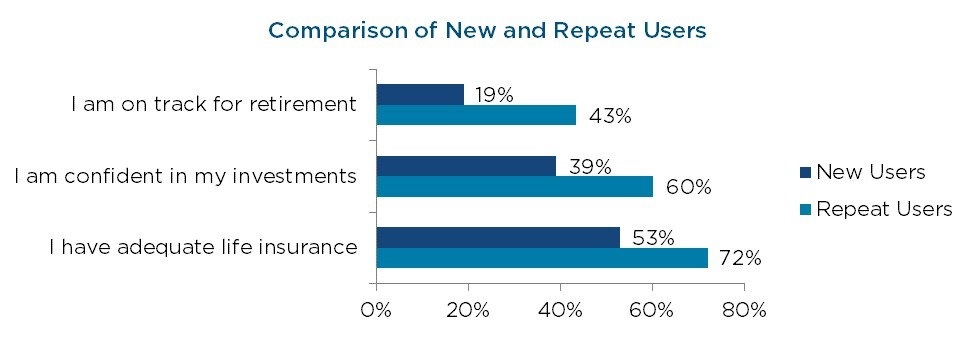

Repeat users are twice as likely to be on track for retirement (43 percent vs. 19 percent of first-time users), and are also less likely to report high or overwhelming levels of financial stress.

Related: Why financial wellness needs to be an ongoing effort

“Numerous studies cite the effects of financial stress on productivity, absenteeism, healthcare claims, turnover, and delayed retirement,” the authors write. “For this reason, employers may be particularly interested in finding ways to reduce employee financial stress.”

The study also found that repeat users showed substantial improvements in key areas of financial wellness, including handling their personal cash flow, maintaining an emergency fund to cover unexpected expenses, checking their credit on an annual basis, and carrying enough life insurance to replace their income, among other improvements.

Many of the employers in the study are offering incentives to boost participation in their financial wellness programs. They are also providing one-on-one financial coaching in person and on the phone, in addition to using technology to identify gaps in financial wellness and provide education.

“We're seeing solid evidence that a long-term program which engages employees in multiple ways, including online, in workshops, over the phone and in person, works as predicted,” says Financial Finesse CEO Liz Davidson.

Comprehensive programs that include unbiased financial coaching are particularly successful, adds Think Tank director Greg Ward, a CFP.

“From our experience, trying to address employee financial wellness with a technology-only approach has had limited success, which may have contributed to the recent shutdown of several financial technology companies.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.